You may have heard of the term MoR, but what exactly is MoR, and why is it important?

Well, to get straight to the point, a merchant of record (MoR) is a third-party service provider that assumes responsibility for managing and processing payments for online businesses. Merchants of record provide valuable services that enable businesses to securely process payments while providing customers with a positive experience when making purchases online.

There are many services that MoR provides. Firstly, merchants of record provide services such as payment processing, fraud prevention, compliance management, and grievance resolution. In addition to this, MoRs are also responsible for collecting payments from customers and transferring them to your business’s bank account.

Merchants of record also provide additional services such as dispute resolution, customer service, and refunds and returns management. These services help to ensure that customers have a positive experience when making purchases from an online business.

Now that we've had a brief look at what MoR is, let's unpack why businesses use a MoR, the merchant of record business model, how merchant of record is different from a payment services provider, and whether or not your business needs a MoR!

Why Use a Merchant of Record?

The primary purpose of a MoR is to protect both the customer and the business from any potential risks associated with online transactions. By acting as an intermediary between the customer and the business, MoRs can ensure that all payments are secure and legitimate. This helps to reduce the risk of fraud or chargebacks for both parties.

Businesses typically work with merchants of record because they offer a variety of benefits, including increased security, better customer service, improved payment processing speeds, reduced costs associated with chargebacks or disputes, and access to more payment options. Also, working with an experienced MoR can help businesses comply with applicable laws and regulations related to online payments in their jurisdiction.

Merchant of Record Services

As mentioned, merchants of record provide a wide variety of valuable payment services to businesses. By providing these services, MoRs enable businesses to focus on other matters while ensuring their payment logistics are handled smoothly. Some of the most important services provided by merchants of record include:

- Facilitating payments, including integrating payment processors and managing payment processor fees.

- Setting up merchant bank accounts in separate financial jurisdictions.

- Establishing local entities for tax purposes as well as calculating and applying local sales tax to applicable transactions.

- Managing regulatory compliance on all transactions (and bearing responsibility for it).

- Converting currencies for international transactions.

- Implementing and maintaining fraud detection measures and investigating detected cases of fraud.

- Handling customer payment disputes such as refunds and chargebacks.

The Merchant of Record Business Model

So, how does the MoR work as a business?

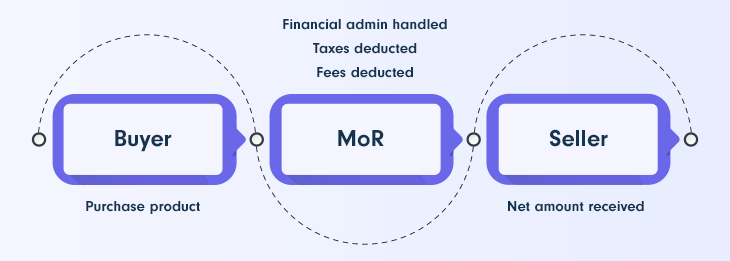

To begin, a merchant of record buys your product from your business and then sells it to the customer. Therefore, MoR is essentially acting as a middleman and assuming all legal and financial responsibility for the transaction in the process. The MoR’s name, not your business’s name, will appear on the customer’s receipt, and the customer must take up any payment disputes directly with the MoR.

This whole process happens “behind the scenes” — the customer still retains the experience of purchasing the product from your business via your business’s website or app. The MoR’s relationship with the customer extends only as far as the logistics of the transaction are concerned. Your business is still fully in charge of marketing, selling, and supporting its products.

Here is a step-by-step breakdown of how the process of selling products in partnership with a merchant of record works.

- The customer begins their journey on the vendor's website, where they locate their desired product and are led to a checkout page hosted by a merchant of record solution.

- The customer makes a payment and the transaction is processed via the merchant of record.

- The MoR transfers ownership of the product from the vendor to the customer.

- On their credit card statement, customers will usually see either the website's name where they made their purchase or a combination of both vendor and MoR names as a soft descriptor for the transaction.

- Any post-sale disputes are handled by the MoR. For example, if a customer attempts to reverse charges with a chargeback, then it is up to the MoR to take responsibility for resolving this action.

How is a Merchant of Record Different From a Payment Services Provider?

If a MoR takes care of the payments and transaction processes, then how does it differ from a PSP?

The most important difference between a merchant of record and a payment services provider is that a merchant of record assumes liability for the transactions it processes, while a payment services provider does not.

A payment services provider facilitates transactions between your business’s bank account and your customer’s bank account, but the service begins and ends there. The payment services provider is not responsible for the payments — it simply enables them. Your business is still entirely responsible for administrative tasks like managing compliance and security and handling payment disputes.

Does My Business Need a Merchant of Record?

When it comes to determining whether or not your business needs a merchant of record, there are several factors to consider.

First, you should assess the size and scope of your business. If you’re running a large-scale operation with multiple international locations, then it’s likely that you will need a merchant of record to help manage the complexities associated with international payments and transactions.

Additionally, if you’re selling digital products or services online, then having a merchant of record can help ensure that all payments are properly processed and tracked.

You should also consider the types of payment methods that your customers use when making purchases from your business. If customers are using credit cards or other forms of electronic payment, then having a merchant of record can provide additional security for both parties involved in the transaction.

