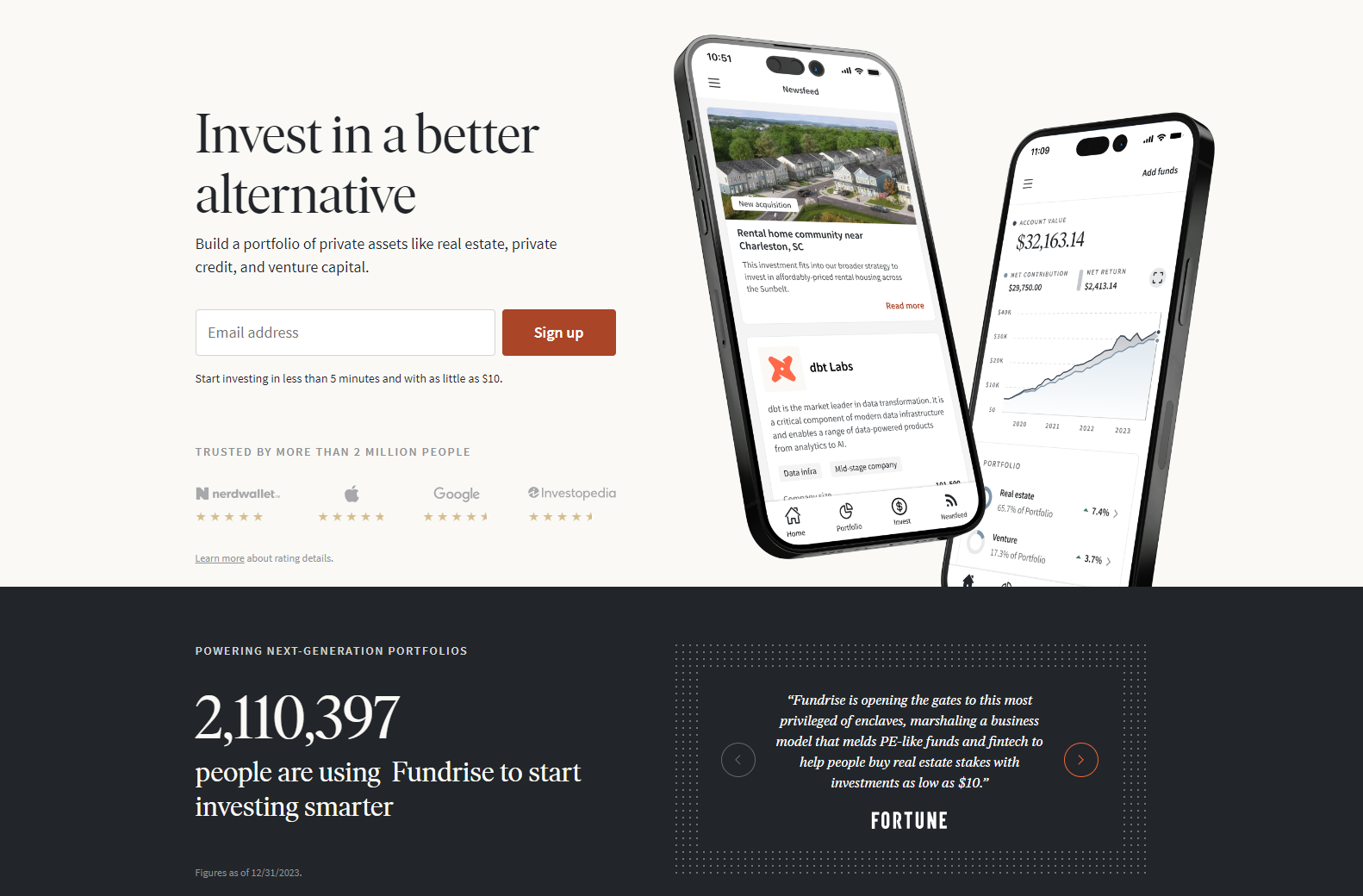

Founded in 2012 and headquartered in Washington, DC, Fundrise is one of today’s leading online real estate platforms and has been making waves in the world of investing.

