If you’ve searched for anything trading-related over the past few years, chances are that minutes later you see an ad for eToro. The platform has been one of the top ones when it comes to investing in stocks, ETFs, and crypto for over a decade.

But does it still hold up? Is it still the best all-around investing platform, or are you better off looking for another one? That’s what I’ll be finding out.

I signed up with an entirely new, US-based account on eToro and checked out everything it has to offer. I’ll go over every little step I took right below, so feel free to scroll down to see what I have to say.

However, first, I’d like to quickly go over the history of eToro.

The history of eToro

eToro’s roots go back to 2007 when it was launched as RetailFX by brothers Ronen and Yoni Assia alongside David Ring. The platform was originally dedicated to traditional Forex trading, but 3 years and a recession later, came the flagship feature of what’s now known as eToro: CopyTrader.

The platform slowly changed its focus to become a social investing platform, and CopyTrader helped massively. It allowed any trader to follow top traders and copy their exact strategies and portfolios with just a click.

Another 3 years after that, eToro basically became the platform we know them as today. In 2013, they added stock trading and were one of the first brokers to introduce Bitcoin trading.

The real boom happened in 2017, which is also when I found out about eToro’s existence. The platform launched for the US market and slowly introduced many crypto and other assets.

While eToro was at its peak in the early 2020s, partially helped by everyone taking a shot at trading, the platform hasn’t been at its best, especially for the US market. In September 2024, eToro stopped offering crypto trading to the US market, with the exception of Bitcoin, Bitcoin Cash, and Ethereum.

Alas, I’ll talk more about this throughout the review. Speaking of that, it’s about time I tell you my thoughts on eToro.

How easy is it to use eToro?

To be fair, eToro is one of the easiest investing platforms I’ve tested to date. Everything is neatly presented on your homepage, and you’ve got plenty of customization options.

Setting up an account

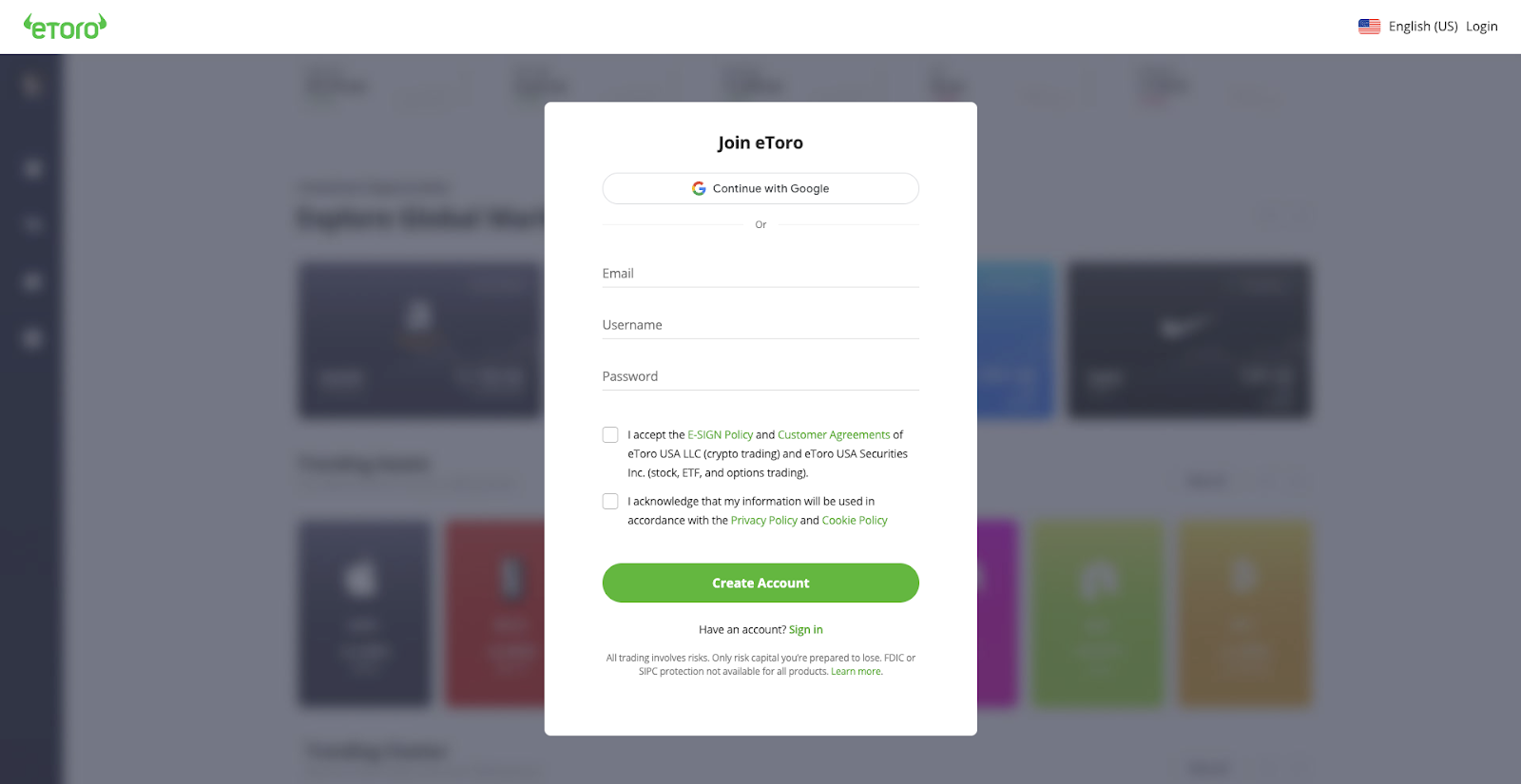

So, first things first, I had to create a new account. Super simple process overall. All I needed to do was go to the eToro site and click “Join eToro”, before being forwarded to the sign-up page.

There, as you can see from the screenshot above, came the first benefit of the sign-up process. I only had to add an email, username, and password. While my personal info was required later on to make a deposit, I didn’t have to do this outright, which is a definite plus in my book. You can also sign up using your Google account.

