Stock trading and investing is easy to do today, but with so many options out there it has never been harder to pick the right broker. Luckily, we’ve put together this guide to the best free stock trading apps of 2024 in order to help you make the right decision.

Choosing a free stock trading app can be tricky thanks to the variables involved, with different assets, commission structures, and account types going around. We’ll dig into all of that and show you some of the top options on offer, as well as what to look for when you’re comparing this year’s top trading apps.

Why Use a Free Trading App?

Free stock trading sounds like a no-brainer today, but it hasn’t actually been an option for all that long. Prior to 2015, just about every stockbroker or trading app charged some sort of fee, whether flat or percentage based. Some would also engage in a certain amount of gatekeeping, requiring minimum deposits in the thousands or even tens of thousands in order to get started.

The advent of free trading apps has created a market where low or no-cost trading has become the rule rather than the exception, and stocks (along with other asset classes) are much more readily available to the public.

Picking a free trading app, as with choosing any other product or service, tends to be a matter of your circumstances, behavior, and risk tolerance.

If you’re just looking to learn how trading works and would like to start off with some $5 trades, for instance, a broker that charges $1 per trade would be a bad idea. By the same token, if you can’t afford the sign-up fee or minimum deposit required by a traditional broker, then a free trading app might be your only choice.

Whatever your situation is, though, the free stock trading market is mature enough in 2024 that finding the right app for you is far from impossible!

5 Best Free Stock Trading Apps in 2024

Here are our picks for 2024’s best free stock trading apps along with a list of 5 honorable mentions below!

#1. Fidelity

Fidelity is better known as a traditional stock broker, and has been one of the giants of the field for a long time. It may come as no surprise, therefore, that they’ve kept up with market trends and can offer a free trading app of their own!

Setting up with a traditional powerhouse like Fidelity can help you alleviate some of the major risks that smaller free trading apps might pose. Fidelity also has billions of assets under its purview, so it’s unlikely to run into any problems where stability and safety is concerned.

Stock and ETF transactions are free on the Fidelity app, and the mobile experience is user-friendly and offers a slick, intuitive design. You also don’t have to deal with any account minimums, and there are plenty of zero expense ratio index and mutual funds to choose from.

The main down-side of Fidelity is that options contract fees can be more expensive than with competing brokers. This isn’t a problem if you’re just starting your investing journey, but if you’re actively looking for higher risk via options and margin trading, it may be the wrong platform for you.

For a top all-round experience and zero fee operations across the board, along with the security of knowing your assets are in safe hands, Fidelity is the undisputed number one.

#2. SoFi

SoFi is a stock trading app targeting beginner investors, but don’t let that fool you if you’ve got a little experience in the trading game—it’s an excellent option for users of every knowledge and experience level.

It features low commissions across all assets and completely free stock and options trading, meaning that it may be your top pick if options are your thing. You can also invest in fractional shares with a minimum of just $5.

SoFi’s only real down-side is the fact that it doesn’t offer mutual funds at this time. If you’re looking to build a diversified portfolio this might concern you, but if you can live without mutuals then SoFi is an option well worth checking out. They even offer a selection of popular cryptocurrencies.

#3. Vanguard

Vanguard is often mentioned in the same breath as Fidelity, and is a pioneer of index fund investing. If index funds are going to be a big part of your strategy, you can’t go wrong with Vanguard given their breadth of options and low-cost access.

You also don’t need to worry about account minimums or commissions on stocks, ETFs, or even mutual funds. Watch out for fees on assets like options, though, which can still have a contract fee while being free of commission.

Vanguard’s interface isn’t as smooth as you might want from a stock trading app, and they do lack some of the research tools and other bells and whistles that competitors offer. Still, Vanguard is massively capitalized and their safe, steady reputation ought to count for something.

