Ebooks have emerged as a popular way for consumers to unwind and learn on their favorite devices. For digital creators and authors, the booming ebook industry represents a profitable revenue stream.

At Whop, we’ve used our expertise to deliver over 100 ebook statistics to fuel your ebook strategy in 2024. Keep reading to discover insights related to industry growth, monetization, and more.

Ebook Industry Statistics

The first concept of an e-reader is credited to Bob Brown in 19301.

The writer put forward a manifesto advocating for the development of ‘readies’ or portable, simple reading machines that could attach to an electric light plug, allowing readers to enjoy their favorite novels anywhere.

However, the first ebooks are credited to Michael S. Hart in 1971.

With access to a mainframe computer and Arpanet—the precursor to the internet—the University of Illinois student created a digital text of the Declaration of Independence and published it on the network. This launched an ebook publishing venture called Project Gutenberg. The project still exists today and boasts over 60,000 titles.

Throughout the 1990s, ebooks and the ebook industry experienced key developments.

Namely:

- Bibliobytes, a website for distributing free and for-sale ebooks was founded in 1993.

- In 1995, HTML, the markup language of the web and ebooks became a standard.

- Project Gutenberg published its 1,000th e-book in 1996.

- E-Ink, the display technology used in e-readers like the Nook, Kobo, and Kindle, was invented and commercialized in 1997.

- In 1998, the first handheld e-readers were launched, the library lending of e-books started and eBooks got ISBNs.

- In 1999, the OEB or Open Ebook Publication Structure, an open standard format that all ebooks could use was published.

- In 2004, the OEB became the IDPF, the International Digital Publishing Forum.

- By 2007, the IDPF, then OPS (Open Publication Structure) 2.0 was released and was subsequently renamed EPUB.

In 2007, Amazon launched the Kindle.

Amazon continues to dominate both ebook publishing and sales.

By 2013, over 20% of adults read ebooks2.

At the time, the ebook industry was driven by high-earning, well-educated female readers under 45.

Throughout the early 2010s, e-readers were an indispensable part of the ebook industry. By 2017, e-reading had shifted to tablets (59%) and mobile phones (23%).

As of 2024, Spain has the highest share of e-reader owners, followed by China.

In large ebook reading markets such as the US and the UK, the share of ebook readers has decreased significantly (below 30%), with consumers opting to use tablets, and smartphones in favor of traditional readers.

Between 2017 and 2023, ebooks borrowed from libraries and schools worldwide more than doubled from 155 million to 370 million3.

While this trend was driven by the pandemic, engagement with ebooks, both for learning and entertainment purposes, is on a general upward trajectory.

Estimates suggest that 300 million or $1.25 billion4 worth of self-published books are sold each year.