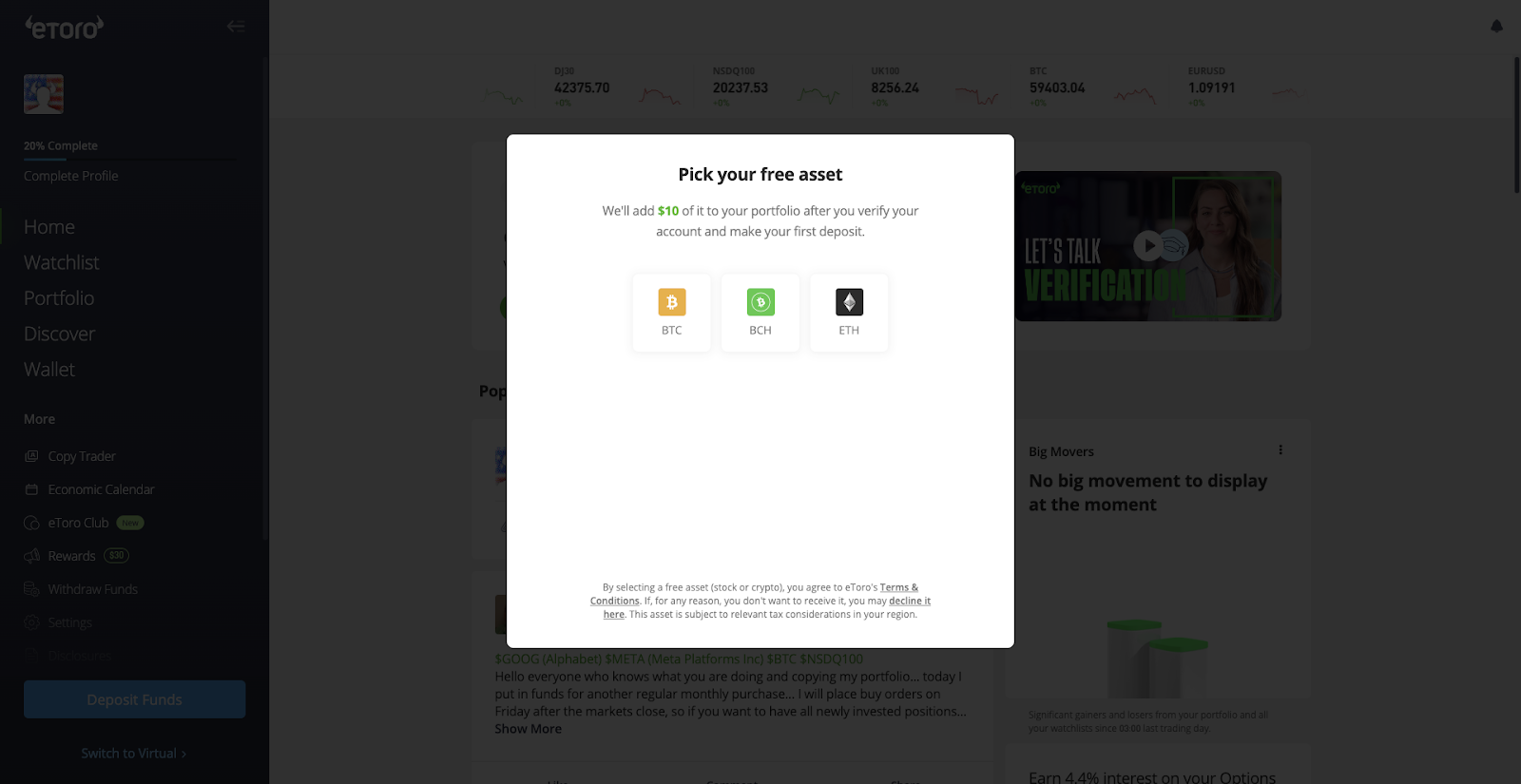

In any case, once I added my sign-up credentials, I was redirected to my homepage and received a confirmation email. From the get-go, I was also offered a free crypto asset worth $10 as a sign-up bonus after making my first deposit.

Once I confirmed my email, I started browsing through the platform, and, well, I was happily surprised.

Using the platform

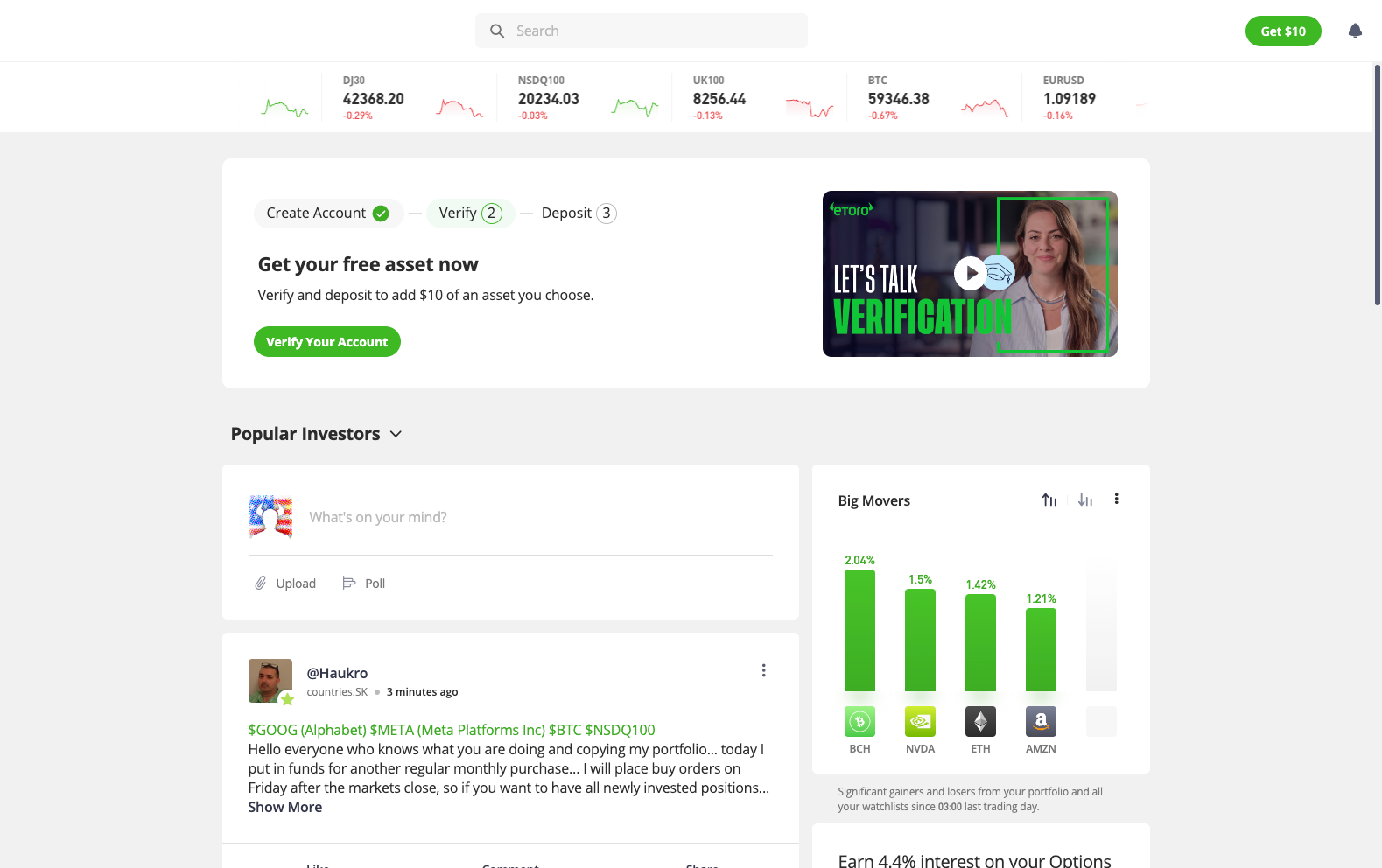

The platform was super intuitive yet simple in a sense. As you can see from the homepage, I basically had most of what eToro has to offer right on there. The banner on the top has all the popular stocks, cryptos, and ETFs with their daily trajectories. Right under it, I could easily go straight through to the verification page.

