If you're happy with the amount of money you get every month—and let's face it, few people ever truly are—you might think you're sorted. Why improve something that already works so well? After all, your job or your business covers your expenses.

But what if, one day, it stops being enough?

We live in a shaky economy, with inflation and AI both working in tandem to displace jobs and make it harder to cover our monthly costs. Fortunately, there's something you can do to protect yourself: Manage multiple streams of income instead of settling for just one.

Having more than one stream of income is what gets people from a paycheck-to-paycheck situation to a cushy savings account and a less stressful life. It could be as simple as earning extra money alongside your day job, but there's also much more to it than that.

Below, we'll show you all the ways you can diversify your income and start improving your finances step-by-step.

Why Should You Have Multiple Income Streams?

Did you know that the average millionaire has not one, not two, but seven sources of income? That's right—7 different ways to keep the money rolling in.

Sure, some people get lucky and are born into money, but those who work their way up to that 7-figure net worth do so by getting creative. Working a single job is unlikely to make you a millionaire … unless you're the CEO of some massive corporation, in which case, you're probably not reading this article right now.

However, just because considerable wealth is hard to achieve through a single 9-to-5 job, that doesn't have to mean that it's unattainable. All kinds of wealth are within reach, but the whole point is that it's better not to rely on just one source of income.

This is because of two reasons. First, due to the so-called glass ceiling, where you'll work that one stream of income until it's unlikely to go any higher—say, get promoted and earn $150K per year, but be unable to advance further. Second, because if one source of income dries up, you'll be left in a very precarious position.

The solution? Think like a millionaire and start setting up multiple income streams.

Diversifying opens up a whole world of possibilities. Instead of spreading yourself thin and picking up a second and a third job, you can set yourself up for success and explore sources of income that may have never crossed your mind.

Creating multiple streams of income is not just about getting rich (but hey, that'd be great, too). It's about staying safe no matter what happens, building up a savings account, setting money aside for retirement, and sprucing up your credit score.

There's a lot to gain, so let's dive right in.

How to Create Multiple Streams of Income

That average millionaire we just talked about above, the one with the seven different streams of income? They're not getting their money from working seven different jobs. Instead, they're dipping into the seven different types of income streams, which are as follows:

- Earned income: Money from jobs and side hustles

- Dividend income: Income from investing in a company that pays dividends

- Rental income: Money from real estate, not just owning it but also investing in it

- Royalty income: From making and selling your own intellectual property

- Business income: Money made through running your own business

- Interest income: From investing or owning a savings account

- Capital gains: Income from selling assets, such as stocks or crypto

If you're new to the idea, some of these income streams might sound intimidating—but a lot of investments are much more accessible to the general public than you might think. Besides, remember that you don't have to start big.

All you need is to expand your horizons and work your way up toward having more than one income stream, at least at first. From there, you'll see that it's not so difficult to go up to three, four, and more.

The best part is that a lot of the above are passive income ideas. They're things you'll have to pay attention to now and again, but more often than not, they'll just run in the background making you money. For a lot of them, you can use Whop to start earning in minutes.

Still unsure what this is all about? That's what we're here for. We'll demystify the idea of having seven streams of income and give you some great options so that you can start earning money. Let's dive into those seven streams:

Rental income

It's no secret that landlords often have it made. With rising rent costs, renting a property out can net you a sweet sum of money every month. The downside? Most of us can't afford to buy a house for rent at the drop of a hat.

As such, if you don't happen to own a place to rent out to others, you might think that this stream of income is not for you. You'd be surprised! There are ways to make rental income without owning a property, and it's bound to be worth your time.

As far as investments go, investing in rental property is often a safe bet. While actual property costs appreciate and plummet throughout every decade, rentals provide a steady cash flow. The barrier to entry is shockingly low for smaller investments, too.

Below, we'll tell you about some options for both when you have something to rent out and when you don't. Remember that you should still consult a professional financial advisor before committing money to any project.

1. Earn rental income through REITs

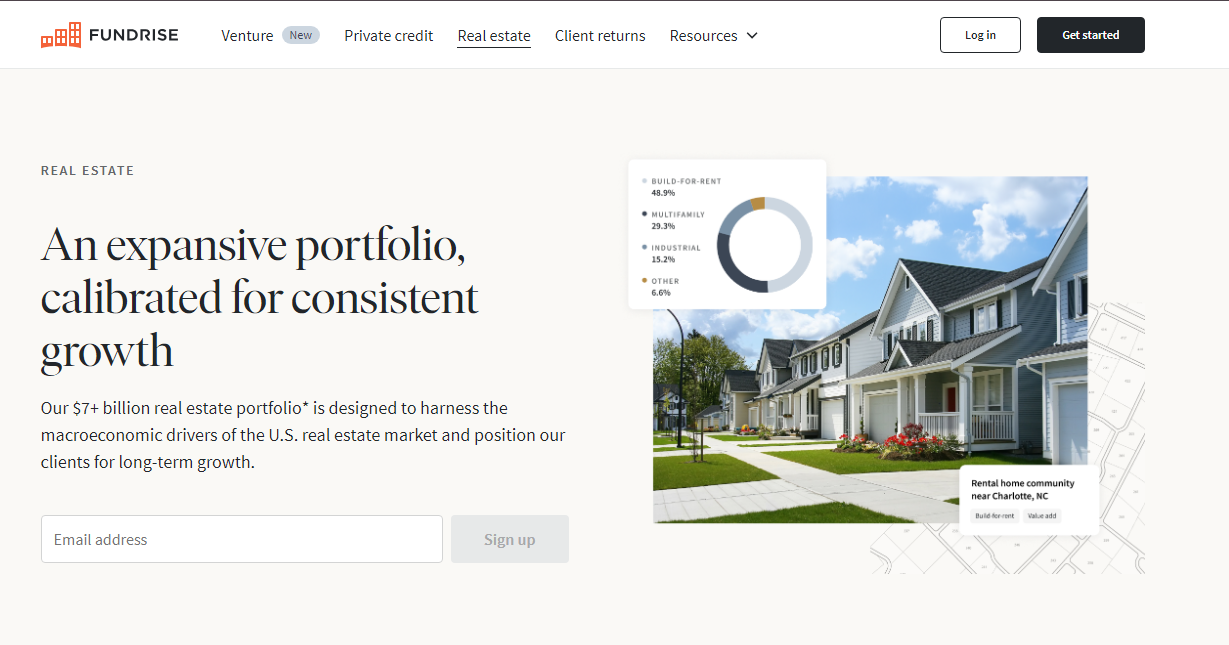

This is one of those "don't own property but still want to invest" ideas. REIT stands for real estate investment trust, and the term describes a company that owns, runs, and finances properties that produce income.