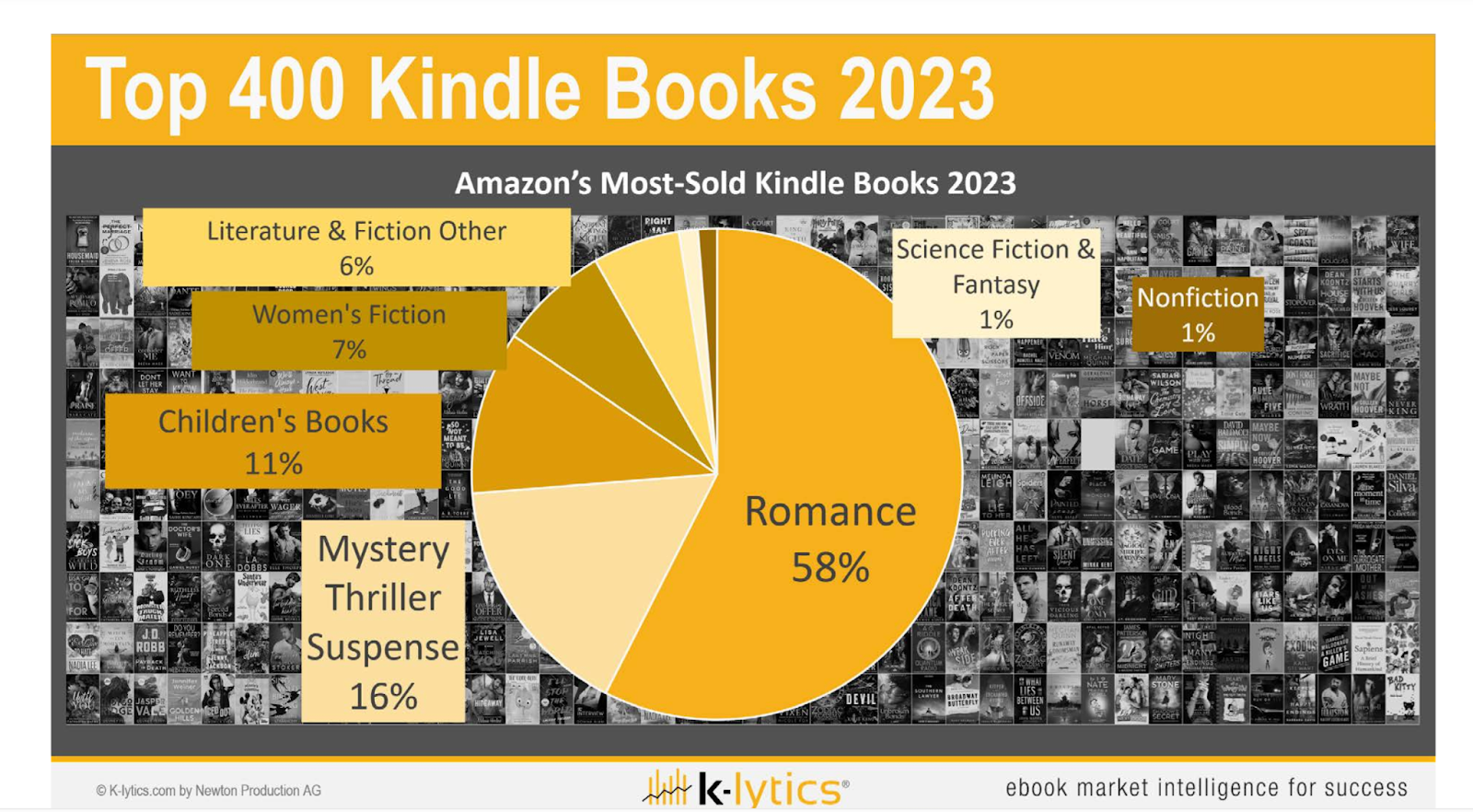

In 2023, 58% of Amazon’s most sold ebooks5 were in the romance genre.

- 16% were in the Mystery, Thriller and Suspense genre

- 11% were in Children’s Books

- 7% were Women’s Fiction

Another trend driving the demand for ebooks is their value as lead magnets in B2B and B2C marketing settings.

- Ebooks remain the most popular type of B2B content6, with a 34.5% increase in usage in 2024.

- They’re also the most popular content format used by demand generation teams and marketing organizations, representing 39.5% of demand.

- In 2020, 55% of small businesses said ebooks had the highest conversion rate7 of all short-form written content.

By 2027, the ebook market is expected to generate $15.33 billion8 annually.

The ebook market is expected to generate $14.61 billion in 2024, up 3.2% from $14.16 billion in 2023. Overall, the ebook market has shown steady upward growth over the last 6 years.

| Year | Revenue ($) in billion | Revenue Growth (%) |

|---|---|---|

| 2024 | 14.61 | 3.2 |

| 2023 | 14.16 | 3.2 |

| 2022 | 13.59 | -1.6 |

| 2021 | 13.81 | 7.7 |

| 2020 | 12.82 | 0.8 |

| 2019 | 12.72 | 6.1 |

| 2018 | 11.99 | 6.2 |

| 2017 | 11.29 | - |

Globally, the US is expected to generate the most revenue, reaching $5.3 billion in 2024. This represents a slight increase from $5.2 billion in 2023.

In second place is Japan which will generate $2.51 billion, up from $2.4 billion in 2023. This is followed by China, which will generate $1.9 billion, up from $1.7 billion in 2023

The average revenue per ebook consumer (ARPU) is expected to hit $13.65 in 2027.