And, most importantly, the homepage is where I had my very first look at the social aspect of eToro. As you can see, I was able to immediately check out some of the quotes of the most popular investors on the platforms. I actually followed a couple of them, and I found them straight from the homepage.

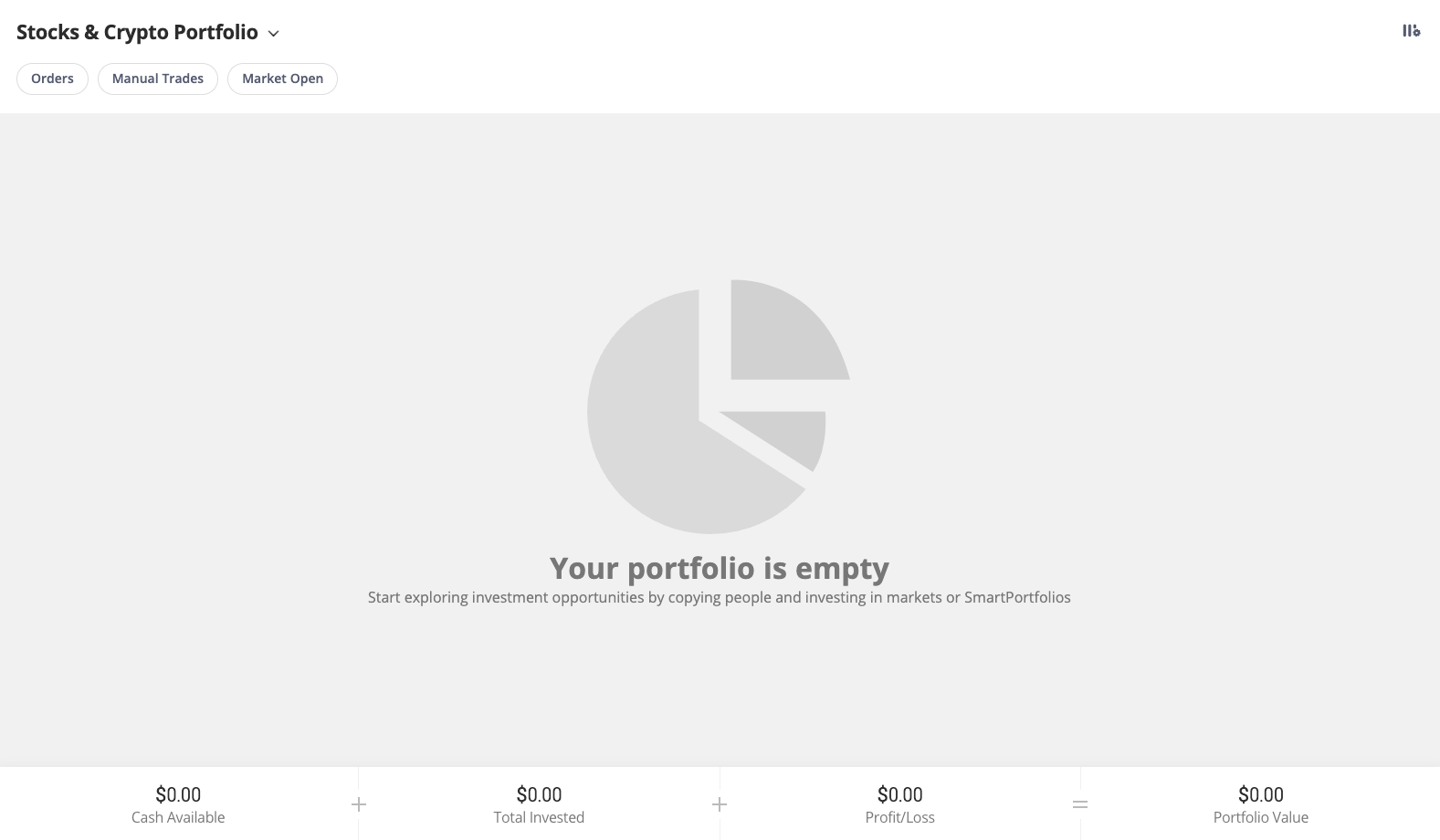

As I scrolled through the different tabs, everything was just greatly laid out. For example, the “Portfolio” page was as straightforward as it can be. While my portfolio was empty, I still managed to play around with it and see all the data the tab offered.

My market orders would all be in one place, my trades would be in a separate one, and I’d have my P/L and total investment right at the bottom of the tab. Pretty neat.

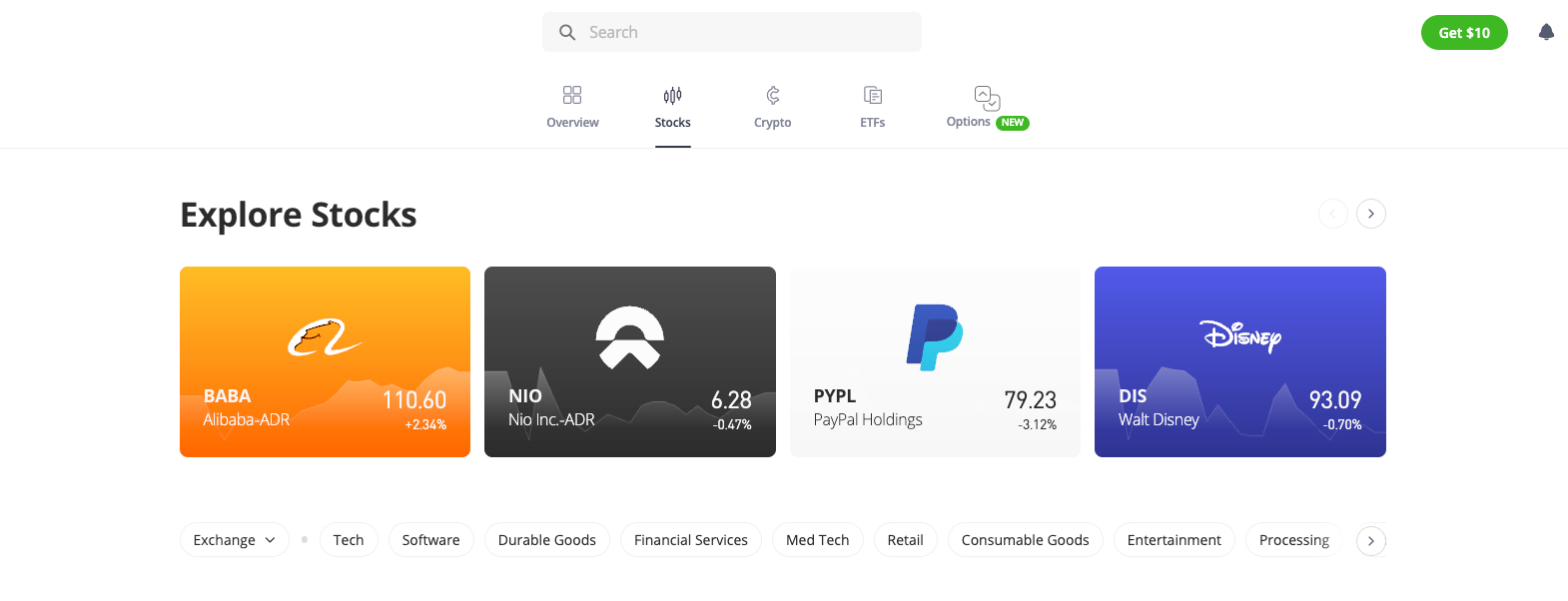

Then, there’s also the “Discover” page. While I imagine most of you already know what you want to invest in, the tabs on this page have the most popular assets, all neatly split into categories.

