One of the biggest challenges developers face is finding ways to monetize their software. Offering ad-supported solutions only goes so far. While the Software as a Service (SaaS) model is a popular option, you still need a billing solution to handle subscriptions, payment processing and taxes. That's where Paddle comes in.

The company provides billing solutions for a huge number of SaaS companies, including Laravel, 3Commas, removebg, Fortinet, and others. Let's take a closer look at what Paddle is and how it works.

What is Paddle.com?

Paddle.com is a Merchant of Record (MoR) that provides payment infrastructure for thousands of companies worldwide. When a customer purchases a product or signs up for a subscription with a client of Paddle's, they'll make payments to Paddle, who will then handle issues such as foreign exchange, banking, and sales taxes, before passing the proceeds on to their client.

Who is Paddle For?

Paddle is aimed at software companies that want to sell their products online, or offer subscriptions for SaaS services.

Working with a MoR simplifies the many technical, legal and regulatory challenges of operating in a global marketplace. In addition, Paddle handles the back-office tasks associated with payment processing and provides the technical infrastructure for it, freeing the developer to focus on the thing they do best – providing great software.

What Does Paddle Do?

Paddle provides a comprehensive range of billing services for SaaS merchants, including:

- Subscription Billing: Paddle can handle both one-time payments and subscriptions. Developers can automate the process of sending monthly invoices or taking recurring payments.

- Invoicing: SaaS developers can use Paddle's API to automate their invoicing processes, reconcile payments, and provide product access based on successful payments.

- Multi-Currency Checkouts: Provide a better experience for end-users from all over the world with localized checkouts available in more than 17 different languages and 29 currencies. Use regional pricing to unlock new markets and maximize profits. Show users the most popular payment options based on their region.

- Tax Compliance: Paddle handles sales taxes and local regulatory requirements for more than 100 jurisdictions. They automatically collect, file and remit takes for you, so you don't have to worry about holding funds and keeping track of the regulations in multiple territories.

- Fraud Protection: As part of the payment MoR, each transaction is carefully analyzed and evaluated based on multiple variables to detect potential fraud while reducing the likelihood of false positives. This helps protect you from chargebacks or penalties from your payment network and protects your reputation among your customers.

The complex regulatory environment is one of the biggest challenges faced by SaaS developers. Paddle is compliant with SOC 1 & SOC 2, PCI-DSS, GDPR, CCPA and several other data protection regulations.

All of these features are made available by an easy-to-use API. The company publishes the source code for its frameworks on Github, under the Apache-2.0 license.

How Much Does Paddle Cost?

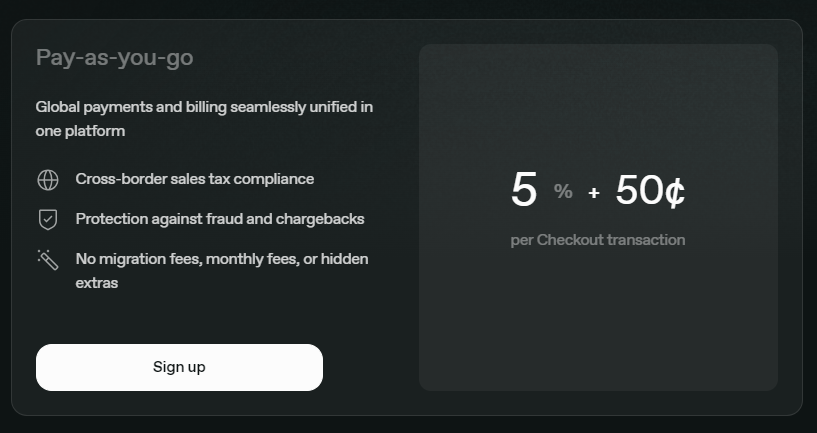

There are two pricing models available with Paddle.

The Pay-as-you-go model includes all the features listed above and costs 5% + $0.50 per checkout transaction. This is aimed at people who are selling products costing $10 or more.

If you sell products that cost less than $10, would like to be invoiced for your usage, or expect to sell a very high volume of products, you may benefit from the company's custom pricing option. This is aimed at larger businesses or those who aim to scale quickly and offers access to premium services, a success management team, and bespoke pricing that would most likely save you money compared to the PAYG pricing.

While these fees may seem high compared to the transaction fees charged by rivals such as Stripe and PayPal, it's important to consider what Paddle offers for that fee. The company is more than just a payment processor. The tax compliance and fraud protection services included in the fee can save you a huge amount of time and reduce the risk of you running into issues with chargebacks or incorrectly-filed tax reports.

What are Customers Saying About Paddle?

Paddle works with thousands of developers, from start-ups to huge enterprises. These companies have come to rely on Paddle to help them reduce chargebacks while scaling internationally. For example, Master English Ltd partnered with Paddle after experiencing a high rate of chargebacks with their previous payment processor. Paddle's anti-fraud systems helped the company reduce its chargeback rate by 55% among US customers, and 54% worldwide.

Kaleido partnered with Paddle for their remove.bg service, allowing them to work with a global customer base. Paddle's payment solutions helped them increase their month-on-month customer growth by 20%, and reduce their subscription churn by 38%.