This is down from a high of $16.35 in 2017. Since then, the ARPU has slowly declined year over year as follows:

- 2018: $15.75

- 2019: $15.49

- 2020: $14.92

- 2021: $14.64

- 2022: $14.54

- 2023: $14.41

The top players in the ebook market have consistently seen their revenues increase since 2018.

- Amazon’s revenue increased 121% from $233 billion in 2018 to $514 billion in 2022.

- Apple’s revenue increased 48% from $266 billion in 2018 to $394 billion in 2022.

- Alphabet’s revenue increased 107% from $136.8 billion in 2018 to $283 billion in 2022.

- Tencent Holdings revenue increased 91% from $47 billion in 2018 to $90 billion in 2022.

- Rakuten Group’s revenue increased 70% from $9.98 billion in 2018 to $17 billion in 2022.

Ebook Consumer Statistics

By 2027, there will be over 1.1 billion ebook consumers.

Meanwhile, in 2024, the number of ebook consumers is expected to hit 1 billion, up from:

- 900 million in 2022

- 800 million in 2019

- 700 million in 2017

The uptick in ebook consumption is expected to be driven by factors such as:

- Increased convenience

- Greater accessibility

- Green initiatives discouraging the use of paper

- Access to subscription models that encourage ebook reading

The user penetration rate or the number of active consumers of ebooks globally, is expected to increase to 14.1% by 2027.

In 2024 the user penetration rate in the ebook market will hit 13.3%. Over the past 6 years, the user penetration rate has increased steadily year-over-year as follows:

- 9.5% in 2017

- 12.5% in 2021

- 12.8% in 2023

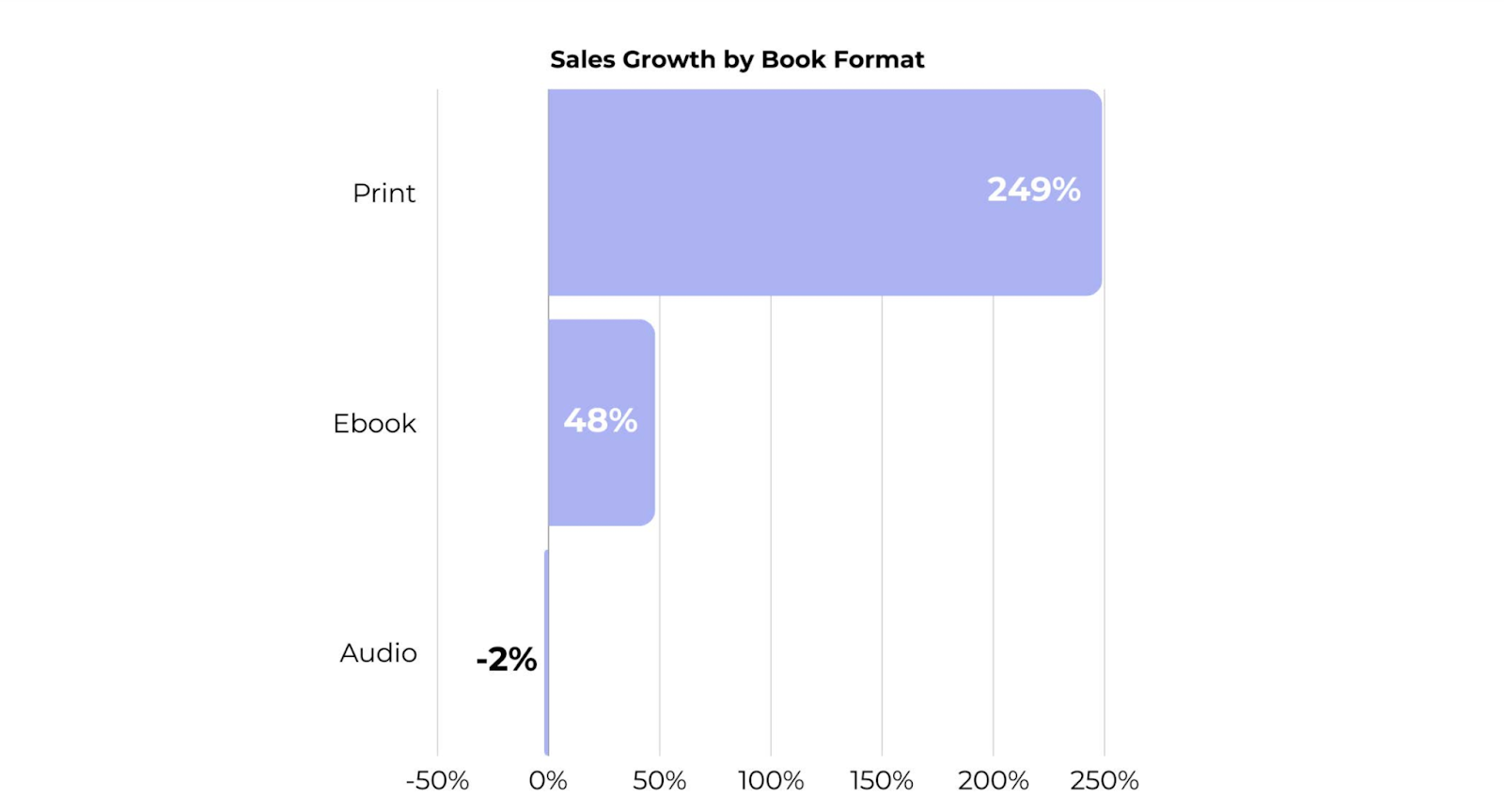

Ebooks have grown in popularity, establishing them as a complementary format to print books.

- In the US, 20% of the population bought an ebook in 2023.

- In China, 27% of consumers bought an ebook in 2023.

- In Japan, around 19% of consumers bought an ebook in 2023.

- In the UK, around 17% of consumers bought an ebook in 2023.

- In Australia, around 13% of consumers bought an ebook in 2023.

In the US and the UK, over 75% of consumers bought ebooks on Amazon in 2023.

Following closely behind were Apple Books and Barnes and Noble.

As of 2022, over 30% of adults in the US and UK read ebooks for leisure on a dedicated e-reader, smartphone, tablet, or laptop9.

A 2023 study tracking adults' ebook reading behavior found that adults read in sessions of 10 to 15 minutes.

Additionally, most readers only focused on the text for 5-7 minutes at a time.

Generally, while ebook reading took place in a variety of locations, ranging from work and transport to restaurants, reading at home proved to be the most popular place.

Compared to 2011, ebook reading amongst consumers was higher10 in 2020.

Notably, according to two Simon Kucher studies carried out a decade apart:

- Ebook reading in Germany quadrupled from 15% in 2011 to 56% in 2020.

- In the US, ebook reading increased from 48% in 2011 to 75% in 2020.

- In the UK, ebook reading increased from 45% in 2011 to 60% in 2020.

The same report found that consumer willingness to pay more for ebooks had increased significantly in the 10 years between 2011 and 2020.

For example:

- Compared to a 47% premium on ebooks in 2011, US consumers were willing to pay 110% more for ebooks in 2020.

- Meanwhile, UK consumers were willing to pay 50% more in 2020 compared to 33% more in 2011.

- Consumers in Germany were willing to pay a staggering 80% more in 2020 compared to just 4% more in 2011.