In this review, we’ll take a look at what’s under the hood and why Fundrise has been such a game-changer, how the platform really works, and whether you should consider investing on the platform.

What is Fundrise?

Fundrise is an investment platform that opens the world of private markets to ordinary household investors, allowing you to add assets like real estate and venture capital to your investment portfolio.

This is a game-changer, given that institutional capital has historically monopolized these private markets, with household or retail investors restricted to the public markets.

How does Fundrise work?

Fundrise works by giving everyday investors access to opportunities they usually do not have access to.

Let us explain what that means in more detail.

Access to 'accredited investor' opportunities

Most ordinary citizens of the US are well aware of the advantages of investing, but even if buying stocks and shares is extremely common across the population, they aren’t necessarily defined as an ‘investor’.

Under Regulation D, the Securities and Exchange Commission (SEC) defines a set of criteria for accredited investors in income, net worth, asset size, governance status, or professional experience. If these criteria can be met, an individual or organization can gain this designation and entire the market for securities that aren’t registered with financial authorities.

As an accredited investor, you can gain access to investments that are considered more risky or complex than regular stocks or mutual funds. Such investments are private companies, real estate projects, and hedge funds. The SEC assumes that accredited investors are more financially stable and so can handle the risk that comes with these investments.

However, most ordinary folks can’t gain accredited investor status since the income ($200k per year or $300k joint income) and the net worth ($1 million not including primary residence) tests are pretty steep.

That’s where Fundrise comes in.

Non-accredited investors can use Fundrise to get exposure to assets they couldn’t otherwise. Fundrise takes the investments or deposits made by its customers and pools them, then invests in those assets to give customers the exposure and portfolio diversification they’re looking for.

You can sign up with and use Fundrise via desktop or mobile, pick your asset classes, and make your investment choices before monitoring your performance with a variety of functions. These include portfolio and project alerts, and trend analysis tools, and you can even earn passive income on the platform.

If you’re coming into Fundrise without a specific investment strategy or portfolio goal of your own, you can choose one of the Fundrise recommended plan options. They are:

- Balanced: In this plan, you’ll invest 90% of your capital in real estate and 10% in private credit assets focused on growing wealth. The goal of this plan is long-term appreciation via consistent short-term income earnings.

- Long-term growth: As the name suggests, this plan goes all-in on long-term growth with 100% portfolio allocation into real estate assets expected to appreciate.

- Supplemental income: This plan focuses on 80% private credit with a 20% side of real estate to bring in regular dividends. If you’re looking to retire on your investments or a passive income stream, this is it.

- Venture capital: This plan looks toward pre-IPO tech companies, and can vary quite significantly across the short term. Over the long term, however, it can provide massive windfalls via options like the Fundrise Innovation Fund.

You can take a much more micro-managed approach toward your own portfolio on Fundrise if you register for a Fundrise Pro account, and this lets you pick and choose your allocations into a wide variety of asset types rather than plumping for customer favorites like the Fundrise Flagship Fund. You also get access to advanced data, market research, and a selection of content from publications that are usually gated behind a paywall.

It’s worth noting that you can also use Fundrise to open a traditional, rollover, or Roth IRA as a general investing account, and their IRA custodian is Inspira Financial Trust LLC.

What is private credit?

Private credit is an asset class that consists of loans, fixed-income, and other structured investments that tend to offer a more favorable risk-reward profile compared to equities.

By putting money into private credit, you’re essentially lending money to borrowers in exchange for a fixed rate of return—and unlike bonds or asset-backed securities, it’s an illiquid but higher-return form of investment.