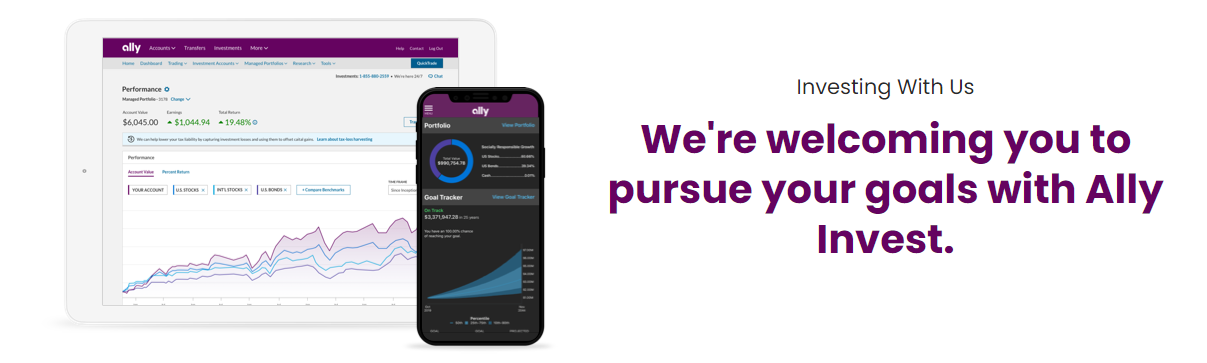

#4. Ally Invest

Ally Invest takes things a step further from just trading; it offers an all-in-one financial suite that lets you manage your finances efficiently in one place. Whether it’s your checking account, savings, or stock portfolio, you can manage the lot with the Ally Invest app.

This does mean that it’s a little light on options as a sophisticated trading platform, but if you’re just looking to start building a portfolio it’ll do just fine. Ally also brings low commissions when it comes to mutual funds, but it doesn’t actually offer no-transaction-fee (NFT) mutual funds.

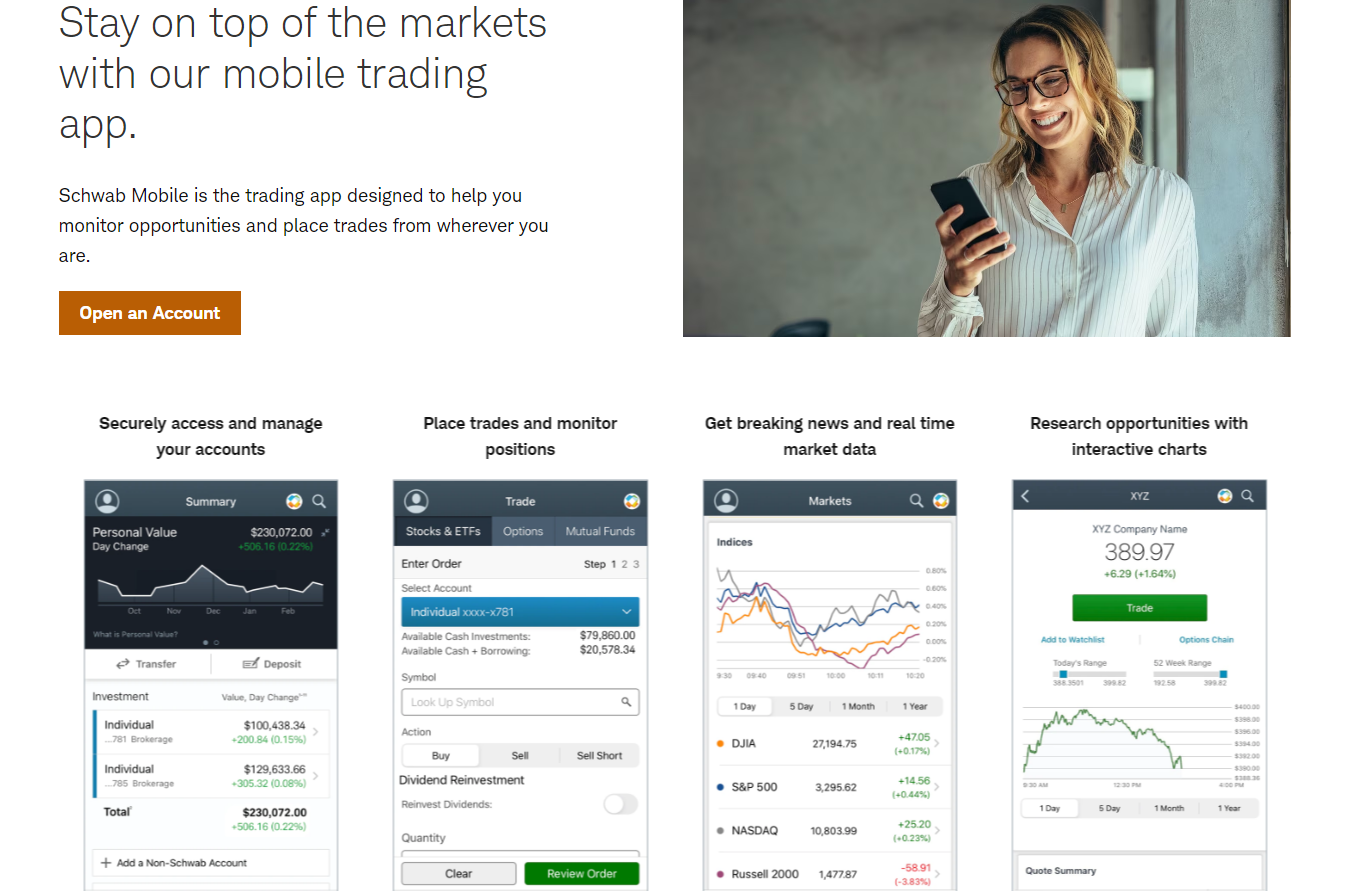

#5. Charles Schwab

Charles Schwab is yet another specialist broker to make the list, but there’s a good reason for that. Schwab has a vast selection of assets for you to invest in, offers fractionals, and has several account types based on your profile as a customer.

