There are few things as rewarding as a side hustle—a product of your own ingenuity or creativity that starts being rewarded by the general public in a way that makes a difference. Whether you’re looking for side hustle revenue to top up your disposable income or take over from your day job sooner rather than later, you do want the cash to come in…and that means you’ll need a payment processor to help make it happen.

So, what’s the best way to get paid for your side hustle, what do you need to know about payment processors, and which payment companies are the best for side hustles in today’s market? We’ve got all of that information for you right here, so read on.

How to get paid for your side hustle

We get it, a hustler’s gonna hustle. Sometimes it feels right to just plug away at your side gig and focus fully on your product and engagement believing revenue will sort itself out. And while that’s true to some extent, not paying attention to payment infrastructure might leave you in a pickle later on—imagine the goodwill and cash you’d lose if customers flock to buy your product but checkout just doesn’t work.

So, whatever the side hustle you’re working on, make sure to get your revenue streams set up well ahead of time. Some side hustles have their own way of doing this—on YouTube, for instance, there’s a clear, step-by-step way to activate monetization and get your bank details verified and connected to AdSense. If your next video goes viral overnight and the views and subs come pouring in, you’ll want to start earning right away.

For most other side hustles, though, you’re going to have to put payment infrastructure in place. Consider a hotdog stand—if you focus on everything else but payment, come your first day you’ll suddenly realize that you can only accept cash from your customers when you make a sale. What about the many people passing by who prefer going cashless, or just don’t have any change on them and therefore can’t buy from you?

That’s not even mentioning online side hustles—you’ll need some sort of mechanism that brings funds from your customers to you in as safe and efficient a manner as possible.

What’s the difference between a payment gateway and a payment processor?

The terms payment processor and payment gateway are often confused, but that’s because brands in the industry typically do both of these jobs within the remit of being a payment services provider. It’s smart as ecommerce requires both a payment processor and a payment gateway to function effectively.

A payment gateway acts as an intermediary between a business and a customer, collecting and verifying the customer’s payment information such as credit card details. It then transmits this verified data to a payment processor, which manages the transfer of funds between the business, the credit card company, and the respective banks involved in the transaction.

As such, ecommerce requires both a payment processor and a payment gateway in order to get things done. Traditional in-store commerce may be a little bit different, because a payment processor can, via a physical POS (point-of-sale) terminal, validate the authenticity of a card without needing a payment gateway.

If you try to deploy your online side hustle and offer online checkout without a payment gateway, transactions can still be processed but your standalone payment processor can’t check if customers have enough money in their account to complete purchases. You might even be scammed by users giving fraudulent payment information.

So, unless you can pair your side hustle up with an effective physical POS solution, you’ll definitely need to make sure that the payment processor you choose is more of a full payment services provider in that it also plays the part of a payment gateway.