REITs buy properties for rent, be it apartments, houses, skyscrapers, and more. They're the ones that later manage and rent out these properties. This generates a steady stream of income that is later distributed among those who invest in the REITs.

To invest in REITs, all you really need is a brokerage account and starting capital. On some platforms, that initial investment can be as small as $10. Popular platforms for investing in REITs include Fundrise, RealtyMogul, and Crowdstreet.

Pros:

- Fantastic source of passive income from real estate

- Most REITs are open to anyone and have a low barrier to entry

- Historically, REITs remained relatively steady and provided a decent return on investment even during market crashes

- Some REITs are publicly traded and can be sold on major stock exchanges

Cons:

- In some cases, your investment may be locked up for years

- REITs are subject to market volatility

- REITs don't typically offer much capital appreciation

2. Rent out through Airbnb

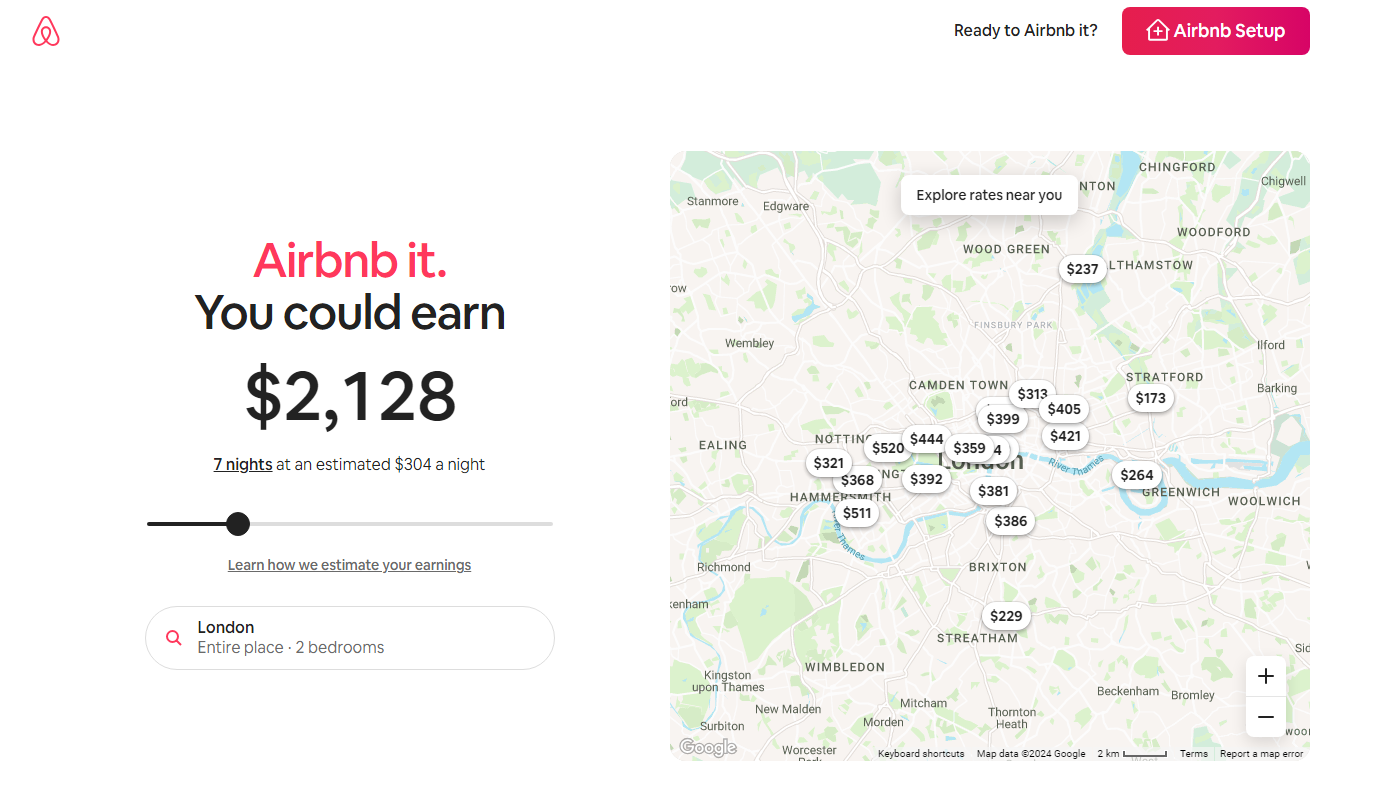

If you have a room or an apartment that you want to rent out, but don't want to commit to being a full-time landlord, using a platform like Airbnb can be a good idea.

Short-term rentals often have the benefit of commanding higher rates compared to long-term leases. This is especially true if your property is located some place where many people want to go, be it a big city or a popular holiday destination.

As a host, you can set your own prices, and dynamic pricing may sometimes work to your advantage—for instance, you can raise the nightly fee during the busy season and lower it when the demand slows down.

Pros:

- Renting out on a nightly basis is flexible

- Higher income potential than a long-term lease

- Using platforms like Airbnb makes the process more secure

Cons:

- Airbnb properties require a lot of management and upkeep

- The income can be highly seasonal

- Multiple tenants equal more wear and tear

- Your neighbors may not appreciate it

3. Buy a property to rent out

If you have the means to do so, buying property is often viewed as a financially sound investment. You don't need to have the entire capital to sink into it upfront, either—all you need is to have a credit score that allows you to take out a mortgage. That's a lot for many of us, which is why REITs (and other ideas down below) are a more accessible option than this.

The ideal rental property is one where the projected rent will cover more than just the mortgage. Your rental income should exceed the total of mortgage payments, insurance, maintenance, property taxes, and maintenance fees, giving you some extra cash on the side.

If you want a smaller investment, you can always rent out something else, such as a parking space or a car.

Pros:

- You may benefit from various tax benefits

- Real estate value tends to appreciate over time

- Steady source of income

Cons:

- High upfront cost

- Mortgage for 20+ years

- Ongoing landlord responsibilities

Dividend income

The next income stream is Dividend income. Dividend income is peak passive income in the sense that it truly requires no work from you once you get started. In fact, even if you wanted to do some work, there wouldn't be anything to do. However, managing your dividend investments will require some oversight.

The term "dividend income" refers to money you make from owning the shares of a company that pays dividends, which are a portion of that company's profits. These portions are distributed among shareholders on a regular basis, such as per month, per quarter, or per year.

While many companies offer the option of paying out dividends, for some, the dividends are quite minimal compared to their stock value. That's in line with what you'd expect, though—not massive income, but passive income. Such dividends are part of a long-term investment strategy.