Customer service is a noted strength of the company, and while the mobile app isn’t quite as slick and refined as a neo-broker’s might be, Schwab more than makes up for that with its wealth of resources and sterling reputation.

Notable Mentions

Here are some of the other top stock trading apps that offer free or commission-less trading but didn’t quite make our list:

- TDAmeritrade

- eTrade from Morgan Stanley

- Public.com

- Interactive Brokers

- Merrill Edge

How to Choose a Free Stock Trading App

If you’re on the fence about which free stock trading app to try out, here are some of the factors you might want to consider when making your decision:

Free Stock and ETF Trading

By definition, this is the main thing you’re looking for in a free stock trading app since, without the ability to buy stocks and ETF shares without any extra charge, the broker wouldn’t be free! That being said, it may still be worth checking out brokers who charge low rather than no fees—the additional benefits may be worth it.

Minimal Fees and Commissions

Keep an eye out for what sort of fees brokers charge outside of stock and ETF transactions. It’s unlikely that every product offered by the broker will be free, so make sure you know what you can do and how much you’re going to pay for each option.

Access to Different Assets

If you’re on a stock trading app, you’re either looking to invest or trade. To do either of these, you need access to different investment or trading options. Whether you’re after stocks and ETFs or derivatives and even cryptocurrencies, make sure that the stock trading app gives you access to everything you may want now or in the future.

Options and Margin

This is a big one, because you might either discard these completely or be very interested in them. Stock trading apps know this, so keep an eye out for what sorts of fees and charges apply to options and margin trading on the app if you do want to use them.

Fractional Shares

One of the benefits offered by newer stock trading apps is that, unlike traditional brokers, they give you the option to buy fractional shares. If you only have a small amount of money to invest at a time but want access to very pricey stocks, you’ll need a stock trading app that allows you to buy fractionals.

Direct Registration System

You may not have heard of the direct registration system, but it’s the only way to take full ownership of your stocks outside of requesting physical certificates. Checking if the stock trading app allows you to directly register your shares is a great litmus test of how legit they are—that way, you know that they’re actually buying your shares rather than just taking your money and changing a number in the UI.

Customer Service

Aside from a slick, comfortable, bug-free user experience, this might be the most important thing outside of proper, low-cost access to financial options and services. Good customer service can be fantastic to have especially when things go wrong.

How Can a Trading App be Free?

Different stock trading apps have different revenue models, but the general rule of thumb at play here is that if something’s completely free, then you’re the product.

This is mostly true when it comes to stock trading apps thanks to a practice called Payment For Order Flow that is still legal in the U.S. at the time of writing. PFOF sees free stock trading apps getting compensation for directing your stock and option orders to third parties for execution.

Proponents of this practice (generally the brokers themselves and market makers who benefit from this) argue that it results in faster trade execution and better prices, but this isn’t always the case. It’s also viewed by many as a blatant conflict of interest.

Almost every free stock trading app accepts PFOF, with the notable exceptions of Fidelity, Merrill Edge, and Public.com. For a full list, you can look up the U.S. Securities and Exchange Commission’s Rule 606 reports since brokers are mandated to disclose their participation in PFOF.

Key Takeaways

Choosing a free stock trading app comes down to what you’re really looking for. If you just want to buy a few dollars’ worth of stocks or ETF shares on a regular basis then a simpler, more convenient app might be for you, but if you’re looking to trade options, then you need to have a hard look at contract fees and research tools.

Neo-brokers pioneered the concept of free stock trading, but all of that gamification is geared toward making you trade as frequently as possible—meaning that they have more orders to sell to market makers for execution via PFOF. As such, our top recommendations include more traditional brokers who can offer free trading without resorting to these practices.

👉 Whatever you’re after when it comes to finance and whichever app you like the look of, remember to check out Whop.com’s trading communities! You can compare stock trading apps with other investors or traders and see what others just like you say about the different options on offer.

🏆 Don't miss: Whop's Top 10 Best Trading Discord Servers