10 best payment processors

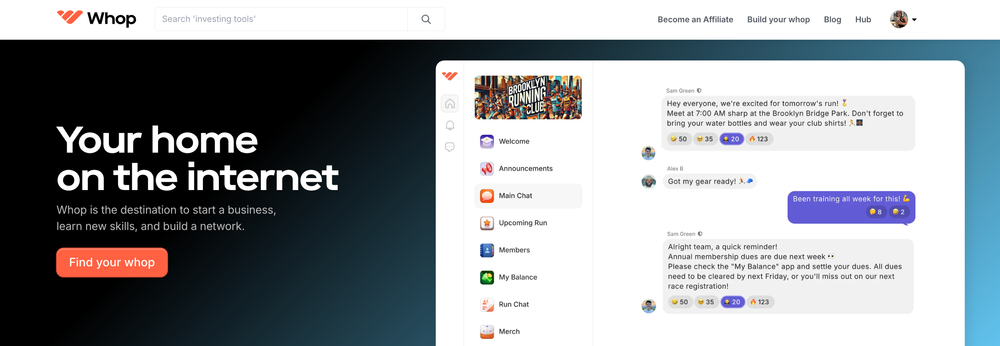

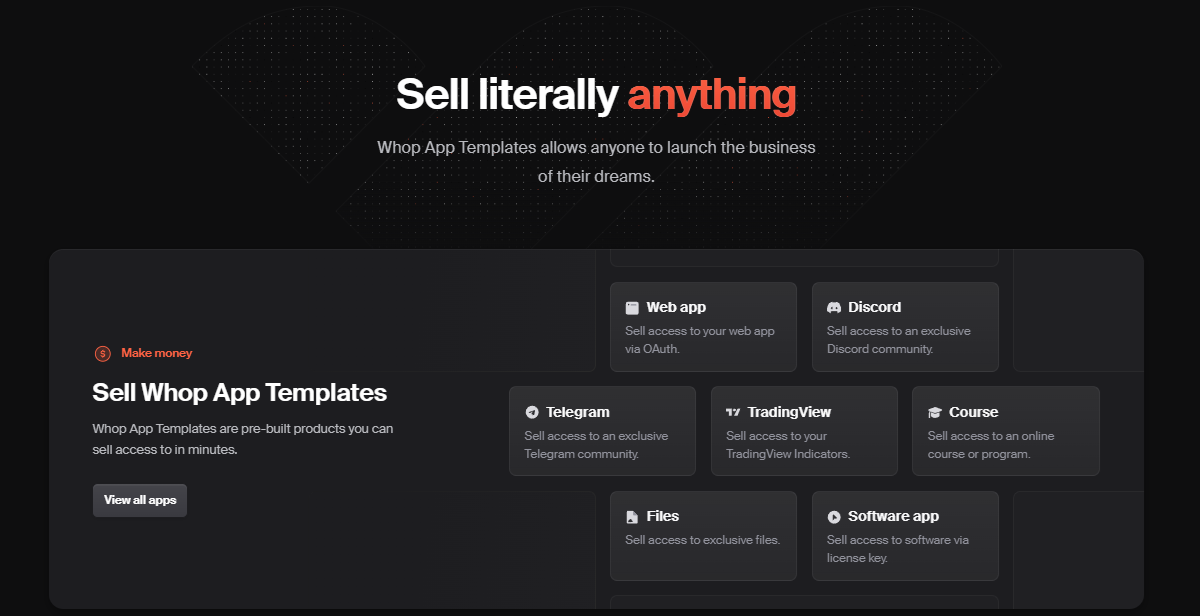

1. Whop

Whop is a payment processor that specializes in side hustles. It gives you all of the supporting features and infrastructure atop a rock-solid payment gateway built on Stripe (our number 2 pick), adding payment options and more currencies for you and your customers to take advantage of.

The Whop marketplace will give you a good idea of just how many side hustles across a variety of niches are already using Whop as an ecommerce platform and payment solutions provider. The feature set that Whop offers means that you can use it as an all-in-one platform for your side hustle or small business, and you can sell just about anything digital using your own whop.

It’s important to note that Whop is one of the very few entries on this list that makes it possible for you to accept cryptocurrency payments as a business via an ETH gateway directly to your blockchain wallet.

Who can use Whop: Any digital entrepreneur running a business or side hustle. If you’ve got physical products you can still use Whop as a payment services provider via integration on your website, but you can use Whop as an all-in-one platform if your products and services are 100% digital.

Fees: Whop charges a 3% transaction fee on top of processing fees to manage your payments.