For instance, if I wanted to invest in a UCITS ETF, all I needed to do was click on the ETFs tab and select “UCITS only”. Now, that might seem elementary to someone who’s used a trading platform before. But it’s excellent for beginners, who might find it difficult to use different search filters and whatnot.

Overall, eToro looked great so far. But I wanted to really see how easy it’d be to get my first investment, from making a deposit to actually investing and creating watchlists.

Making a deposit

So, making a deposit on eToro is fairly simple. You just have to verify your account, go to the “Wallet” tab, and input your preferred payment method. While you don’t have too many options, you can deposit with PayPal, debit card, wire transfer, or online banking.

All of these have different limits, which I’ll talk about more below. But, in short, PayPal, debit card, and online banking transfers are instant, with a $100 minimum deposit, while wire transfers can take up to 7 business days and come with a $500 minimum deposit.

Obviously, the best option here would be anything but a wire transfer. But I have to say that the $100 minimum deposit is pretty high. Sure, if I were to use eToro every day for investing and trading, I’d definitely put in more than $100. But when it comes to beginners who haven’t traded before, investing $100 from the get-go might seem like a lot.

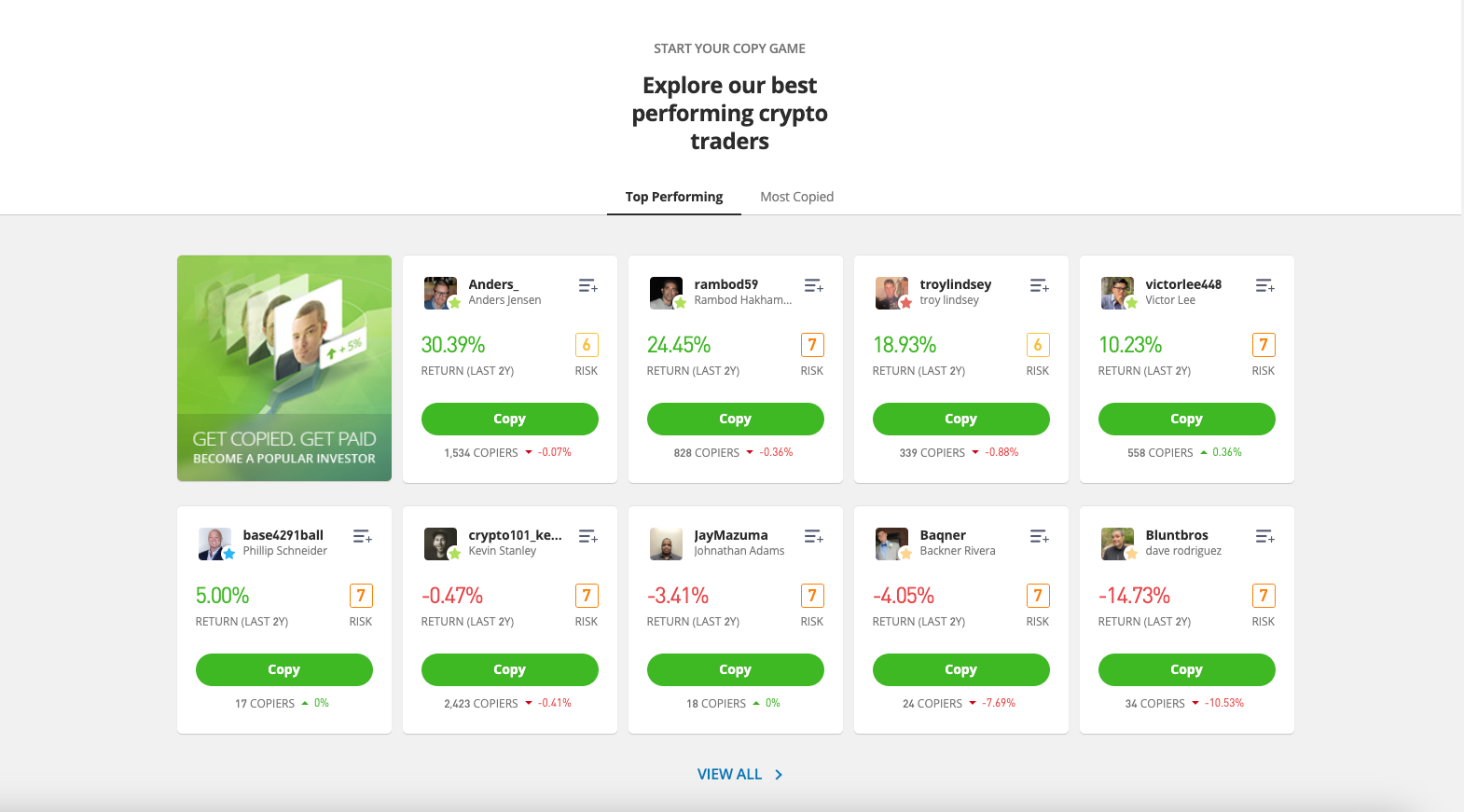

This also becomes an issue when it comes to the CopyTrader side of things, as the minimum investment is $200. I’ll go into more detail about this later on.

For now, let’s get into the real workings of eToro.

Investing in stocks/crypto

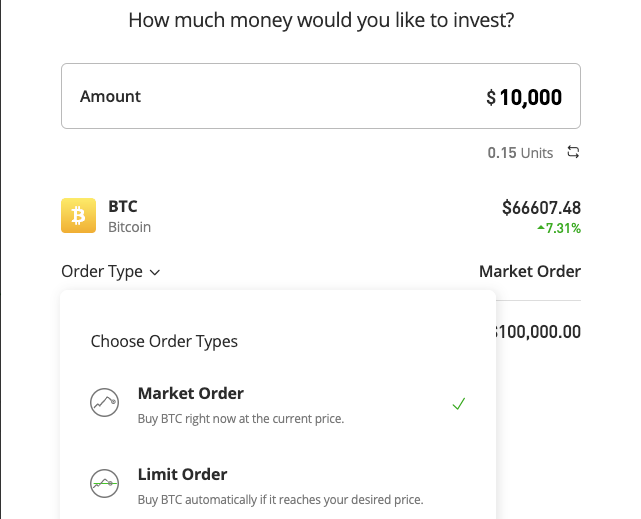

Even before I made my first deposit, I could play around with the “virtual account” to understand how the whole process works. Hence why you’ll see $100k in the screenshot above.

I started with the simplest of trades; I put in a simple BTC market order for $10k. 2 clicks after that, my BTC was in my “virtual portfolio”. I, of course, did the same with the actual money I put in my account, and the process was the exact same. 2 clicks, and my investment was sitting in my portfolio.

I imagined that the process for investing in a stock or an ETF would be the exact same, and it pretty much was. I just had to input the amount I wanted to invest and whether I’d set a market or limit order.