Investing in companies is typically done through a brokerage account. Once you buy stock in a company that pays out dividends, there's not much else to do other than wait for it to pay out. However, it's good to keep an eye on your shares, as if they skyrocket in value, you can sell them—that would fall under capital gain income.

1. Buy dividend-paying stocks in a single company

The most common way of making money through dividends is to just buy the shares of a single company.

Some companies also offer dividend reinvestment plans (DRIPs). If you choose to enroll in such a plan, you won't be paid dividends. Instead, your profits will be used to buy additional shares of the company's stock, and you often won't have to pay brokerage fees.

Before you settle on any one company to buy shares from, it's a good idea to focus on blue-chip companies that have been paying out dividends for years. Some platforms to look into if you want to invest include E*TRADE, and TD Ameritrade.

As always, remember to consult a professional or spend lots of time researching before you sink money into any stocks.

Pros:

- Low initial costs

- Regular and steady cash flow that you don't have to do much to obtain

- Potential capital appreciation means that your stocks could be worth more in a few years

- Limited volatility if you buy shares in blue-chip companies

Cons:

- You need to invest a lot to earn a lot

- Companies can cut or eliminate dividend payments if they're struggling

- Dividends are often subject to taxes in the year they are received

- A lot of research required to get started

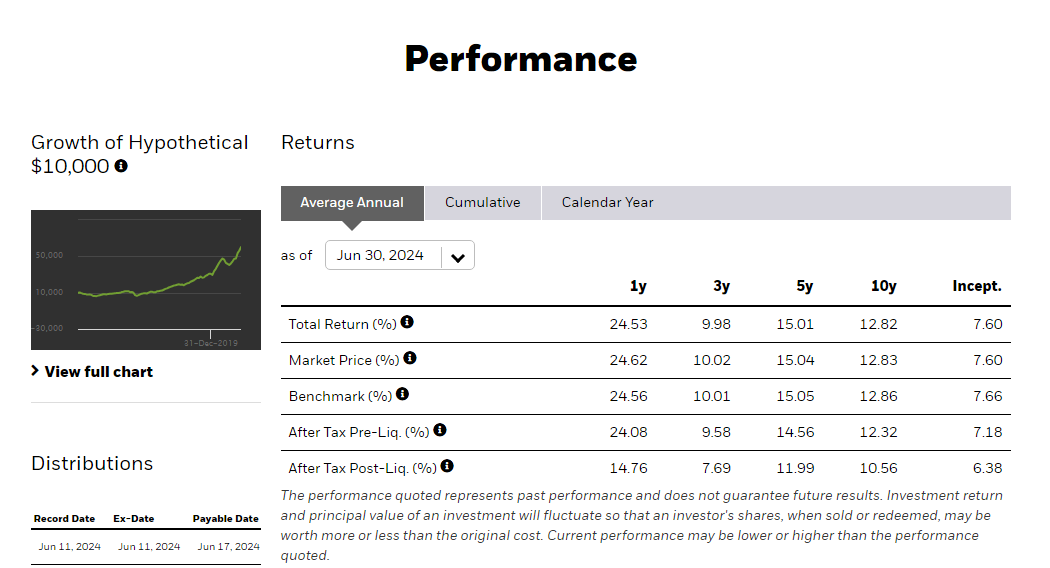

2. Buy dividend ETFs

Exchange-traded funds (ETFs) are increasingly popular, as instead of picking and choosing certain stocks to buy, you're essentially buying a basket of assets. For instance, you might buy a "Tech ETF" that features stocks from Nvidia, Microsoft, Google, and Meta. This would give you exposure to all these companies without needing to individually invest in any one of them.

Similarly, you can buy ETFs made up of companies that pay out dividends. This is a good way to achieve the diversification so many investors aim for—you're not banking on one single stock to do well, and ETFs are pre-made for you by fund managers who select and manage these portfolios.

It's worth noting that buying an ETF is not the same as buying shares in a company—not exactly. Imagine that you buy that "Tech ETF" basket I mentioned above, and let's say, for simplicity, that you only buy one share of "Tech ETF." As there are four different companies in the ETF, you'll own a fourth of a share of each.

If ETFs sound like they might be your jam, check out platforms like Vanguard, BlackRock, and State Street Global Advisors!

Pros:

- Diversification means you spread risk and income potential across multiple stocks

- ETFs are managed by professionals, which may make them safer and easier for beginners

- ETFs typically offer high liquidity

Cons:

- You'll usually have to pay management fees, cutting into your overall returns

- You don't get to choose the specific stocks included in each portfolio unless you work with an individual fund manager

- Mutual funds tend to have worse tax efficiency

Royalties

Income from royalties essentially means getting paid for something you created. You're sharing your own intellectual property and being paid a portion of each sale. This can mean smaller cuts, such as a musician releasing music and getting paid for each Spotify stream, or getting a large chunk of the full price for selling something like an ebook.

It's important to note the difference between royalties and income from sales, though. Especially for tax purposes, make sure that you note the distinct changes between earnings from royalties, which are usually percentage-based (and a pretty sweet form of passive income), and sales revenue that comes from direct sales and subscriptions.

Income from royalties includes things like:

- Authors being paid a portion of each book sale

- Musicians and songwriters being paid when their music is sold, streamed, or performed