As such, from a developer's point of view, Paddle is a convenient solution that saves developer time, simplifies compliance, and makes it easier to work with an international client base. However, from a customer's point of view, there are some issues to consider.

However, when you take a payment from a customer via Paddle, the customer's bank statement will show that it was Paddle that took the money, rather than your company. This can confuse some customers, especially if you have annual billing and they've forgotten that they'd taken out a subscription with you. Platforms such as Reddit and Trustpilot are full of angry comments from consumers who have found charges on their bank or credit card statements that they don't recognize.

Many consumers consider Paddle to be a "scam site" because of this, and it can take a significant investment in customer service time to explain to your users that the charge is legitimate, Paddle took the money on your behalf, and you won't be billing them twice.

For smaller companies that don't deal with an international audience and that operate in industries where chargebacks aren't a major issue, it might be simpler to use an alternative payment processor. However, if you sell VPNs, web hosting or other similar high-chargeback services, Paddle's fraud protection may well be worth having to deal with the occasional angry email from a confused user.

How Does Paddle Compare to Other SaaS Billing Services?

If you need international payment features or fraud protection services, Paddle is good value for money. If you're just looking for a payment processor to accept payments in your home currency, you may prefer to use an alternative payment processing solution.

Stripe

Stripe is a payment processing platform that focuses entirely on processing card payments and sending payouts. It's incredibly easy to get started with, and if you're a content creator who delivers your products via an online marketplace, integrating Stripe could be as simple as providing your API key to that marketplace.

Stripe charges lower fees than Paddle, although the exact fees vary by country. However, what you get for those fees is a much more basic service, and if you're operating in a high-risk niche, Stripe may not want to work with you.

In addition, Stripe handles only card payments. If you want to accept PayPal, or more unusual country-specific payment methods, you'll need to find a different provider to handle those.

Chargebee

Chargebee is a subscription management system that focuses on recurring billing and invoicing. It helps creators set up free trials, manage their subscriber base, and minimize churn. It also offers tax and compliance management but for fewer countries than Paddle.

One useful feature of Chargebee is that it offers a feature-limited free trial tier that may be suitable for smaller organizations, although it lacks invoicing, gift subscriptions, quotes and some of the more advanced account management tools. The Performance Tier costs $599/month for up to $100,000 worth of billing, with a 0.75% fee for bills above that level. Chargebee also offers an Enterprise Tier, with bespoke pricing for high-volume accounts.

If you primarily offer subscription products and work with customers who are based in countries Chargebee can handle tax and compliance for, this pricing model may be appealing. However, for an international audience, Chargebee could be a better choice.

Whop Payments

Whop Payments is a tool to help creators accept payments for their products, whether those products are SaaS applications, ebooks, courses, digital art, or something else entirely. Whop acts as a Merchant of Record, and can accept payments and also assist with accounting and tax-related activities.

Whop charges 3% + payment processing fees for transactions that go through Whop Payments, which is 2% less than Paddle. The payment processing fee varies depending on whether the customer is inside or outside of the USA. Whop payments supports invoicing and subscriptions and is easy to integrate into your existing purchase flow. Plus, you can also offer buy-now-pay-later options with Whop payments.

Whop Payments - The Number One Choice for SaaS Billing

Whop Payments is a leading tool for SaaS billing that offers easy integration with your applications, thanks to its powerful and flexible API. When you choose Whop Payments for your SaaS billing services, you can feel confident that your end users get a smooth experience thanks to the platform's multi-currency support, and all your tax and compliance needs are handled too.

The platform has a facility in place to handle chargebacks, and a fair system for dealing with accounts that receive multiple refund requests in a short period of time. Plus, accounts are manually reviewed to ensure quality. This ensures that even if you've had issues dealing with payment processors such as Stripe, you can still work with Whop to handle your payments.

Our low fees, of just 3% + payment processing fees, mean Whop Payments is ideal for small traders and rapidly growing SaaS companies. As Whop is an all-in-one platform, you can even use it to host and sell your digital products and services. We also offer a variety of marketing, community management and API tools to help you provide a seamless experience for your customers.

If you're looking for a payment processor and MoR that can handle your business's global growth needs, why not explore Whop Payments today? There are no monthly fees or up-front costs, just a small commission on each transaction you make.

Join Whop.com for free today and start growing your SaaS business.

Frequently Asked Questions

Is Paddle a Payment Processor?

Paddle serves as a Merchant of Record, meaning it handles all payments and also takes on the liability related to the transaction, such as tax payments, regulatory compliance, and refunds or chargebacks.

Can you use Whop for SaaS Subscriptions?

Whop is more than just a social commerce platform, it also offers Merchant of Record (MOR) services through Whop Payments. SaaS developers can use Whop Payments to handle subscriptions, invoicing, multi-currency transactions, taxes and more.

Can I Sell More than Courses and Ebooks on Whop?

Yes, Whop is ideal for sellers who are looking to offer more than just courses and ebooks. You can use the platform to handle payment processing for your SaaS applications or off-platform services. If you're not sure how to set this up, contact our support team for advice.