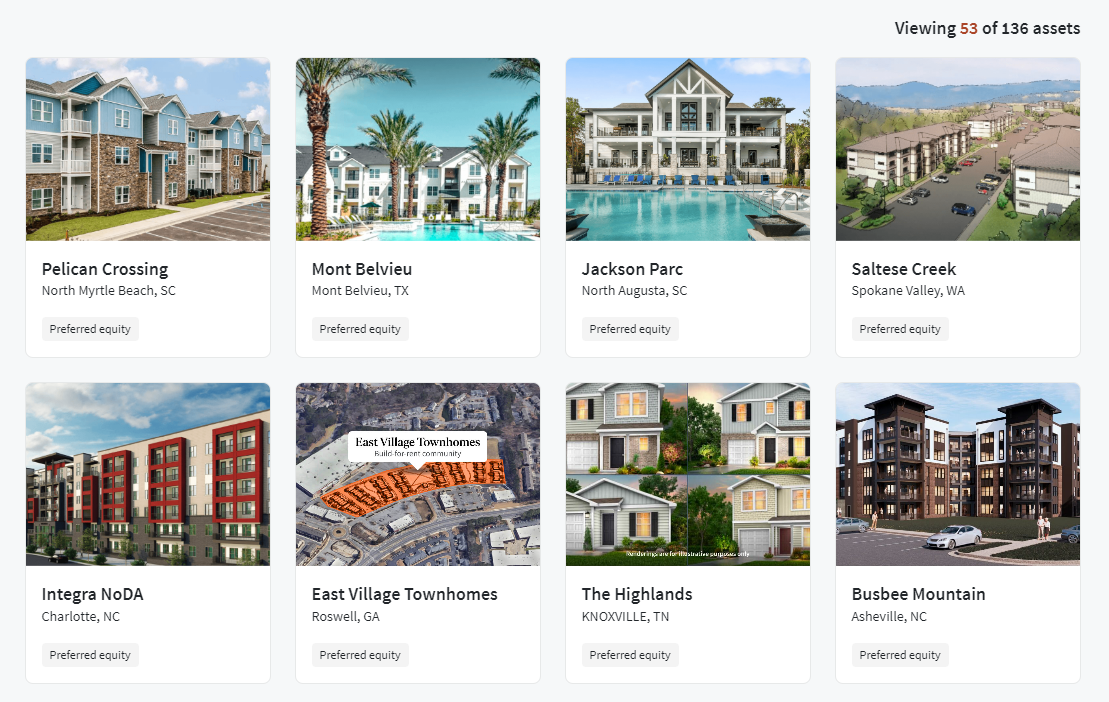

Fundrise’s private credit strategy focuses on high-growth markets such as the US Sunbelt of Dallas Fort Worth, Phoenix, Orlando, Tampa, Houston, Atlanta, Charleston, and Las Vegas.

In fact, the majority of Fundrise’s recent acquisitions were in the Sunbelt, to the tune of over 90% in 2021 and 2022.

Why private real estate?

A major part of the Fundrise strategy includes private real estate because it’s an asset class that has historically offered lower volatility than equities and higher potential returns than bonds. This puts it in an interesting niche from a portfolio-building perspective, gives customers more opportunities for diversification, and leads to strong income generation.