- Inventors getting paid for the use of their patented inventions

- Trademark royalties for companies from licensing their IP to other businesses

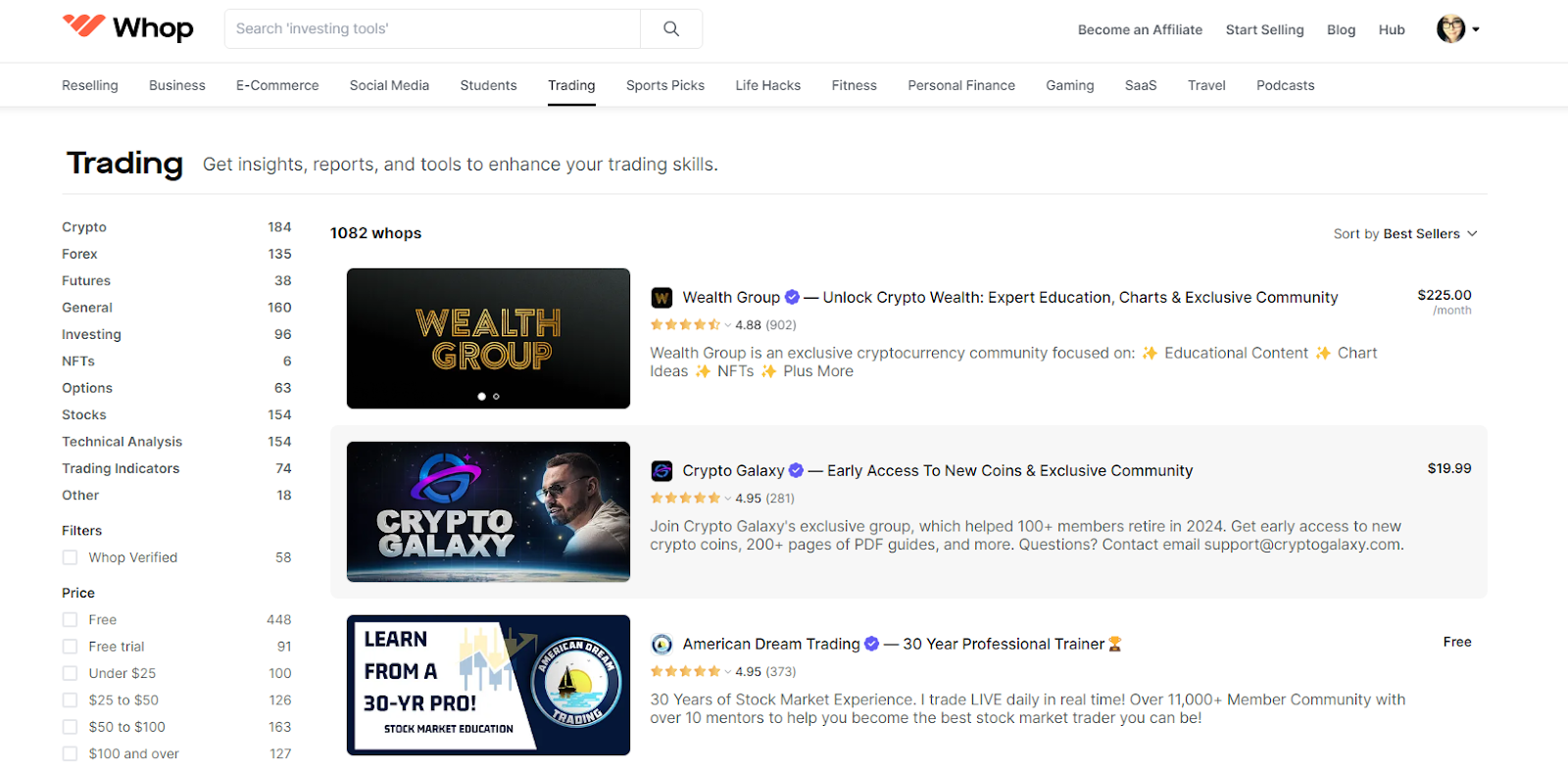

There's a lot of merit in royalties, but if you're writing books, selling SaaS, or making music, it's better to just use Whop. Instead of being paid small royalties, you'll retain 97% of your sales revenue. Then you can earn from:

- Selling online courses

- Selling ebooks

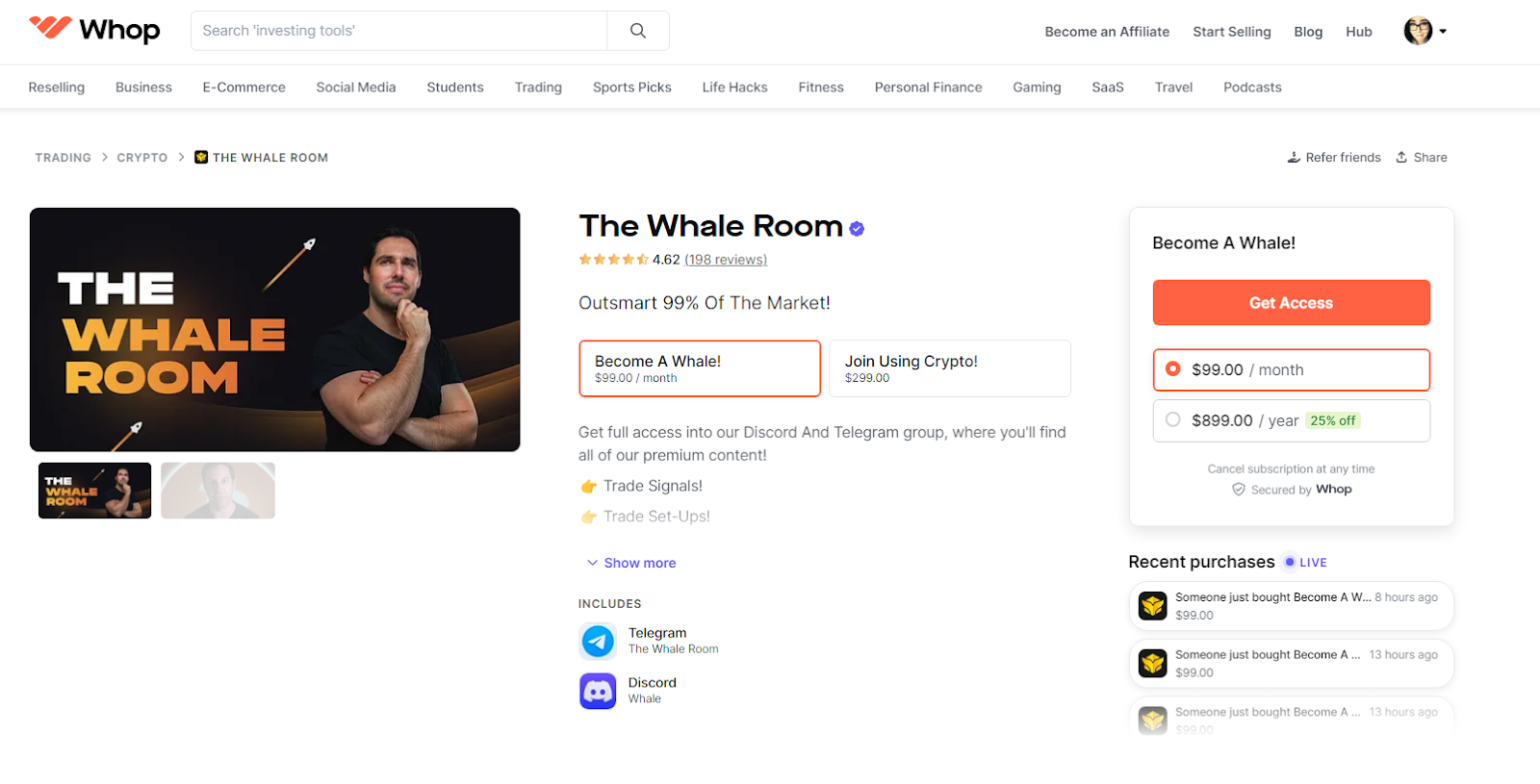

- Offering crypto advice , social media tips, trading advice (or any other kind of advice) inside of a paid community

- Earn with affiliate marketing

- Selling SaaS

Earned income

Earned income is the money you get for working, either for someone else or yourself, if you're self-employed. This is the (somewhat daunting) reality most of us are dealing with on a daily basis. Paychecks, tips, selling things you made, selling your services, commissions - all of that amounts to "earned income."