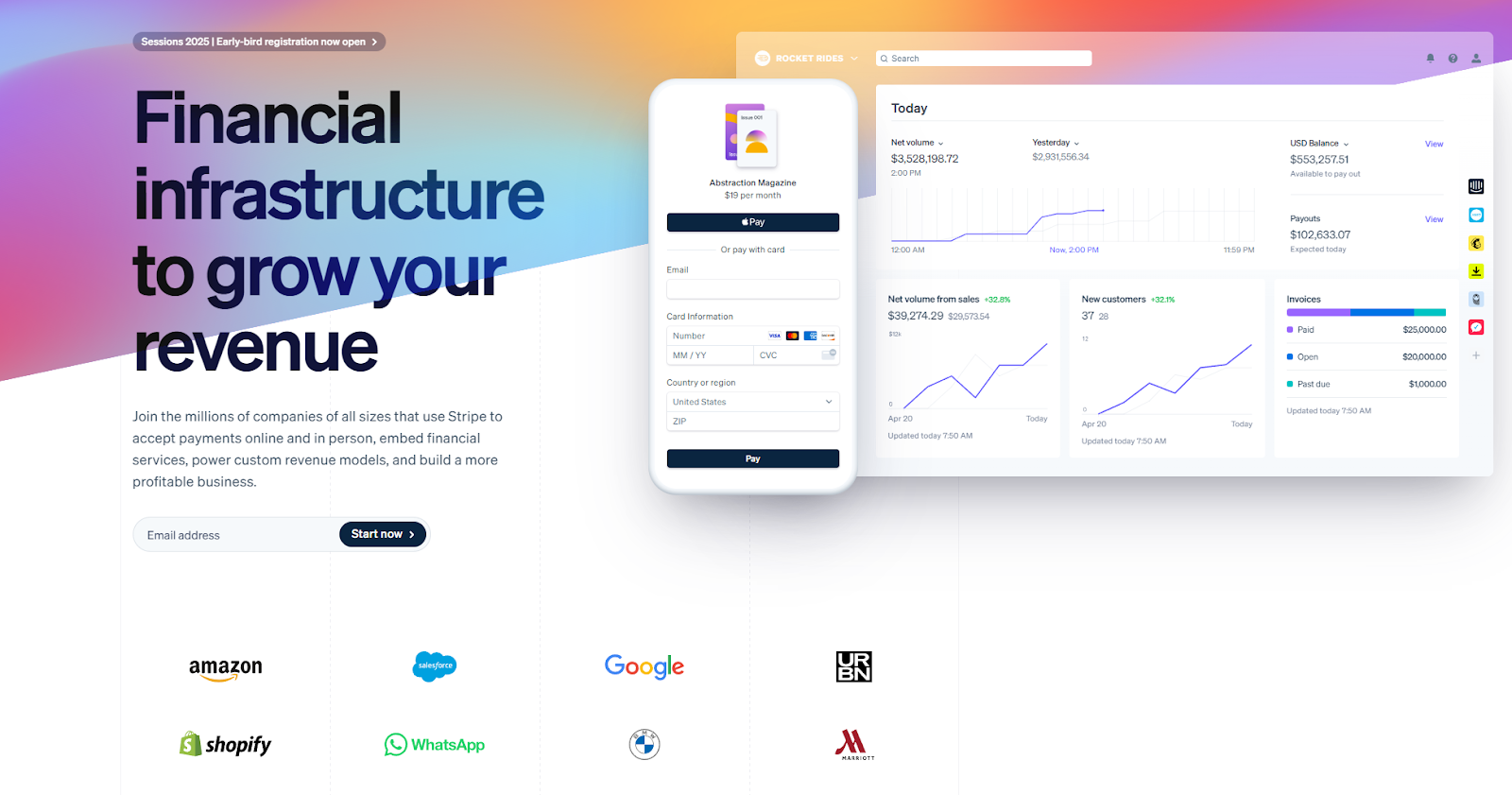

2. Stripe

Stripe is a well-known payment services company that features some of the best payment infrastructure in the business as well as the versatility to accept payments from many sources. You can also create invoices, set up payment links, and even manage subscriptions and international payments. Stripe checks just about all the boxes when it comes to the needs of a modern, online side hustle.

You get a lot of customization options with Stripe via several APIs that let you tweak your payment gateway as best you want, and you can even use Stripe in person via Stripe Terminal. It’s developer-friendly, but that does mean you’ll need some level of technical ability to make the absolute most out of what Stripe offers.

Who can use Stripe: Anyone operating a side hustle that needs a variety of payment options including subscriptions, although customizing Stripe fully needs coding chops.

Fees: Free to use, with online sales charged at 2.9% plus $0.30 and in-person sales charged at 2.7% plus $0.05. Both of these options carry an extra 1% for currency conversion or the use of international cards.