In essence, in just 30-40 minutes, I already had some BTC and an NVDA stock in my portfolio.

That’s pretty good for a trading platform, and it just shows how straightforward everything is. Now, I have been praising eToro thus far, and, to be fair, the platform does exactly what it’s meant to. I wanted to quickly invest in some stocks and crypto, and I did it in almost record time. So far, it’s been one of the best experiences I’ve had with a trading platform. But keep in mind that I did find some caveats that I’ll cover a lot more below, especially when comparing it with Robinhood and Coinbase.

Back to the task at hand, let’s quickly go over my next and last step before I dive deeper into the platform’s top features.

Creating a watchlist

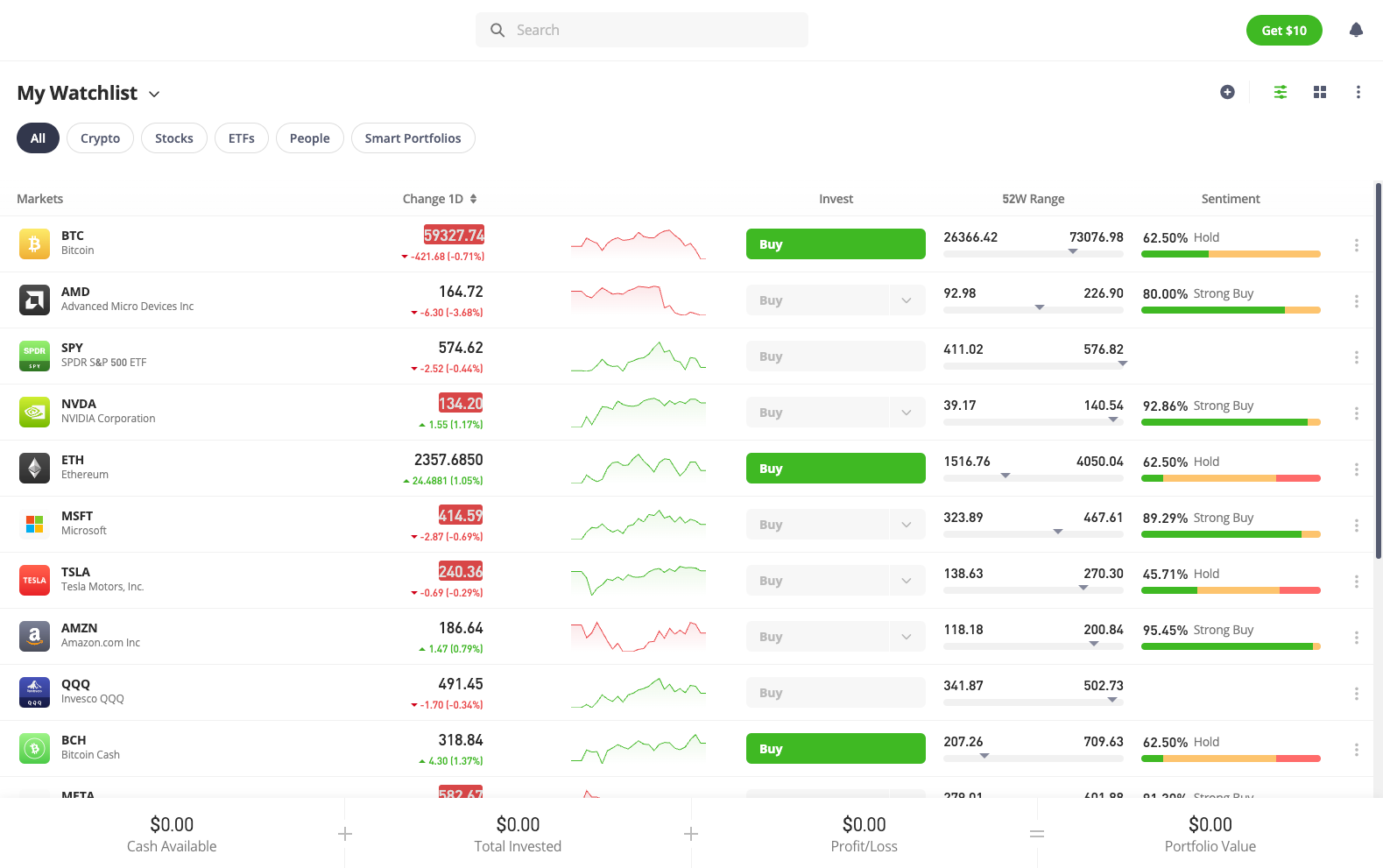

One of the main tabs you’ll view on the daily with eToro is your “Watchlists”. Throughout this review, I created 5 different watchlists for different types of investments (long-term, short-term, high volatility, blue-chip, UCITS ETFs).

Needless to say, like everything else with this platform, it was super easy to create a new watchlist and add the stocks, ETFs, or crypto I wanted. And every watchlist entry comes with a general sentiment, as well as a general trajectory for that asset. Once you click on each entry, you can also access some more advanced charts, but I’ll cover that right below.

Overall, when it comes to its ease of use, eToro is honestly one of the simplest platforms I’ve used. Is it the easiest trading platform I’ve used? It could very well be. It’s definitely the most straightforward one.

And, for instance, when I got an alert to buy TSLA from one of the trading Discords I’ve joined, I was able to do so within seconds on eToro. That’s a huge plus right there.

Alas, I’ve only covered half of what the platform has to offer. Let’s get straight into the best features and tools you can find on eToro.

eToro’s best features and tools

While I covered all of the basics you get with eToro, it’s time to go over the more in-depth tools and features.

Copy trading

So, eToro’s flagship offering is that it’s a social investing platform. Thus, CopyTrader is considered the main feature, the main benefit you get when you sign up. What exactly is copy trading?

It’s much like what you’d do if you were to join a trading Discord. You copy the trades and portfolios of experts in the scene. But, instead of having to do it manually, eToro offers the CopyTrader, which allows you to copy an expert’s portfolio with a simple click.

There are tons of experts on the platform, and, while I was browsing through all the different profiles, they all have something different to offer. One expert might focus on energy stocks, another might only have an 80-20 split on BTC and ETH.

Regardless of their portfolio, as soon as you click on their profiles, you’ll get access to their current P/L, as well as how much they made or lost over the last few years. You’ll also get a “Risk meter” for each expert. The higher the risk, the more volatile assets their portfolio has.

Now, eToro has put a lot of thought into the CopyTrader, and I’ll be honest. It’s actually pretty cool to play around with. I believe it’s great for beginners because it allows them to get their feet wet without having to go over charts and analyses. That said, keep in mind that you’ll need to invest at least $200 to copy an expert.