However, just because we're calling it earned income doesn't mean that you have to be working for eight hours a day to earn it. There are many shades of earned income, and to diversify, it's best to never rely on just one single source of revenue. Instead, the more streams of income you can build up, the better—and I'm not talking about juggling two or three jobs here.

In fact, the best kind of income is almost always passive income. There's no limit to how much passive income you can earn, but there very much is a limit as to how many jobs you can work per day (hopefully, just one!).

Let's skip the obvious "full-time job" source of income and go over some extra ways you can diversify here.

1. Pick up a side hustle (or three)

So, you've got a job that you're quite fond of, but you want to earn money on the side to keep building up your seven streams of income.

Side hustles are your best bet. They're not quite a second job, but they still have a lot of potential. The best part? A lot of them can be done from home, saving you both time and money.

Some of our favorite side hustle ideas include:

- Running a podcast on a popular topic

- Offering financial advice through a paid community

- Working as a social media manager

- Writing a blog

- Sports betting (or teaching others how to do it)

- Flexible gigs like DoorDash or Uber

- Dropshipping or reselling

All of the above aren't too time-consuming, but they have a decent earning potential. Win-win!

2. Earn passive income

If you can do something once and then get paid for it for the months or years to come—why wouldn't you? Earned income that doesn't require constant upkeep is possibly the best kind of income.

It's easier to diversify, as you can dip your fingers in many cookie jars at once without going insane from lack of sleep. Many such income sources are easy to scale and flexible, meaning that they work well if you have a job that you don't want to quit.

How can you earn a passive income? Consider one of the following:

- Offer online coaching, be it fitness advice or stock market insights, in a newsletter or in a private community

- Create things that are in high demand, such as spreadsheets, bots, automation tools, and SaaS, then sell them without any extra work for a long time to come

- Set up subscription-based services, such as paid communities, weekly meal plans, or tech support

Interest income

Interest income is not very convoluted compared to some other ways of making money. In essence, you put in some money and get paid based on the annual percentage yield (APY) of your chosen investment.

Interest is paid out regularly, either on an annual or a monthly basis, from things like lending money or investing in interest-bearing financial instruments like bonds. In simpler terms, though, you're essentially lending money, either to a company, a bank, a government, or even another person, and they're giving you a little extra for a few years before (hopefully) paying it all back in full.

When you invest (or lend) your money, you can choose to go for a safe option that's almost bound to pay you back at the end of it all, or one where it's less likely—based on its financial status. The former will usually offer lower interest, while the latter may pay higher interest rates, but you may never see your money back in full.

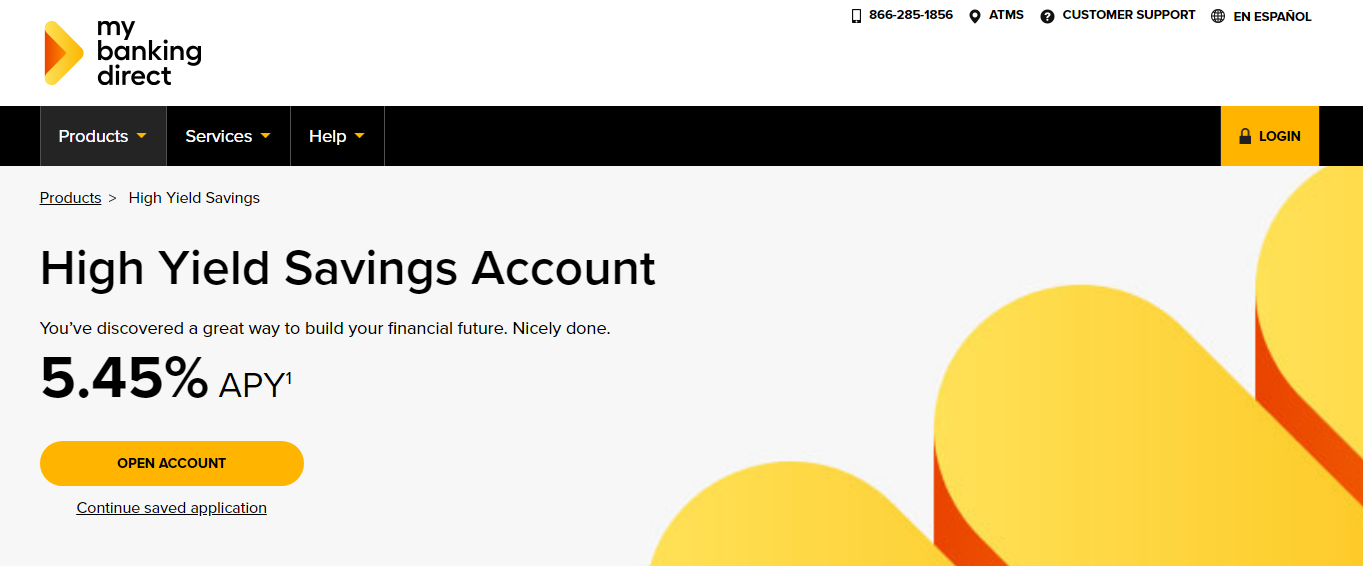

If you have a savings account, you're already using this income stream. But did you know that most banks offer very low interest rates compared to a high-yield savings account (HYSA)?

1. Invest in a HYSA

When you open a savings account with your bank, you'll get some interest … Some being the key word in that sentence. Regular banks, especially well-established brick-and-mortar banks, have no need to offer high interest rates. They're not going anywhere, so you'll most likely get your money back, and as such, that added incentive isn't needed.

Things are different when you open a high-yield savings account, most often with an online bank. While regular savings accounts typically offer interest rates ranging from 0.01% to 1% APY, HYSAs typically range from 3.50% to over 5% APY.

Of course, there may be a higher risk of the online bank or financial institution becoming insolvent and never paying you back, so make sure to do your due diligence and do lots, and I mean lots, of research. With that said, starting a HYSA is a solid idea for passive income for young adults.

Many financial institutions offer HYSAs. For starters, check out My Banking Direct, Upgrade, BMO Alto, EverBank, and UFB Direct. Look for accounts that offer compound interest so that you can earn more every year.

Pros:

- Higher interest rates mean you'll be raking in money faster!