A third factor is whether or not you have any international customers who may require special payment processing rules due to their country’s regulations. Having a merchant of record can make it easier to comply with these requirements while also providing additional protection against fraud and chargebacks.

Finally, take into account any potential risks associated with managing customer payments yourself without the assistance of an experienced third-party provider like a merchant of record. Without this level of expertise in place, businesses can be exposed to greater levels of risk related to fraud and chargebacks, which could have serious financial implications for their bottom line.

Nearly every kind of business can benefit from working with a merchant of record. Partnering with a reliable MoR can allow you to stop fretting over the complex process of managing payments and focus on what you actually care about — managing your business. With that said, there are a few kinds of businesses that can benefit especially from using a merchant of record, such as:

- Businesses selling products internationally or across state lines (especially ecommerce businesses) stand the most to gain from a merchant of record’s services. Selling to a different state or country where your business has no local presence comes along with a whole host of extra legal work that you might prefer to hand off to a merchant of record instead.

- SaaS businesses of all varieties are in a similar situation to the one described above. If you have a SaaS business, you intrinsically have a global audience because anyone can access your services via the internet. This means payment logistics can get more complicated than expected very quickly. It’s probably worth having a merchant of record to help you overcome this hurdle.

Merchant of Record Benefits

We have outlined a couple of reasons why companies use a MoR, now let's look at the benefit using a MoR brings.

To begin, the primary benefit of partnering with a MOR is that it allows merchants to outsource their payment processing and order fulfillment needs. This relieves them from having to handle these tasks themselves, freeing up time and resources for other areas of their business. Additionally, MORs are typically well-versed in compliance regulations related to online payments and transactions, so they can help ensure that merchants remain compliant with applicable laws.

Here is a breakdown of some of the most important benefits of working with a merchant of record:

1. Improve billing at your company

Even if your small business isn’t dealing with the complexities of selling to an international market, you may be struggling to keep up with your business’s billing demands. Partnering with a merchant of record can be a more cost-effective way to upgrade your company’s payment processing capabilities than investing resources in an in-house billing department. This can make it easier to ensure your business’s billing processes are as efficient and compliant as possible.

2. Free Up Your Time to Focus on Building Your Business

Partnering with a merchant of record can also help free up more of your time and attention to devote to running your business. After all, you almost certainly aren't starting your own business because you're excited to oversee your customers' payments. However, it takes a lot of administrative effort to manage a business's billing process, including verifying compliance with tax laws, processing payments, managing refunds and chargebacks, and much more.

By partnering with a merchant of record, you can essentially outsource these tasks so that you don’t have to worry about them yourself. This can allow you to focus on growing your business instead of constantly getting bogged down by billing paperwork and administrative duties.

3. Stop Worrying About Compliance

By outsourcing the responsibility for managing payments, businesses can reduce the risk of non-compliance with payment regulations. As such, by partnering with a merchant of record, businesses can gain access to comprehensive payment solutions that are compliant with local laws and regulations.

A merchant of record can also provide ongoing support and advice on how to stay compliant in different jurisdictions. This can be especially beneficial for businesses that provide products or services on an international scale. Additionally, a merchant of record can provide guidance regarding best practices for maintaining payment compliance in accordance with applicable local laws. To sum up, partnering with a merchant of record, businesses can ensure their payment processing is secure, efficient, and compliant at all times.

4. Stay Up to Date on Payment Regulations

It’s essential for your business to abide by all the local payment regulations in the regions where your customers are based. However, it can be very difficult to keep track when you have a widespread customer base — not to mention that tax requirements and other payment-related regulations frequently change in many areas of the world. A merchant of record can worry about staying in the loop for you, so you don’t have to stress about missing an important change and falling out of compliance.

5. Accelerate Your Path Toward Global Markets

Working with a merchant of record can allow your business to expand its reach beyond its local market. When partnering with a merchant of record, you can enable your business to accept payments from customers in different countries and currencies. Working with a merchant of record also enables your business to benefit from the expertise and experience of an established provider A merchant of record can also offer access to a range of payment options.

Expanding your business to cater to a global audience is an exciting step, but it also comes with quite a few billing-related complications. When you're facilitating transactions with customers from all over the world, there are naturally a great deal more payment logistics to consider. Working alongside a reliable merchant of service can be a great way to engage in global markets while offsetting the added burden of managing a global payment network.

MoR For Your Business

Small businesses should consider working with a merchant of record for a variety of reasons --- mainly because doing so allows them to outsource many payment processing tasks and focus on their core business operations.

By working with a merchant of record, your small business can benefit from the expertise and experience of the MoR in the context of managing financial transactions. The merchant of record will be able to provide advice on how to best manage payment processing and ensure compliance with applicable laws and regulations.

The MOR also provides additional security for small businesses by taking responsibility for any fraud or chargebacks that may occur during the transaction process. This reduces the risk to small businesses as they are not liable for any fraudulent transactions that may occur while using their services. Having an experienced merchant of record as a partner can also help small businesses streamline their operations and allow them to focus on growth without worrying about administrative tasks associated with running an online store or website.

Ultimately, working with a merchant of record provides numerous benefits to small businesses, including cost savings, increased security measures against frauds and chargebacks as well as streamlined billing operations.