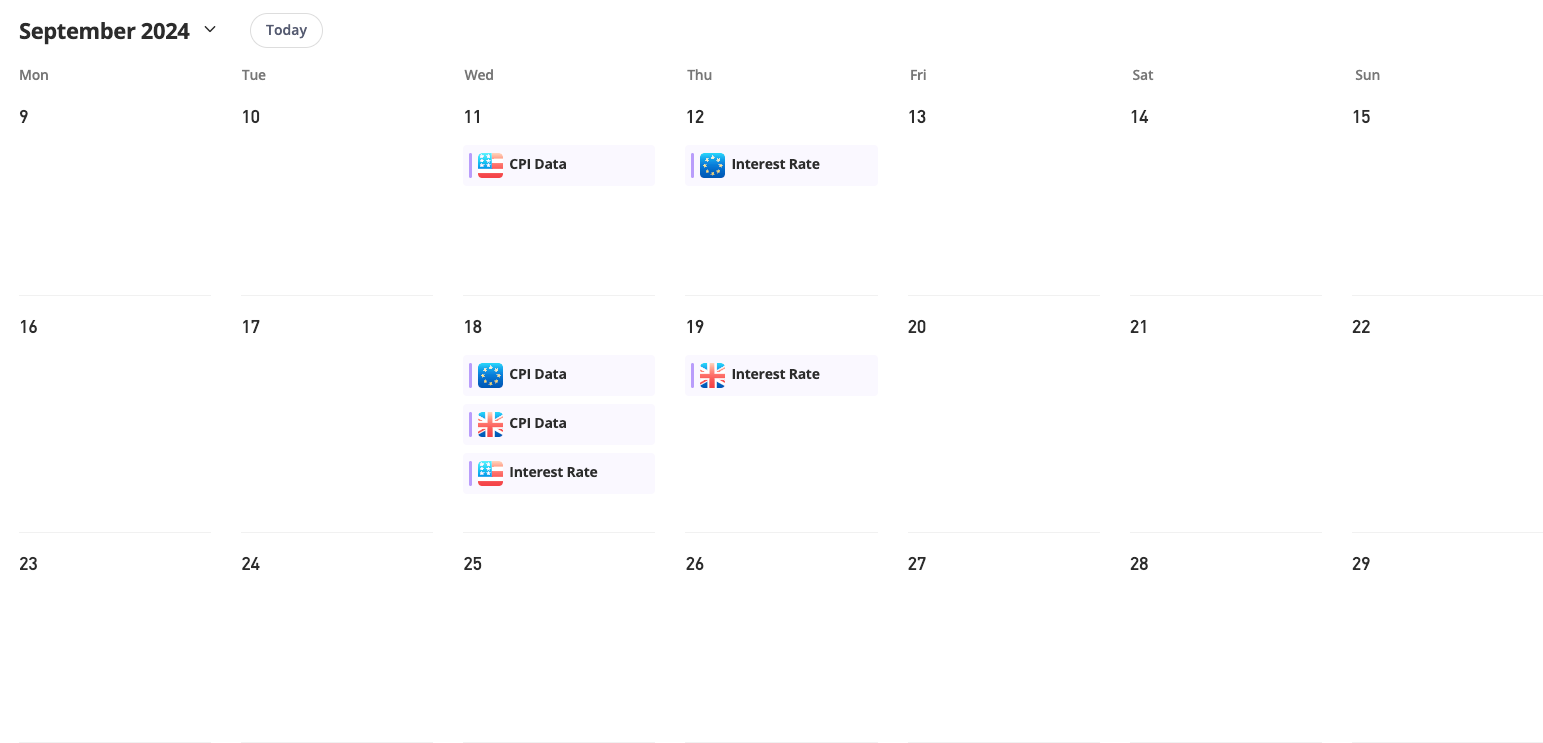

Economic calendar

A more general feature that I was happy to see on eToro is its economic calendar. I try to stay up-to-date with all the financial events going around, like earnings calls or CPI data. eToro has all of this on a tab, ready for me to check out.

Now, this isn’t the most intuitive feature, don’t get me wrong. You can find a lot more data on sites like MarketWatch or Trading Economics. However, having all the important data on one platform helps quite a lot.

For example, knowing that the US CPI data is on, say, Monday, I can keep an eye out to see how the markets will react. And, instead of having different tabs open, I can have it all on eToro.

On top of that, you can also check out all the major earnings call dates right on the calendar, which is pretty neat.

Advanced charting

Now, we get onto the stuff that actually matters. Most beginners just want a platform where they can make their trades, and that’s it. More advanced traders want some advanced charts. And, thankfully, eToro’s got plenty of that.

For one, you can check out the charts of any and every stock, ETF, or crypto, with different intervals. But the best thing is that you get access to tons of different indicators, which should be more than enough to get your trading game rolling.

Again, as with the economic calendar, this isn’t something revolutionary. But it’s definitely a great thing to have to bring in more advanced traders. Plus, right next to these charts, anyone can check out some information about the assets they want to invest in.

Overall, I have to say that the charts on eToro are pretty good. All the indicators are there, all the features you’ll need are there, so you’re definitely not missing out.