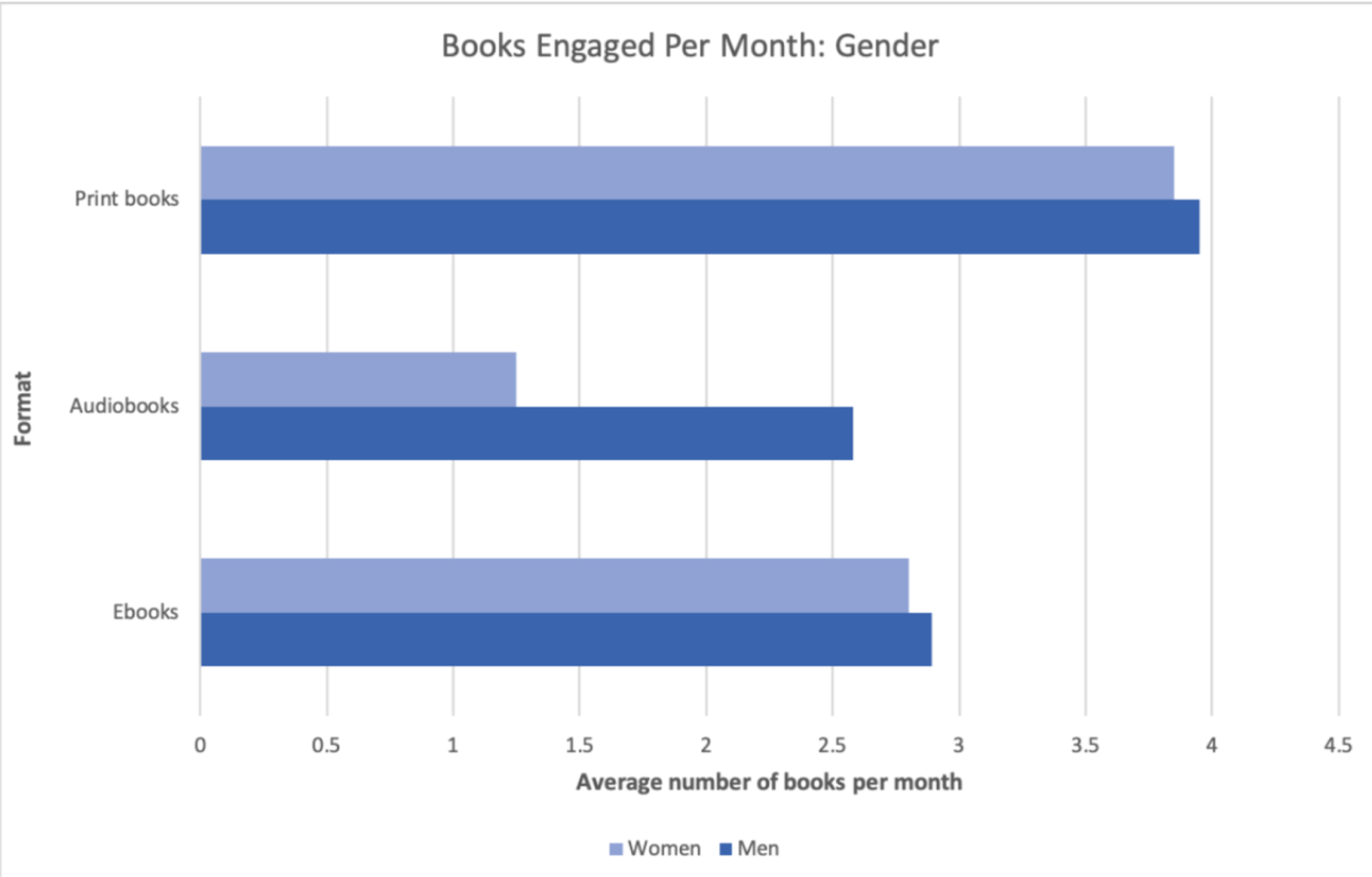

A 2020 book research report found that avid book readers who engaged with more than 4 books per month were younger and more ethnically diverse, identifying as Black, Latinx, and male11.

Additionally, millennials engaged with books more than Gen X and Baby Boomers, typical monthly consumption rates for the cohort included 3.1 ebooks, 3.1 audiobooks, and 5.3 print books. This is compared to an average of 2.4 ebooks per month for the general population.