- Many HYSAs are protected by the FDIC for extra safety, so make sure that they're covered before they invest

- HYSAs often allow some number of withdrawals without penalties

Cons:

- HYSAs are often offered by online banks with no brick-and-mortar locations

- Interest rates may be variable and can fluctuate

2. Buy bonds

Buying bonds is another way to earn interest, this time by lending money to governments, municipalities, or even corporations.

You're lending them money for a defined period of time by purchasing their bonds. In return, they'll be paying you periodic interest payments (known as coupon payments) until the bond matures. At that point, if everything goes well, you'll get your principal back.

Government bonds are typically considered very safe investments, but it depends on the economic state of the country. Countries that are doing well don't offer high interest rates. As an example, the U.S. Treasury 10-year bond offers a 4.2% interest rate, while Ukraine offers 16.1%.

Pros:

- Bonds are considered regular, stable income, with some bonds paying on a semi-annual basis

- Some bonds carry minimal risk

- Certain bonds may offer tax-free interest income

Cons:

- Bond prices may fall when interest rates rise, which can result in capital losses if bonds are sold before maturity

- Bonds typically offer lower returns than HYSAs

3. Peer-to-Peer lending

P2P lending is a method where you can lend money directly to people or companies through an online platform that makes it all happen. It's considerably safer than just lending money to someone directly.

For borrowers, these platforms are often more lenient when it comes to credit scores. On the other hand, the interest rates are higher, which means higher returns for you—but also higher risks.

P2P platforms will let you choose the loans you want to fulfill. Some options include LendingClub, Prosper, and Upstart. Unofficial P2P lending is also done through subreddits like r/borrow, but be wary—there's zero guarantee that you'll ever be paid back.

Pros:

- P2P lending tends to offer much higher interest rates, sometimes as high as 20%

- You can lend to multiple borrowers across different credit profiles

Cons:

- The risk with P2P loans is much, much higher than most other types of investments

- P2P loans are typically illiquid, meaning that selling or transferring them is hard

- P2P platforms may charge high fees on your loans, limiting your returns

Business income

Many, if not all, of those millionaires with their seven streams of income are business owners. Working for someone else can only get you so far. On the other hand, taking a great business idea and running with it can break through any notion of a glass ceiling and evolve into a fantastic source of income.

So what is business income, really? It refers to the earnings you get from running a business. This includes every type of revenue, from sales to interests, royalties, and dividends.

The structure and formality of your business can affect all sorts of things, from your taxes to various legalities, so this income may fall under earned income, too. It all depends on whether you're running a sole proprietorship, an LLC, a corporation, or working as an independent contractor or freelancer.

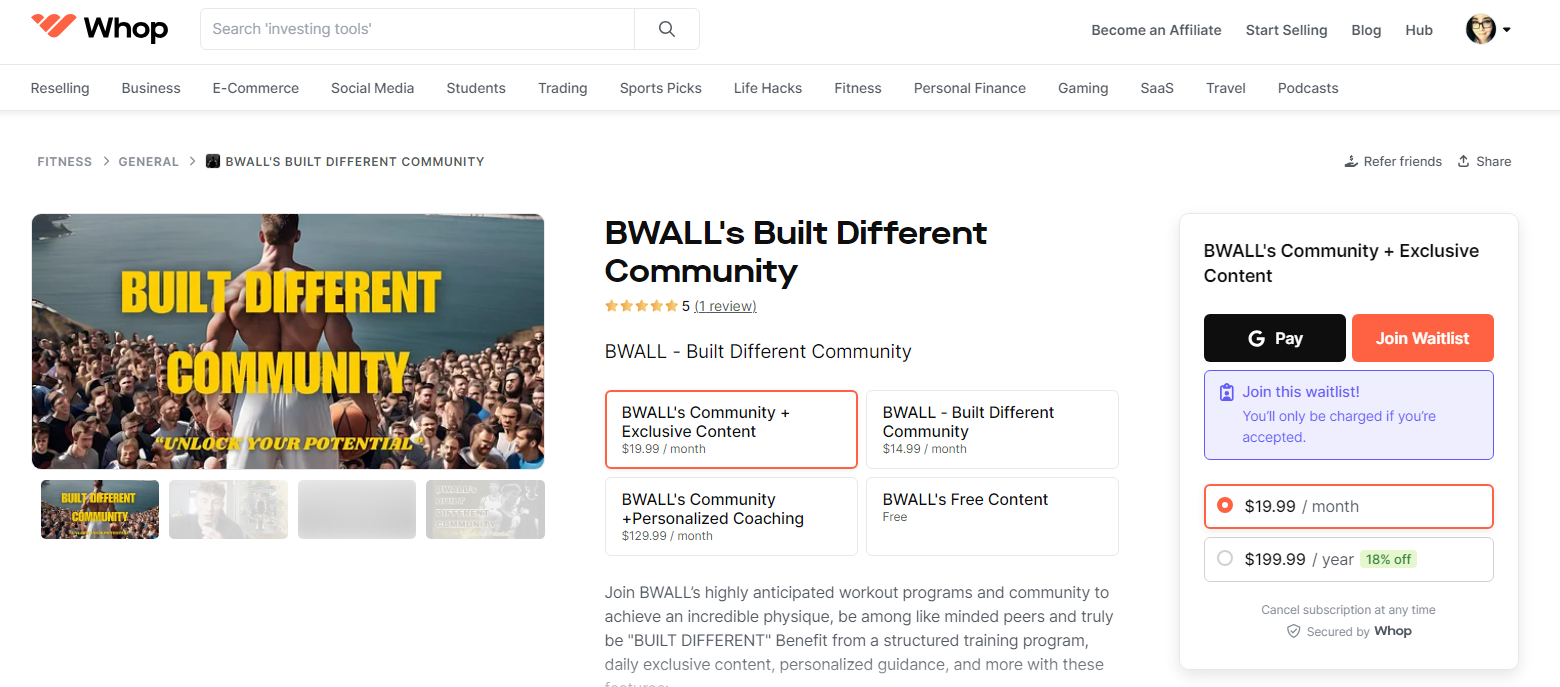

1. Start a personal training business

If you're passionate about fitness and have a personal trainer certification, you could earn money from running your own business. You could operate as a sole proprietor, be self-employed, or open your own LLC—although most personal trainers don't need to do that.

As a personal trainer, you can work with clients directly in person. At that point, it helps to team up with a gym or set up your own training room. On the other hand, you can also work with clients online, and that's where you can start getting your hands on some of that sweet passive income.

You can sell ebooks, courses, or set up a private community to motivate your customers and offer one-on-one coaching calls or classes. Want a tip? You can do all of that through Whop in a few minutes, so check out our guide to making money as a personal trainer.