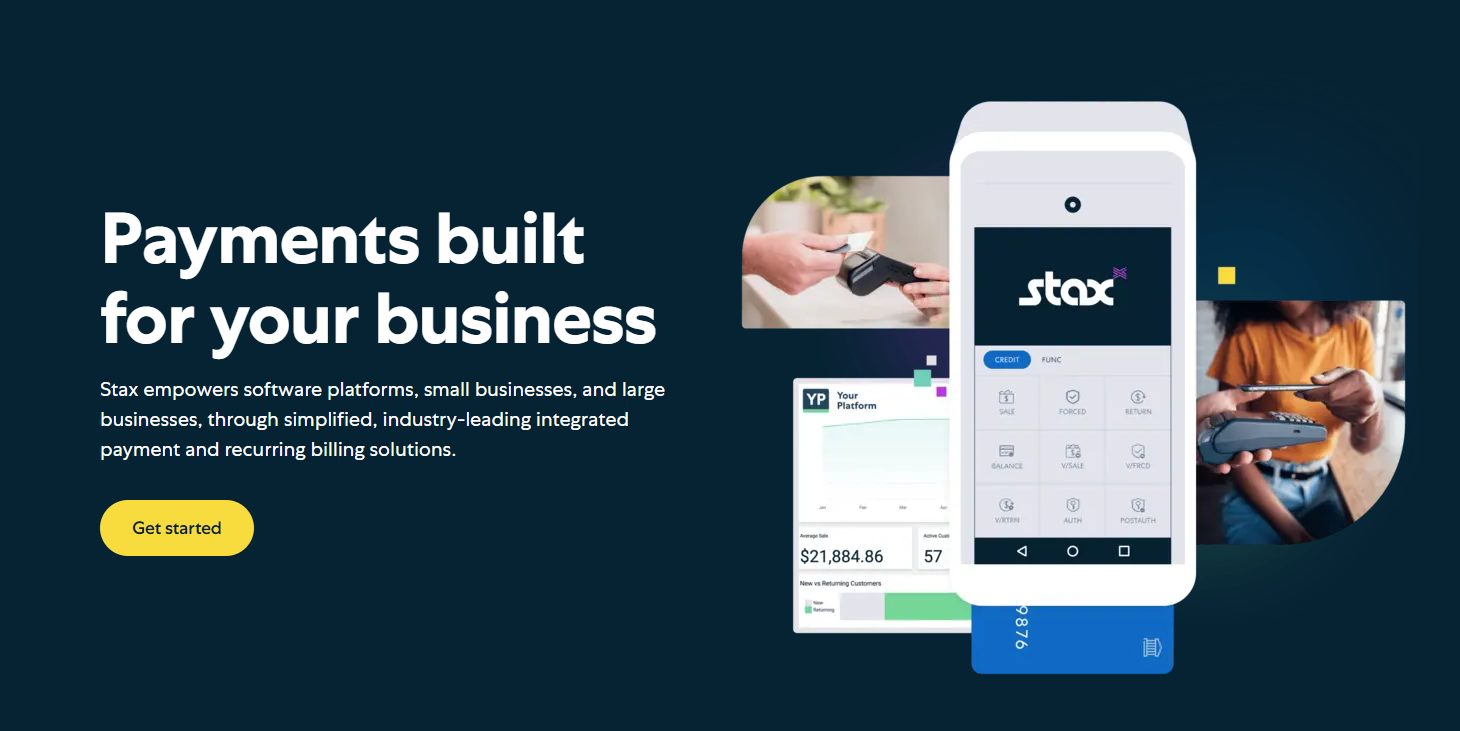

3. Stax

Stax is a payment processor that can handle both in-person and online credit card processing via Stax Pay, an all-in-one business management platform that provides safety in every environment. Smart terminals and mobile readers comprise the latest in POS technology, and Stax integrates with multiple gateways when processing payments online via payment links, buttons, and even QR codes that you need no development knowledge to create.

Stax also works as a mobile payment processor via the Stax mobile app, letting you collect keyed, swiped, or tapped payments via your mobile phone while also enjoying real-time monitoring, regular sales reports, and convenient payment management options.

Who can use Stax: Anyone who owns a business or operates a side hustle, although fees will play a big part in deciding if and when to use them.

Fees: Flat subscription fee starting at $99 per month for processing up to $150,000 a year. If your side hustle makes more than that, your Stax payment will go up to $139 per month (for revenue up to $250,000) or $199 per month.