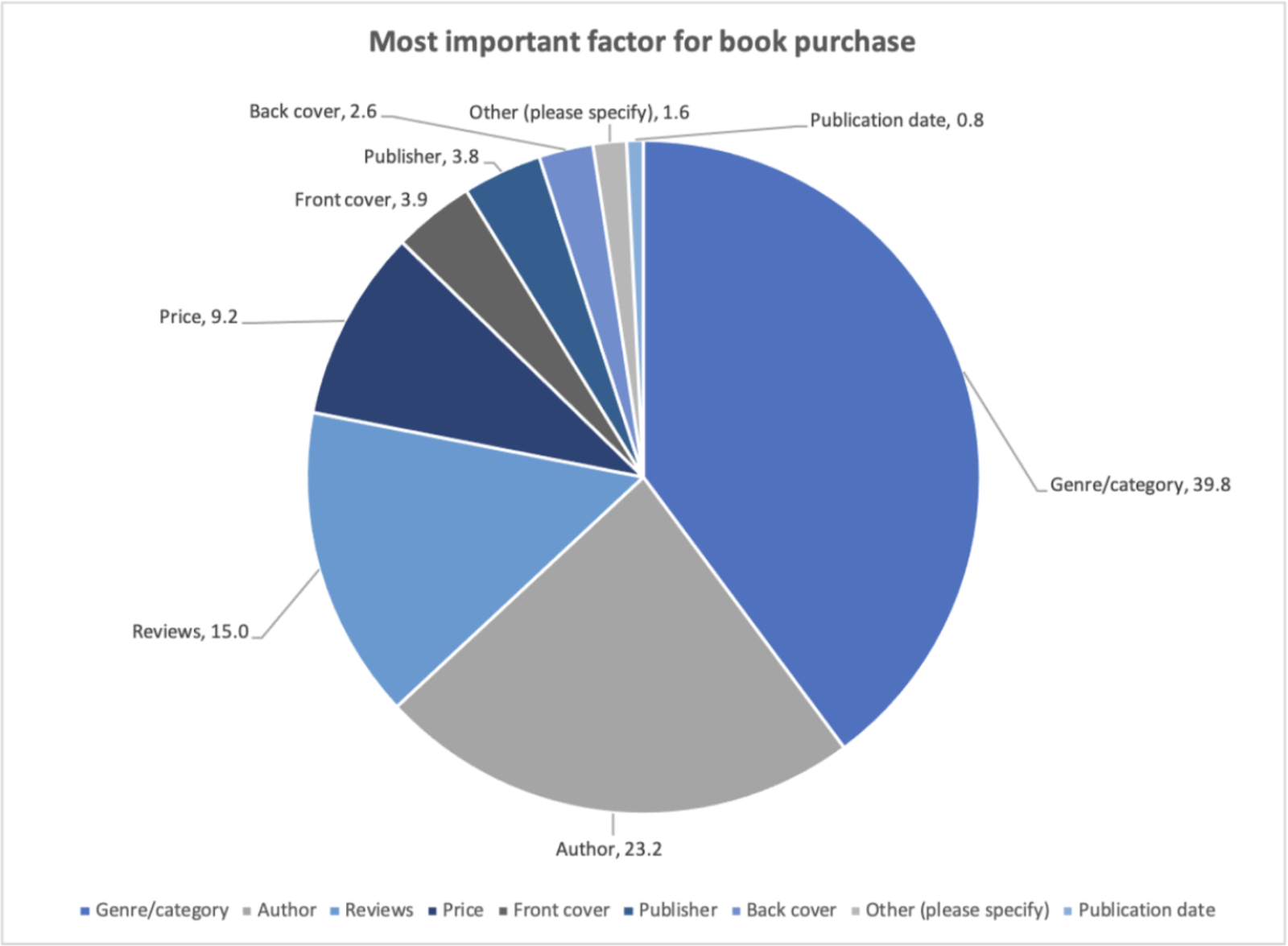

The same report found that the most important factors for book purchase were genre/category (40%) and the author (23%).

Meanwhile, other factors included:

- Reviews - 15%

- Price - 9.2%

- Front cover - 3.9%

Women considered a book’s genre or category as the most important factor when looking to purchase a book, while men considered the author. On average men also read more ebooks per month than women (2.8 compared to 2.6).