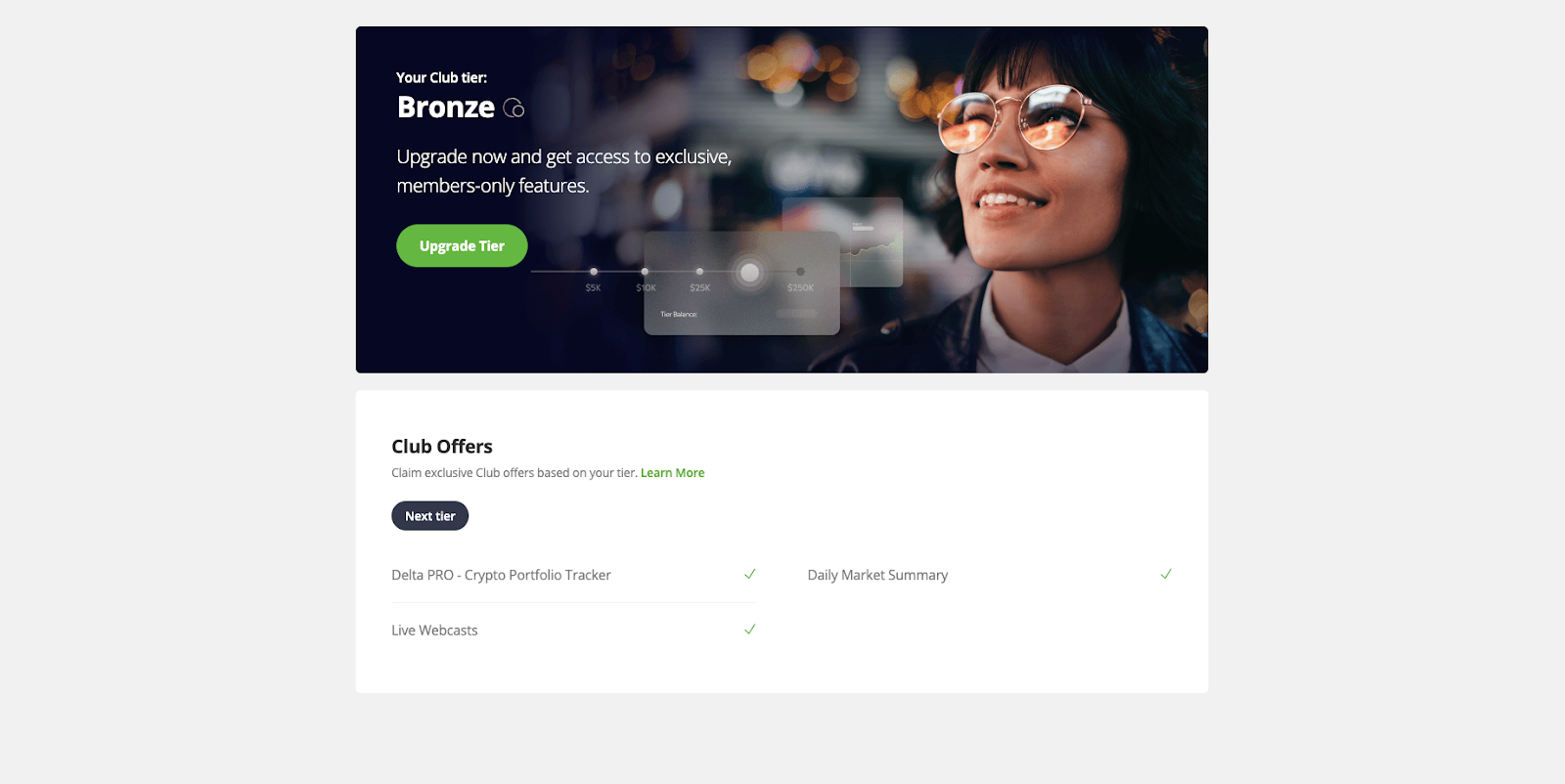

The eToro Club

Let’s get into some of eToro’s more exclusive features, like the eToro Club. Remember, we’re talking about a social investing platform here. It’s no wonder they have a loyalty program that they call a “Club” that rewards users with, among others, access to VIP social events.

Let me backtrack a little bit. As I said, eToro Club is a loyalty program. As soon as you have at least $5k in your account in the form of cash and/or investments, you’ll automatically become a member. The first tier is Silver, and it goes all the way up to Diamond.

For reference, the Tiers and their requirements are as follows:

- Silver: $5,000

- Gold: $10,000

- Platinum: $25,000

- Platinum+: $50,000

- Diamond: $250,000

Each Tier comes with its own rewards, ranging from access to live webinars, financial publications, VIP events, zero-fee withdrawals, etc. And, as you increase your Tier, you’ll still get the perks from the previous ones, as expected.

The way I see it, eToro Club adds that extra bit of social aspect that the platform needs. It can also be considered a way to incentivize members to invest more in the platform, be that a good or bad thing.

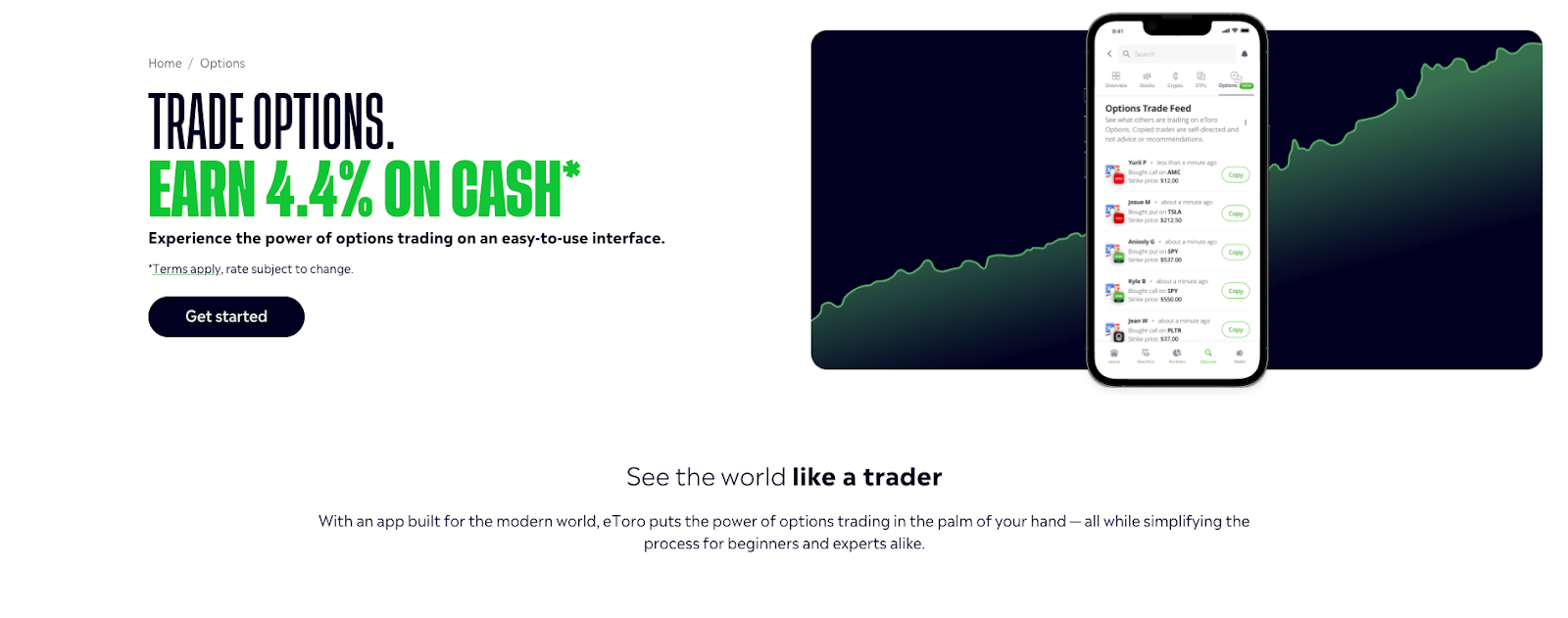

eToro Options

One of the newest features on eToro is eToro Options. As you can guess from the name, this is all about trading options, but it has an extra perk that I didn’t expect. If you keep your cash in your eToro Options account, it’ll be treated as a high-yield savings account, yielding you up to 4.4% interest.

Of course, most of you will open an Options account to trade options, and eToro has plenty to offer. The great thing is that there are no commissions for options trading, just like most other investments on the platform.

Even for beginners, though, this can be a great way to earn passively. Just open an Options account, keep your money in there, and earn your yields every year.

The only caveat with eToro Options is that the amount of cash or number of investments you have on there doesn’t count towards the eToro Club requirements.

Overall, while I was checking all of these out, they were all simple to use, much like all the basic features of eToro. Was I surprised by any of these? Not really. Did I expect a little bit more from the platform? Sure, but these are more than enough for any beginner and novice trader to get started.

How much does eToro cost?

If you’ve come this far, you’re probably thinking that eToro has a ton of fees you’ll have to pay. And, to be fair, while I was searching for these fees, I got a few different answers. One page on the platform mentioned there was an inactivity fee, another one said there are no fees when investing in stocks.