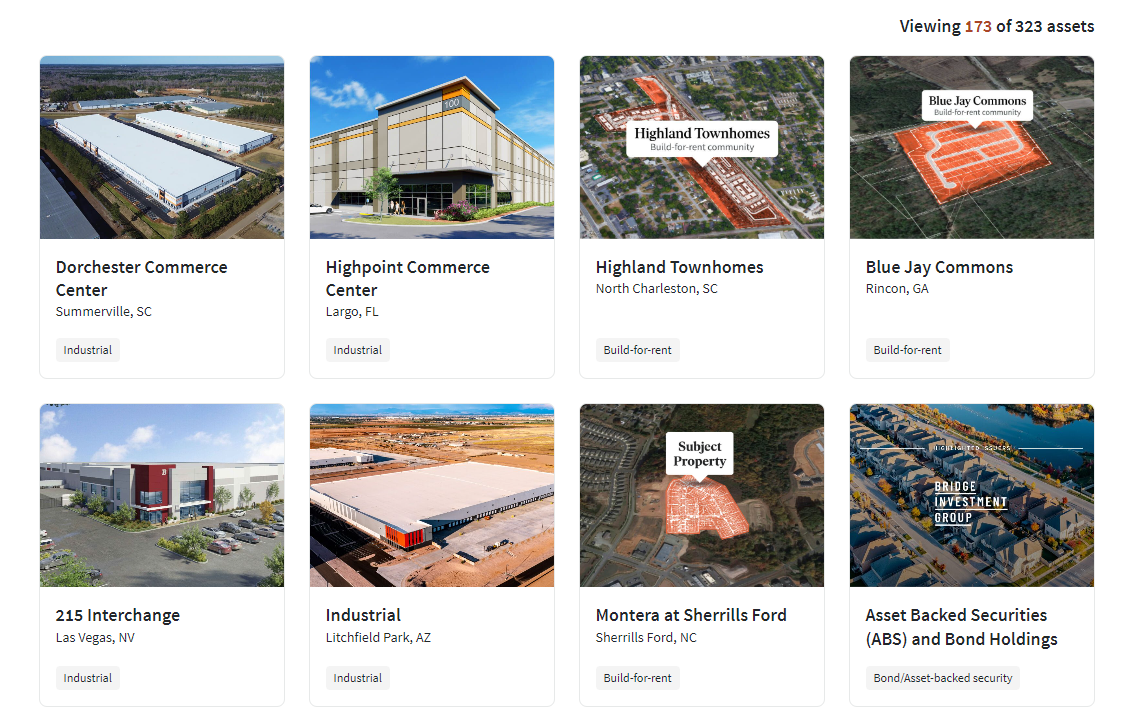

Fundrise invests in industrial properties like those pictured above but also targets multifamily apartments and build-for-rent properties. They own over 3,400 single-family homes, and almost 9,000 residential units, and control over 2.3 million square footage up for lease.

Fundrise minimums, fees, & charges

In order to open a Fundrise general investing account, you’re only going to need a $10 minimum. This opens the doors to private markets wide, since companies that enable investor access to these usually add a whole bunch of zeroes to that figure.

There’s also a 0.15% annual advisory fee for a general investing account, which isn’t likely to take a big bite out of your investments. However, the more capital you put into Fundrise, the more sense a Pro account is going to make—there’s no percentage there, rather a $10 per month or $99 per year fee.

IRAs on Fundrise have a $1000 minimum, but it’s worth going in with $3000 per year or more with an investment or maintained balance of $25,000—at that threshold, you can get the $125 annual IRA fee waived.*

Management fees are also a thing on the platform, but their nature depends on the fund option you’re looking at. Real estate funds charge a management fee of 0.85%, while their Innovation Fund (an integral part of the Venture Capital plan) has a 1.85% management fee. IRAs also add a 1% annual fee.

Early redemption fees also depend on which fund you’re invested in. It’s usually a 1% fee, and the holding period to avoid any penalty is five years—although some funds don’t involve a fee, and Fundrise may waive them in times of economic uncertainty as seen in March 2020.

Despite the relative transparency of this fee schedule, Fundrise also says that its funds do reserve the right to charge additional fees such as development or liquidation fees. These can be found in offering documents, but aren’t necessarily easy to find at a glance.

*As always, anything written here is not financial advice. Always do your own research

Fundrise compliance

Fundrise is an accredited business and holds an A+ rating from the Better Business Bureau. This is the highest possible rating that a company can achieve, and is scored on both business and public data sources as well as reviews of any customer complaints against the company.

The company does have one civil penalty on record for a case filed against it by the SEC back in 2016. Proceedings were settled in 2023, with Fundrise agreeing to pay a $250,000 fine pertaining to compliance requirement violations when working with content creators.

Liquidity at Fundrise

Fundrise offers withdrawals and redemptions from its core investments using a share repurchase program.

You can redeem some or all of your shares at any point, and redemptions are processed quarterly. This option offers more liquidity than the usual 5-year hold period, but it still means you may have to wait a little while for your money depending on when you initiate a repurchase.

Is Fundrise worth it?

Let's take a look at the pros and cons of Fundrise.