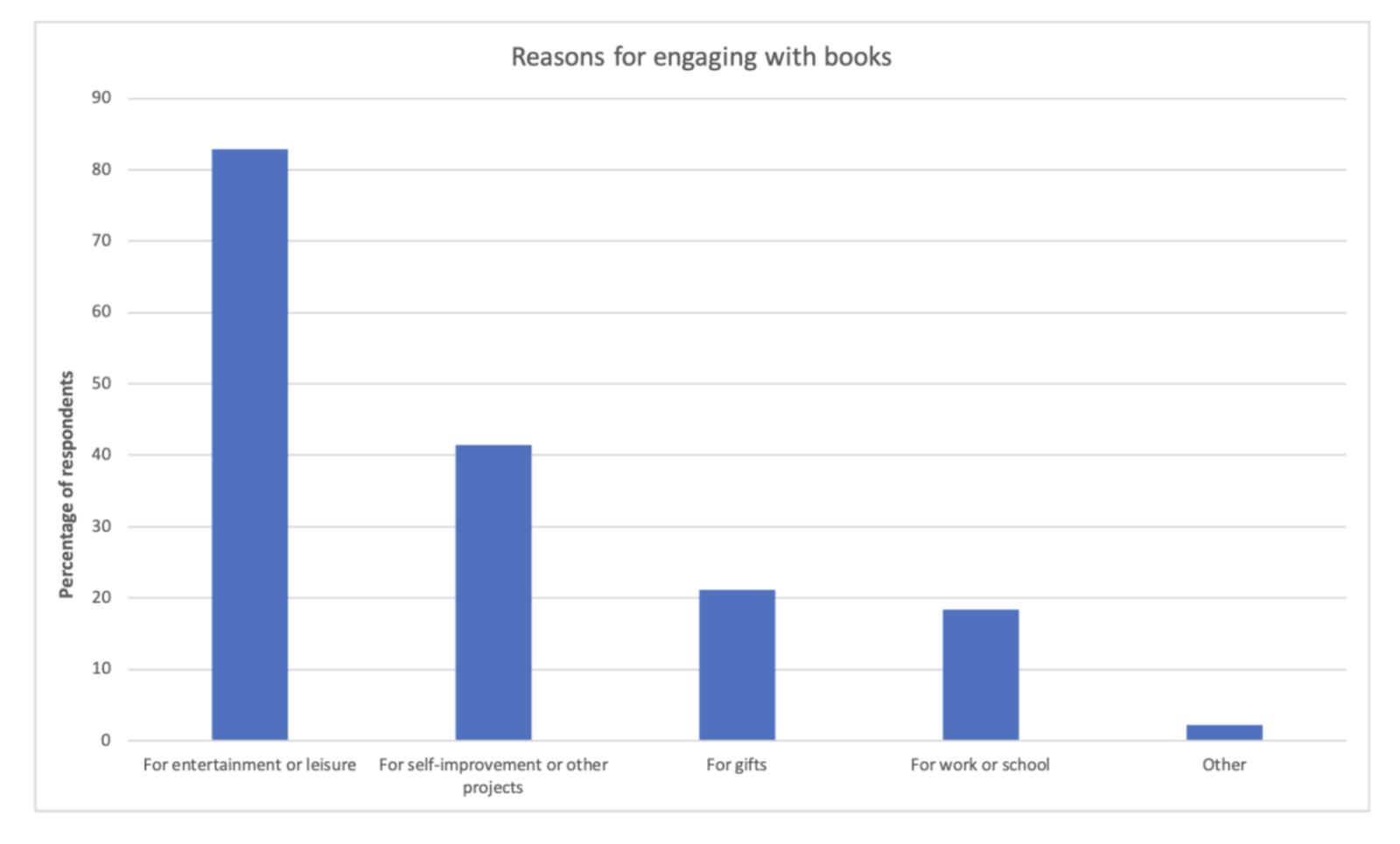

Further, entertainment (82.9%) was the main reason readers engaged with books, followed by self-improvement or other projects (41.4%).

Other reasons included reading a title received as a gift (21.2%) and reading material for work/= or school (18.4%).

39.8% of readers posted book reviews or recommendations to websites or social media.

However, only 7.32% discovered books this way. Meanwhile, 44% of men posted book reviews compared to 36% of women.

The top three ways readers discovered books were:

- Recommendations from friends (20.8%)

- Their favorite author (15.3%)

- Recommendations from family (12.1%)