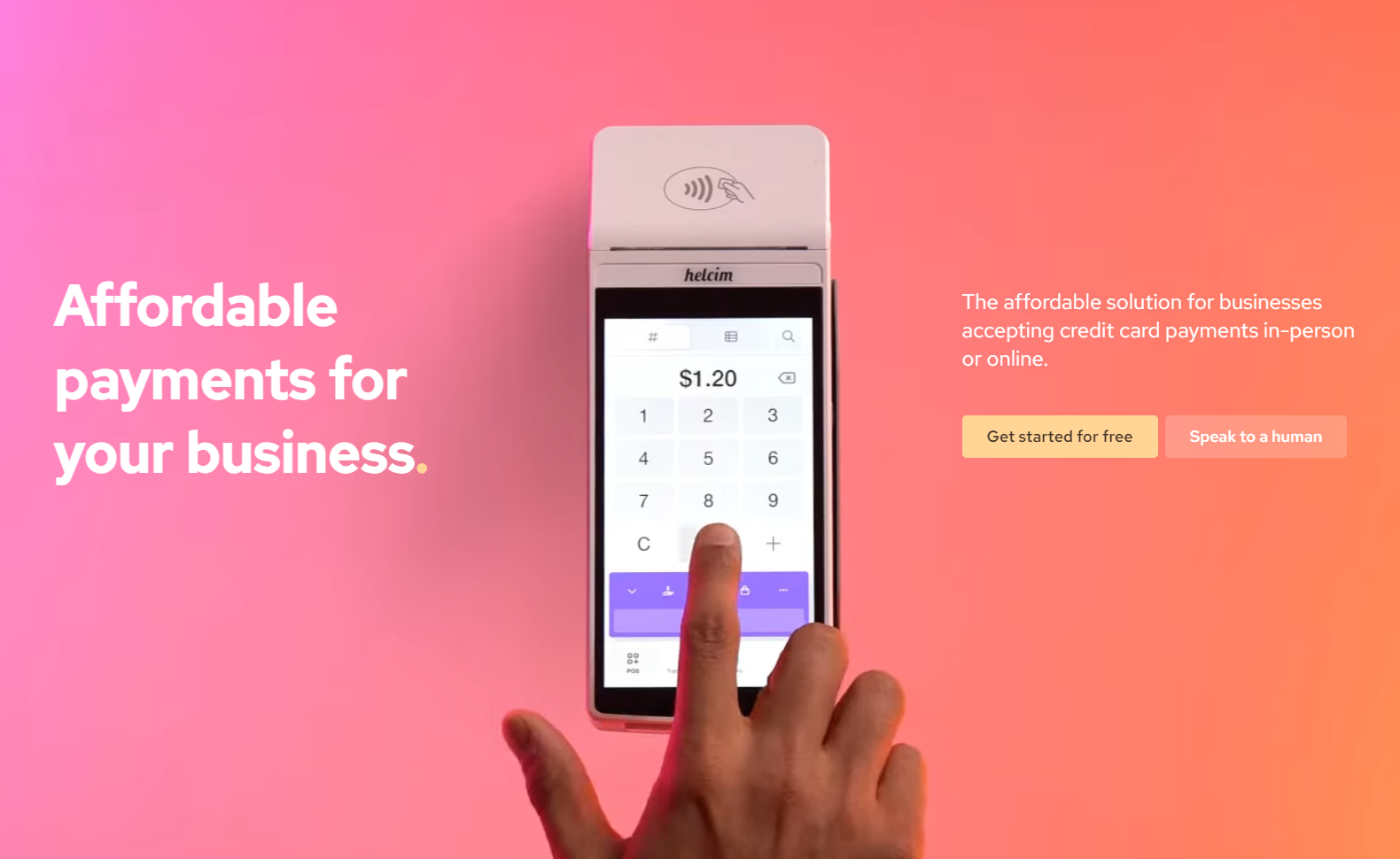

4. Helcim

Helcim is a payment processing solution that specializes in volume-based pricing, making it an excellent option to consider as your side hustle starts scaling and you get to the point where you’re thinking about turning it into a full-time business. However, the nature of your side hustle will play a big role here too—Helcim is one of those companies with a pretty wide prohibited list and refuses to take on clients in industries such as betting.

That being said, if you’re on Helcim’s allowed list, then you’d be getting a powerful suite of financial tools when you sign up, including easy integration with inventory management and other software.

Who can use Helcim: Any company that doesn’t operate in the fields of gambling, adult entertainment, web hosting, debt resolution, and even certain personal services. However, the service is best for businesses able to pull in significant volume thanks to its tiered pricing model.

Fees: 0.40% plus $0.08 in person/0.50% plus $0.25 online at revenue up to $50,000 with five tiers going all the way down to 0.15% plus $0.06 in person/0.15% plus $0.15 online if you bring in $1,000,000 or more.

5. Square

Square is a payment processor and payment gateway that’s well known for its robust POS system that allows businesses of all sizes to operate knowing that the payments side of their operation is in good hands. Side hustles are especially suited to Square because the service is free to start using and the Basic plan doesn’t have any monthly fees—so if you’re just starting off and revenue’s only just beginning to trickle in, you don’t have to worry about covering any costs.

Thanks to the wide range of hardware and multiple reading options, Square is an especially good choice for side hustles that could benefit from a POS system, although there are a lot of online options too—you could use Square’s ecommerce API, their online store, online invoicing, or online checkout. Importantly, Square also offers buy-now-pay-later for both in-person and online transactions.

Who can use Square: Small businesses, side hustles, and startups looking for a free plan and POS solutions.

Fees: 2.9% plus $0.30 for any of the online options, 2.6% plus $0.10 for card-present payments using Square POS, 1% with a $1 minimum for ACH bank transfers via invoice.

6. Shopify

Shopify is a giant in the world of ecommerce, and definitely an option for you to link up with if you’ve got a side hustle with any sort of online component. It’s got just about all of the tools you need, and it’s possible to run an entire business on Shopify—and even if you have everything else built out, Shopify can simply plug into your existing infrastructure and do just what you need it to.

That being said, using Shopify mainly as a payment processor and not for its ecommerce features feels like a waste since it’s on the ecommerce side that Shopify really shines. This’ll hit you right in the wallet, too, since Shopify can be a little on the expensive side—the platform has a subscription pricing charge that goes up to $299 and tacks on transaction fees and credit card rates for Shopify Payments on top of that.

Who can use Shopify: Anyone with a side hustle, although Shopify is best utilized if you set up a store using their website builder and take advantage of their advanced marketing tools.

Fees: Basic plan costs $29 per month billed annually, with online credit card rates for Shopify Payments sitting at 2.9% plus $0.30. If you want their premium plan, you’ll have to pay $299 billed annually but enjoy half a percent less on the transaction fee.