Pros

- $10 minimum:

Compared to hedge funds and other traditional private investment options, Fundrise opens up a host of possibilities for ordinary investors while remaining affordable to all. - Accessible to all:

Fundrise is also accessible by anyone, not putting up any boundaries other than geographical ones—any US citizen or permanent resident above the age of 18 can use the platform. - Includes IRA accounts:

Fundrise includes IRAs so you aren’t forced into the traditional options any longer.

Cons

- Illiquid investments:

Assets like real estate and private credit tend to be illiquid, and Fundrise tends to require a 5-year minimum hold on its funds. The share repurchase program is more liquid and is processed quarterly. - Additional fees:

Some funds may charge additional fees, so you’ll have to pore through fund offerings in detail to make sure your chosen options are truly right for you.

Who is Fundrise best for?

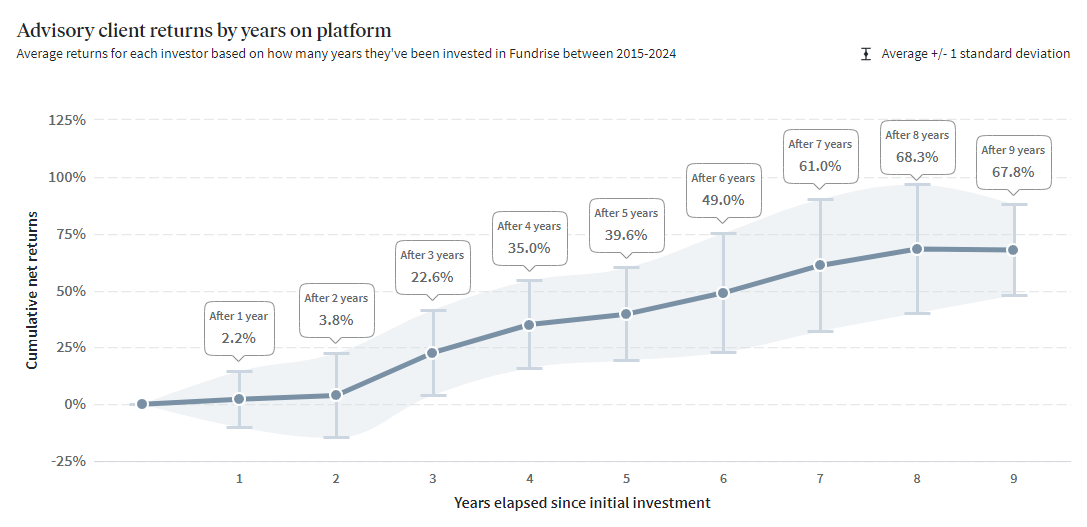

Fundrise investments are intended to be held long-term, so if you’re looking for a quick profit, it probably isn’t the platform for you. Private investment funds tend to take a while to generate value, with the advantage of returns compounding themselves as the years go by.

So, if you’re looking for long-term investment options and want to diversify your portfolio beyond public options such as equities, bonds, and crypto, Fundrise can give you a lot of options. Being able to invest in assets such as real estate, private credit, and even venture capital with an extremely small amount of capital can only be a good thing.

However, the platform hasn’t been through times like 2008 and there’s no telling how it’ll hold through any sort of potential real estate crash. That being said, this probably holds true of many other investing platforms and even entire asset classes.

Learn more about real estate investing with Whop

If the different options unlocked by Fundrise interest you but you’re not quite sure whether to make the leap, don't worry! Whop’s real estate communities can help you deepen your understanding of real estate and private credit markets. You’ll find plenty of others like you to talk over these options, as well as expert guidance and even courses if you want to go the extra mile.

Whop’s trading communities can also give you the insight you need when it comes to deciding what to do with your money. Fundrise focuses on a longer horizon for investments to pay off, but other assets and trading styles can give you similar or even better returns while also managing risk.

Head to Whop and start browsing all their communities today! It's the perfect opportunity to educate yourself and make the right decisions when it comes to investing your hard-earned dollars.