Pros:

- You can work with clients directly or online

- Depending on your state, you may not need to start a company

- You can branch out to make passive income through courses or ebooks

Cons:

- You may need a personal training certification

- Outside of ebooks or courses, most of your money will come from active earning like coaching

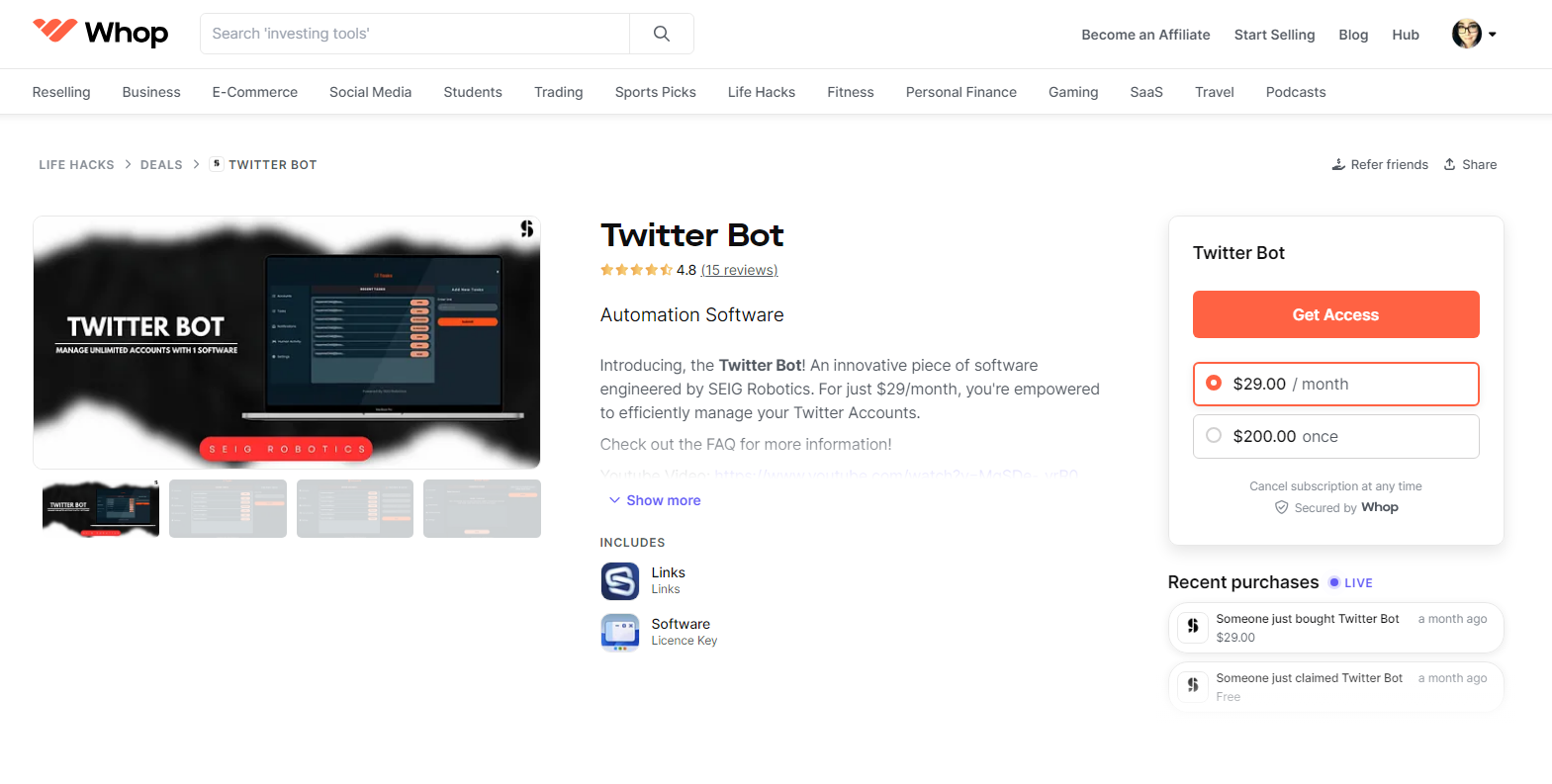

2. Become a developer

If you're one of those cool techy people, why not put your skills to good use and open up a business? As a programmer, you can work as an independent contractor (which, again, puts your income under "earned income" instead of business), but you can also set up a company to make things official.

You could be selling downloadables or SaaS, such as Discord bots or automation software. Moreover, you could offer on-demand programming services for those who need a skilled dev.

Through Whop, you can sell your digital products and offer one-on-one calls. All you need is your own hub and a few minutes of your time, so sign up today

Pros:

- Low starting costs—all you need is a computer

- No credentials required—if you're self-taught, no one is going to care

- Potential for passive income if you want to sell courses or bots

Cons:

- You'll need a lot of specialized knowledge

- Some markets are rather saturated

Capital gains

Capital gains income is the profit you earn when you sell an asset that has appreciated in value. This can be anything, really, from stocks to real estate to NFTs and stamps. It's the ultimate "buy low, sell high," and with a very high earning potential to boot.

If you buy something for less than you end up selling it for, the difference is what's considered a capital gain.

Two things in life are certain: death and taxes. As a result, it won't surprise you to hear that capital gains income is subject to taxes, which can vary depending on how long you've held onto the asset before deciding to sell it.

1. Buy and sell stocks

Few things have as much potential in terms of capital gains income as buying and selling stocks. For example, a friend of mine bought Nvidia stock a few years ago. Needless to say, he's pretty pleased with himself right now, as Nvidia's value skyrocketed in recent years—and so did the value of his stocks.

Let's say that my friend bought $1,000 worth of Nvidia shares in 2017, at which point Nvidia stock was approximately $4.79 per share. That would've gotten him around 208 shares. Now, if he sold these shares in 2024, he'd be in for a treat, as Nvidia's stock price sits at around $118 per share. That'd mean that my friend's initial capital of $1,000 would now net him $24,631. (Mind you, it's quite volatile, so these numbers are surely different by the time you're reading this. This is just an example.)

Buying and selling stocks requires a good understanding of the market. If you want to learn how to do it, make sure to read our guide on becoming a successful trader, and then explore the top trading Discord servers.

Pros:

- High return potential and great liquidity

- You can build a diversified portfolio of stocks, maximizing your income streams

Cons:

- Return on your investments may take years—or it may never happen

- Market volatility has a massive impact on your returns

2. Mutual funds and ETFs

I've talked about ETFs a little above, but only in the context of dividend ETFs. However, mutual funds and ETFs make for solid sources of capital gains income, too, dividends aside.

Mutual funds and ETFs are both types of investment funds that pool money from many investors to invest in a diversified portfolio of assets. They're pretty different from each other, though. Mutual funds are actively or passively managed by portfolio managers who trade assets to make their funds perform as well as possible.