7. Braintree

Braintree’s SDK powers PayPal's payment technology, and while we’ll get into the specifics of that particular payment processor later, Braintree definitely deserves a mention on this list. It’s also the engine behind Apple Pay and Venmo, which speaks volumes for just how safe and reputable Braintree is.

That said, Braintree does have a couple of downsides in that there have been cases of chargeback abuse affecting merchants across the different services using the Braintree SDK. That might be a concern, and there’s also the possibility that Braintree may be absorbed into the stronger brand name of PayPal in the near future.

Who can use Braintree: Side hustles where Braintree’s buy-now-pay-later might be considered a clutch feature.

Fees: 2.59% plus $0.49 per transaction.

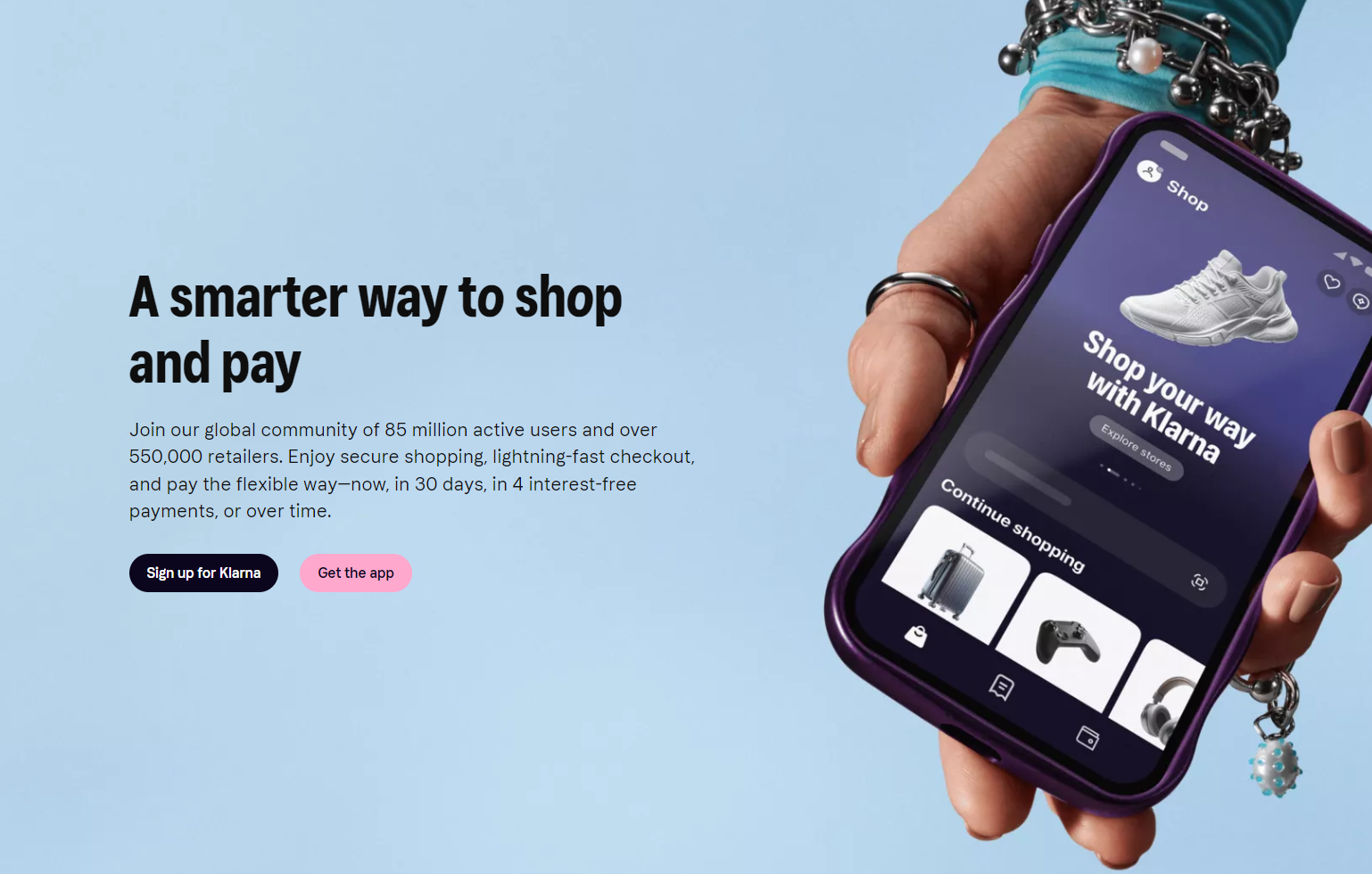

8. Klarna

Like Braintree, Klarna is also well-known for buy-now-pay-later, and the Swedish giant in fact disrupted the market with this feature back when they made their debut. They’ve become an extremely powerful name in the payment services industry since, and are a dominant figure for payments in Europe.