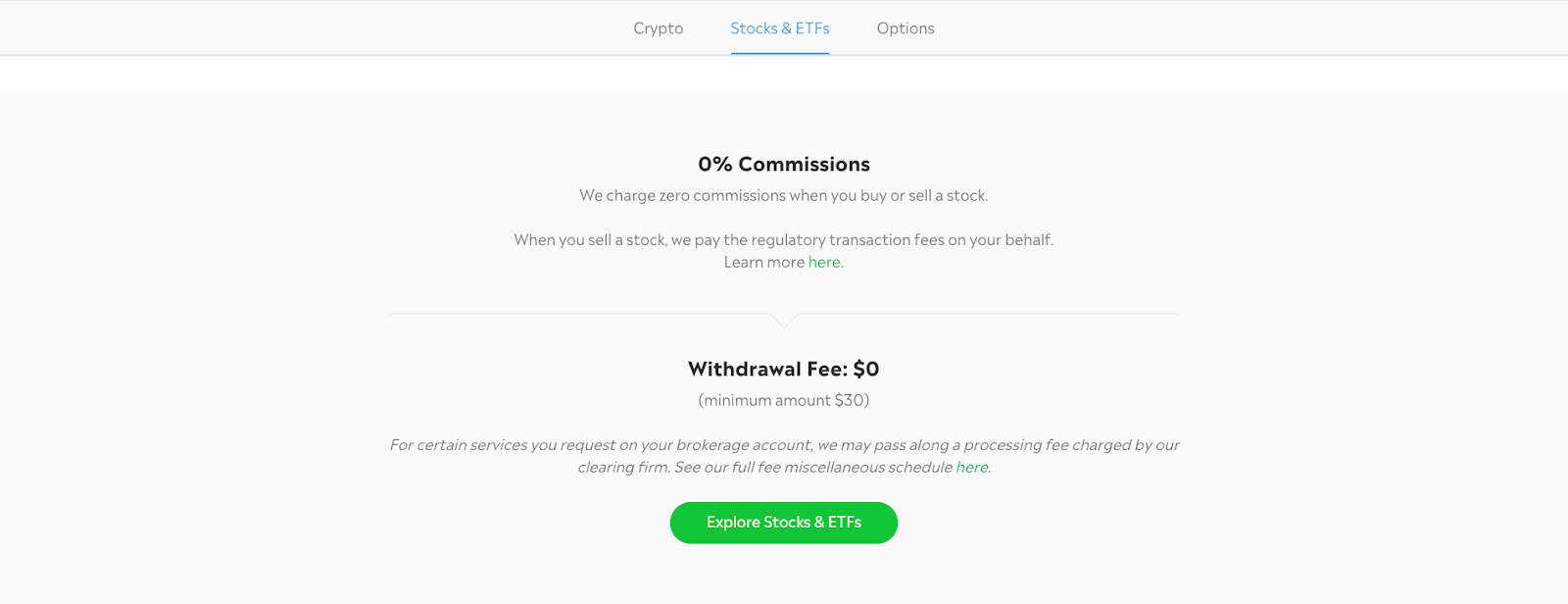

Thankfully, I do have a definitive answer. US-based users won’t have to pay anything to create an account and invest in stocks or ETFs. If you choose to invest in crypto, there’s a 1% fee for buying or selling.

So, essentially, you won’t need to pay a dime to the platform if you just want to invest in stocks. If any of you are outside the US, there are a couple of different fees you might have to pay, like inactivity fees, but there are none in terms of account management and trading fees.

Keep in mind that there’s a rather high minimum deposit of $100, or $200 for CopyTrader, and the the minimum withdrawal amount is $30.

How does eToro stack up against other crypto trading services?

So far, you’ll notice that I’ve been praising eToro for being a great platform with amazing features. But are these features enough to be considered better than two of its main competitors, Robinhood and Coinbase?

Let’s compare these platforms.

eToro vs Coinbase

So, right off the bat, when it comes to crypto, the point goes to Coinbase, hands down, no questions asked. I don’t mean to hate on eToro, but it only has 3 different coins to invest in. Coinbase has 200+. The variety there is more than enough to give the point to the latter.

Alas, having used both platforms for the past few years, they’re pretty much on par when it comes to all other aspects. Creating an account, navigating the platform, deposits and withdrawals, they’re all super simple with both eToro and Coinbase.

Then again, when you look at it from a wider POV, Coinbase is just a crypto trading platform. eToro is a social investing one.

So, if you just want to focus on crypto, Coinbase is the place to be. But, if you want an all-in-one trading platform with some coins to play around with, eToro takes the point.

eToro vs Robinhood

Well, this is a comparison that I read about every day. Look, I’ve looked into Robinhood before, and I’ve been looking into eToro lately for this article. And even now, the two platforms are at a tie, in my opinion.

They both offer great usability, a variety of assets and securities to invest in, and minimal fees. Sure, they’ve both had their controversies in the past, but, in all honesty, I believe they’re both equally great for any beginner to start trading.

Now, if I had to choose one over the other, I personally liked eToro better. The social aspect through CopyTrader and the Feed does give it an extra benefit over RH.

Pros and cons of eToro

So, I’ve looked at the good, I’ve looked at the bad. Let's sum it all up in a few pros and cons, shall we?

Pros

- Incredibly easy to use: eToro is one of the easiest trading platforms I’ve used thus far. The UI is simple and the “Dashboard” is very easy to follow and navigate around, overall.

- Minimal fees: While there’s a fee for crypto trading, I really liked the fact that there are no fees for investing in stocks or ETFs. I didn’t expect anything less, but it was nice to see.

- Social aspect: The CopyTrader and the overall social aspect of the platform make it much more engaging for anyone new to trading to give it a shot.

Cons

- Weak crypto variety: As of September 2024, eToro only allows US users to invest in BTC, ETH, or BCH.

- High minimum deposit: I had to deposit $100 to invest in stocks or $200 to try Copy Trading. Most beginners might find this too much of an investment to start with.

Is eToro right for you?

So, here is the question you’ve had in your mind since the intro. Is eToro the right platform to get your trading game started? In all honesty, I believe eToro is a great platform for any beginner to start trading, as well as experienced traders.

Here’s the deal. It has everything a beginner needs. Even if you’re an experienced trader, you can use different indicators to analyze each asset. The fees are minimal, if any. The platform’s easy to use.

Besides a few hiccups, there’s nothing that’d deter me from suggesting eToro to beginner and experienced traders alike.

Now, it’s definitely more suited for beginners, sure. And I’d personally go for Coinbase if I wanted to invest in crypto, or Interactive Brokers, for long-term investing.

But, for trading, especially thanks to the CopyTrader feature, eToro takes the cake.

Thus, is it right for you? If you’re a beginner, that’s a 100% yes. If you’re more experienced, I’d still say to give it a shot.

Find crypto trading education, advice, and mentorship on Whop

There’s no doubt eToro is a great trading platform. I really enjoyed the whole process of reviewing, from start to finish, and there wasn’t a point where I found anything confusing or difficult to navigate. I do have one more thing to say, though.

A trading platform is one thing. But, without the right education on crypto and stock trading, you’ll end up risking a lot of your money on trades that aren’t the best at that moment. The platform you use won’t matter at that point.

Thus, you have to first focus on getting the best trading advice and education. And there’s no better place to find this than on Whop.

If you just scroll around the Whop Marketplace, you’ll find hundreds of different Discord communities and whops that specialize in crypto or stock trading. All of them are run by expert traders who have a good track record and are full of like-minded traders across all skill levels who are ready to help you out or just chat with you.

So, if you’re ready to take your trading game to the next level, check out the Whop Marketplace. Browse through all the different trading communities and find the one that fits you best.