ETFs are passive, with an allocation to many different stocks. In mutual funds, portfolio managers may regularly respond to market ebbs and flows and change your allocation to each component of the fund. As a result, you'll often pay higher fees for mutual funds than for ETFs.

You can also invest in ETFs that track the S&P 500, as in the top 500 publicly traded companies in the United States. Some of the more popular ETFs that track the S&P are the iShares Core S&P 500 ETF and the Vanguard S&P 500 ETF.

Pros:

- Mutual funds and ETFs tend to be professionally managed, making them easier for beginners

- Broad exposure to various asset classes and sectors

Cons:

- You'll generally have to pay higher fees, especially for mutual funds

- Mutual funds cannot be traded throughout the day and are only priced at the end of the day

- You may need a higher initial investment

3. Cryptocurrency

If the stock market is volatile, then crypto is downright tumultuous—but if you can keep your head above the water, you might walk away significantly richer.

Assuming that you have a higher appetite for risk, buying and selling crypto assets could prove super lucrative. There are tried-and-true coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) that are often considered relatively safe bets. They may net you less money, but the risk is much smaller.

On the other end of the scale are small altcoins and meme coins that may blow up—think Dogecoin (DOGE) and Shiba Inu (SHIB). But remember, for every DOGE and SHIB, there are thousands that crashed and burned. It's a risky business, so tread carefully.

There's more to crypto than just the good ol' buy and sell. Decentralized finance (DeFi) is a subsector of crypto that lets you earn passive income by lending or staking your assets to earn interest. (At which point it no longer counts as capital gains income.)

Pros:

- Low barrier to entry—you can invest small sums to begin with

- High earning potential

- Low counterparty risk

Cons:

- Extremely volatile

- Very difficult to make winning picks

The Best Passive Income Revenue Streams

I've been yapping on and on about passive income all throughout this article. Hey, there's a good reason for it—it's just that good.

There are only 24 hours in a day. Assuming you can't get your hands on Hermione's Time-Turner and magically stretch that time to amount to more, you can only reasonably dedicate eight to 12 hours a day to work. Honestly, 12 hours are stretching it. Aim for eight to stay sane.

This is why, in order to maximize your income streams, you should aim for income that's close to entirely passive. You may need an initial time investment, but after that, you'll sit back and watch the money come rolling in.

Some of the best ways to achieve passive earned income include selling digital products. This includes:

- Writing and selling ebooks. Once written, a book can get sales for years.

- Making courses—you'll just need to perform light updates now and then.

- Creating and offering SaaS, which gets you money on a subscription basis. Who doesn't love that?

- Run a paid community, where members will pay a one-time or a subscription-based fee to join.

- Create various downloadables, such as graphic designs, Notion templates, or Discord bots.

- Trading crypto and stocks, but also investing in schemes that offer a solid interest rate.

There are a lot more options—the sky is the limit. If it's something you can make once and then sell over and over, it means passive income.

Did you know that Whop is the leading platform for selling digital products, by the way? You can turn your idea into money in mere minutes.

Managing Your Income Streams

So, you've made it. You managed to diversify and now sit on more than one income stream. And even if you're not quite there yet, you're planning to be, which is pretty great.

Now what? Of course, the goal is to keep trying to build up to seven income streams. But just having a lot of good ideas and investing your money and time well is not enough to ensure that you'll walk away rich.

It's not just about setting up your income streams—you also need to manage them well. Without good systems in place, it's all too easy to start bleeding money and spread yourself thin.

What can you do to successfully juggle multiple income streams? Here's our checklist.

Diversify as much as you can

The whole point is to spread your wings a little. If you're an investor, invest in various asset classes such as stocks, bonds, real estate, and businesses to spread risk and increase potential returns. Even if one part of the market crashes, you'll still be fine if you're investing in many different kinds of assets.

The same applies to income types. Mix active and passive income to earn more money without being exhausted.

Budget carefully

If you're investing, it's easy to fall victim to the sunk cost fallacy and spend too much on assets that aren't worth it. This is why setting up a budget for your investments, no matter how big or small, is a good way to keep yourself safe.

For budgeting, you can use tools like Mint, You Need a Budget, or PocketGuard.

As your streams of income start paying off, start building up emergency funds and savings accounts to ensure that a short lull in revenue won't put an end to your plans.

Review and adjust

Some of the things we outlined above are long-term investments. In those, your money may be tied up for years. Other things, such as selling ebooks or making courses, are far more flexible.

Set aside time every month to review your current income streams and adjust. For instance, if one of your digital products is underperforming, perhaps some market research might help?

Figure out your taxes

It's important that you understand the tax implications of becoming an entrepreneur with multiple streams of income. Without beating around the bush—it's tricky.

Look into the taxes you have to pay for each income stream, including deductions and credits. Set aside money for when you have to pay each tax, and consult a professional if you're unsure. It's always worth it.

Use helpful software

Gone are the days of budgeting with a pen and paper (not that there's anything wrong with that). These days, many kinds of helpful software can make your life easier.

Try out accounting tools like QuickBooks or FreshBooks for managing finances and generating reports. You can also use tools like Asana or Trello to keep on top of tasks like checking the performance of your investments or updating your course.

Investment apps like Robinhood, Acorns, or Coinbase can help if you're investing, while Whop is your go-to for managing a successful online business or side hustle.

Create Multiple Streams of Income With Whop

What a ride -we've gone over the main seven streams of income. You might even have your favorite picks.

Before you get started, let us remind you that you don't need to dip into every income type. Instead, you can have multiple streams of revenue that all fall within the same kind of income. In fact, that's the easiest way to make money, feel secure about the future, and still have time to do the things you enjoy the most.

But how do you achieve all these different income streams without going insane? It's easy—just sign up with Whop.

With Whop, you can lean into multiple sources of revenue from all sorts of different things. You can sell courses and charge a flat fee or a subscription; you can write ebooks and collect money from each sale; you can even charge a fee for joining your own private community.

Those are three streams of income right there. Even if one temporarily dries up, you'll still have two more—and better yet, these all fall under that highly desirable "passive income" umbrella that we all love.

What's even better is that you control all of your income streams from the same place: your own whop. In your whop, you can add apps such as Chat, Courses, Forums, or Discord access. Then Whop handles the payment side of things and automatically distributes your digital products.

What do you do? Sit back and watch the money hit your account, and it's all for free. That's right—Whop has no upfront costs. Have I mentioned that getting started takes a few minutes? Take control of your future and your income. Sign up with Whop today.

![40 Easy ways to make money online [2024]](/blog/content/images/size/w600/2023/11/20-ways-to-make-money-online--1-.webp)