Unlike many of the other entries on this list, Klarna is focused on the consumer experience, so it might be a good idea to check them out if you’ve got a side hustle with a similar set of priorities—Klarna makes engagement a part of the checkout game, making them an ideal payment processor for the modern side hustle.

Who can use Klarna: Side hustles and small businesses prioritizing the consumer experience and consumer journey as well as wanting to offer buy-now-pay-later.

Fees: Variable, depending on volumes and industry.

9. Payment Depot

Payment Depot is an option worth considering if pricing is your main concern, but it’s more to the bottom of this list because the best pricing ranges are only attainable if you’re able to hit certain volumes—as such, it’s best utilized by small or medium businesses, though fees at the high end are still very reasonable and in many cases lower than the base offerings of other payment processors.

Payment Depot is also part of the Stax group that we’ve touched on before, so you know that the technology that you’re getting by signing up with them is legit and trusted.

Who can use Payment Depot: Side hustles and small businesses that can take advantage of Payment Depot’s volume-dependent pricing.

Fees: Between 0.2% and 1.95% depending on your business model.

10. Amazon Pay

Amazon Pay is a rising power in the field of payment processing, giving your customers the ability to checkout using a familiar interface. Just about everyone has an Amazon account these days, so it makes sense to give your people the option to buy from your side hustle business in the same way that they do on Amazon.

Not just a checkout button, Amazon Pay is listed as a money service business in the U.S., and it supports one-time charges as well as automatic, recurring, and subscription payments—and this means that you can structure your side hustle revenue model however you want.

Who can use Amazon Pay: Any small or medium business, meaning any side hustle can take advantage of Amazon Pay’s convenience and features via web or mobile—but it’s an online-only solution, so you’d need more if you want to take in-person payments too.

Fees: Free to use although bank and credit charges do apply.

5 portable payment processors

1. Whop

We’ve already mentioned Whop as a top payment processing option for your side hustle, but it’s got to appear on this list too given that Whop on mobile gets the job done just as effectively. It’s a fantastic ecommerce payment provider on the go, and as a merchant of record can rid you of payment liabilities that other processors may not take on your behalf.

Who can use Whop: Any digital entrepreneur running a business or side hustle. If you’ve got physical products you can still use Whop as a payment services provider via integration on your website, but you can use Whop as an all-in-one platform if your products and services are 100% digital.

Fees: Whop charges a 3% transaction fee on top of processing fees to manage your payments.

2. PayPal

PayPal is best known as a revolutionary P2P payment system, but it also offers solutions for small businesses that your side hustle can definitely take advantage of.

You can accept payments using PayPal’s hardware costing $29 on the first go and $79 per supplemental card reader you buy. Online, you can accept all major credit cards as well as Venmo and now certain cryptocurrencies. PayPal’s buy-now-pay-later option is also especially beloved by customers, as is PayPal’s credit facility that lets customers split payments over a longer timeframe.

Who can use PayPal: Any small business or side hustle, although the fees will start racking up once you start to scale up and earn more revenue.

Fees: PayPal charges 3.50% plus $0.15 for keyed transactions, 2.29% plus $0.09 for card-present transactions, and 2.59% plus $0.49 for online payments. PayPal also charges an additional 1.50% international fee for commercial transactions plus a fixed fee depending on the currency used.

3. Google Pay

Google Pay is an easy, convenient, and most importantly ubiquitous payment solution that works across both in-person and online commerce. You can use it on any device to make online transactions, which means that as a side hustler, using Google Pay as a portable payment processor means that you’re not locking any customers out.

The only consideration is when it comes to contactless in-person payments—Apple-carrying customers will have to use another form of payment in order to do business with you. If you’ve got a physical location you can order free stickers from Google to let your customers know that you accept Google Pay, and for online side hustles the Google Pay API is very easy to implement.

Who can use Google Pay: Any sort of retail-facing business wanting a free solution that almost any customer can use easily.

Fees: Free although bank or credit card charges do apply.

4. Apple Pay

Apple Pay is an extremely highly rated mobile payment processor, but we’re going to rank it one spot beneath its competitor Google Pay because it’s only possible to use Apple Pay on Apple devices yet Google Pay can be used for online checkout on Apple phones and tablets. This is a big factor if you’re running a side hustle, as you don’t want to close the door on any customers just because of the tech choices they may decide to make.

Still, this is a payment processor you’ll want to consider adding to the options you offer because it’s extremely quick and convenient for those customers of yours who do indeed use Apple gear—it can be used on iPhones and iPads, naturally, but also on Mac, Apple Watch, and Apple Vision Pro.

Who can use Apple Pay: Any business or side hustle, although you’ll definitely want to add more options for the many customers you’ll have who don’t restrict themselves to Apple devices.

Fees: Free to use although bank and credit charges will apply.

5. Venmo

Venmo is as convenient as it is popular as a way to send money to people, and it should come as no surprise that Venmo does have an option for creating a business profile. In fact, it’s a great choice for your side hustle because it’s simple and easy to use, and you can switch between your personal and business profile with just a simple swipe.

With Tap to Pay, you can accept card payments through your Venmo profile, and you can configure direct payments as well as QR codes—all of it right through your app. This way you can make sales just about anywhere, and while it isn’t the most elaborate of options at your disposal, it’s simple, secure, and easy to set up.

Who can use Venmo: Side hustles and very small businesses. If you start seeing your revenue rise and want to scale, take another look higher up this list. Note also that your business profile is subject to the same transaction limits as a personal profile.

Fees: 1.90% plus $0.10 transaction fee

How to choose the right payment processor for your side hustle

Choosing the right payment processor might not be too easy given the number of quality options out there, but here are some things you can do to find the best one for your needs.

Explore payment options

If you hope to turn your side hustle into a full-fledged business, it’ll pay to really know your customers. Part of that means understanding how they behave and their preferred means of payment for goods and services of different kinds. Most people are fine with (and prefer) using their credit or debit cards, but having to fill in those details at checkout can be annoying, so stored payment and digital wallets are something you’ll want to allow for. And, if your side hustle is somewhat sensitive in nature, crypto might provide the anonymity that your customers need to finally make the jump and complete that transaction.

Look out for fees

Fees and pricing are an extremely important consideration when choosing a payment processor. We’ve outlined the revenue model of each one above, but make sure that you put the payment processor’s fees next to your side hustle’s income and do the maths. If you’re just starting out and only pulling in a couple of hundred bucks a month (every side hustle starts at $0, and some take ages to build up), you really don’t want to lose a lot or even all of that revenue to a big flat fee. At the same time, once you start scaling up, a high percentage fee can really start to take a toll.

Check integrations

If you’re running a side hustle, you’re probably making full use of the different services out there that can save you a little valuable time when it comes to taking over certain tasks. Whether that’s an ecommerce platform, POS system, or something like WordPress, the payment processor you choose is going to need to play nice with whatever tech stack elements you’ve already put in place.

Pay attention to security features

Security is one of the most important aspects of a good payment processor. It almost goes without saying, but if you’re choosing a payment processor for your side hustle, it’s worth doing a little bit of research and making sure that the provider is worth their salt. Trust plays into this as well—if there are too many stories online of security failures you may also want to avoid them because even if the processor themselves have fixed their issues, your customers may have a negative perception of them and be unwilling to purchase from you if they’re handling the payments.

Ensure great customer support

When and if things go wrong, customer support can step in and save the day. And we’re not talking about just security issues here—even accidentally hitting the purchase button can lead to issues that can prove problematic for a customer through no fault of your own. If customer service can step in quickly and help, you’re onto a winner, especially since it’s a side hustle and your own time to deal with customer complaints may be limited.

Other considerations for your payment processor

But wait, there’s more! If you’ve checked all of the above boxes but still can’t decide, take these two additional factors into account as well:

Do your customers shop online or in person?

Depending on the nature of your side hustle, it may be possible to serve customers both online and in person. If you’ve got both of these streams set up, it’s a good idea to figure out which one’s more important to your business now and which has potential for growth because it could well be that the payment processor you choose handles these different forms of payment differently. Many payment service providers charge different rates depending on how you sell, so prioritize accordingly.

What’s your sales volume?

Your monthly sales volume is definitely a factor that you should be keeping on top of as well given how closely it will tie in with the pricing scheme used by the payment processor you use. As a general rule of thumb, the higher your sales, the more a flat-fee processor is going to benefit you, while a free or percentage-fee-based provider may suit lower sales or revenue.

Boost your side hustle with Whop's payments

Starting and managing a side hustle isn’t easy given how much you’ve got to take care of in what little time you have. That’s where platforms and services like Whop come in—thanks to the different features on offer, you can get started with a side hustle with less time and effort than ever. In fact, starting an online business with Whop takes only a few minutes.

So, by entrusting the payments and perhaps even other parts of your side hustle (such as your online storefront, digital fulfillment, etc.) to Whop, you can focus fully on what really matters—perfecting your product or service and then scaling your side hustle to the point where you’ll never need to work again.

Check out Whop for a free look at what Whop has to offer, or talk to one of the team to see what they can do for you.