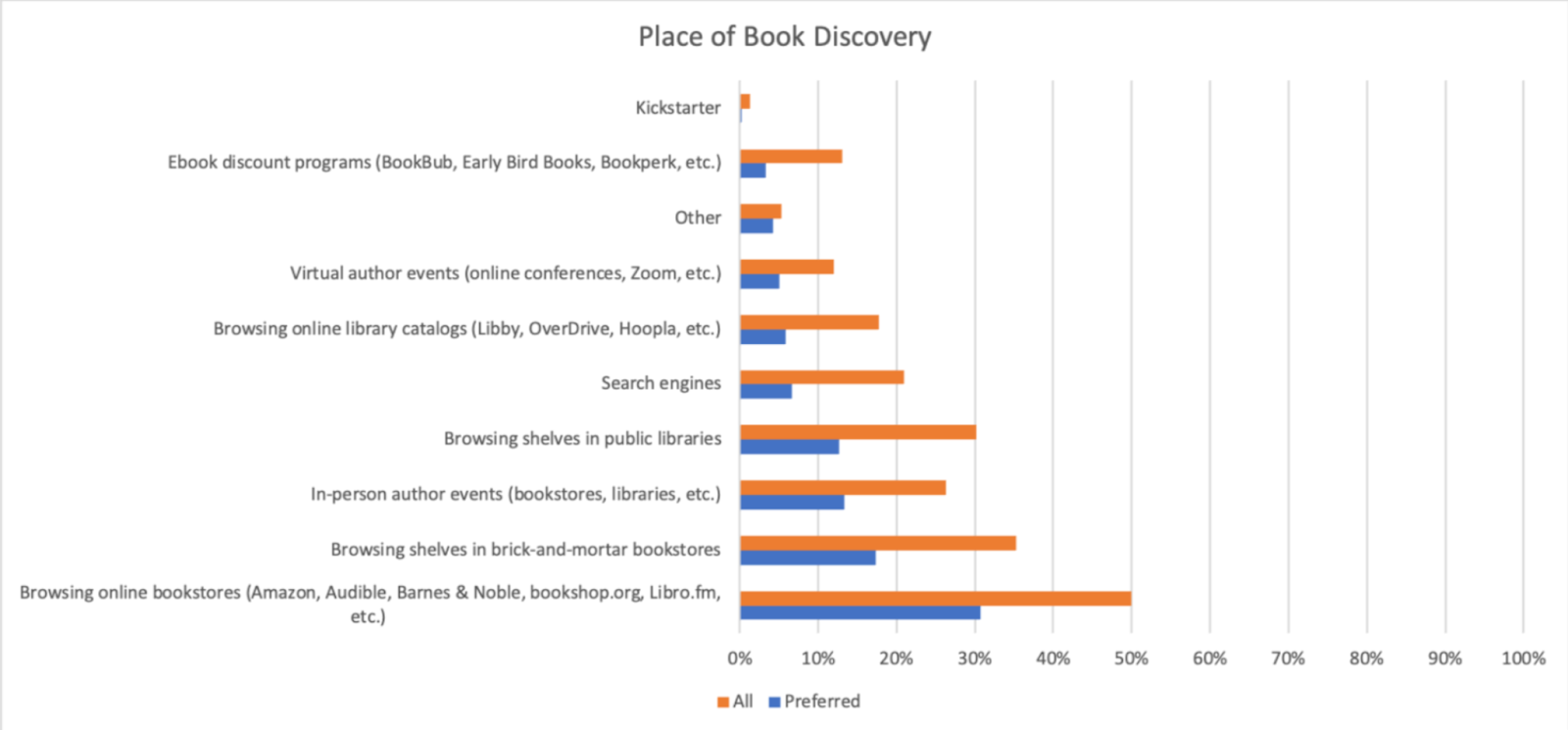

Meanwhile, ebook discovery occurred mostly through browsing online bookstores (30%), search engines (8%) online library catalogs (8%) virtual author events (7%), and ebook discount programs(5%).

The report also found that ebook and audiobook consumers were more likely to multitask (70% for audiobooks and 61% for ebooks).

Multitasking rates were highest among Gen X, followed by Millenials, and lastly, Baby Boomers. Additionally, women were more likely to multitask while reading ebooks (58% compared to 54% for men).

At 72%, engagement with books was highest in Adult fiction.

The top 3 genres in this category were:

- Mystery - 42%

- Thriller - 33%

- Classics - 27%

Adult-Non fiction had the second highest engagement levels at 55.6%

The top 3 genres in this category were:

- Biographies and autobiographies - 31%

- History - 28%

- Body, mind, spirit - 30.9%

Ebook Publishing Statistics

Searches for the keyword ‘independent author’ increased 165% over the last 5 years12.

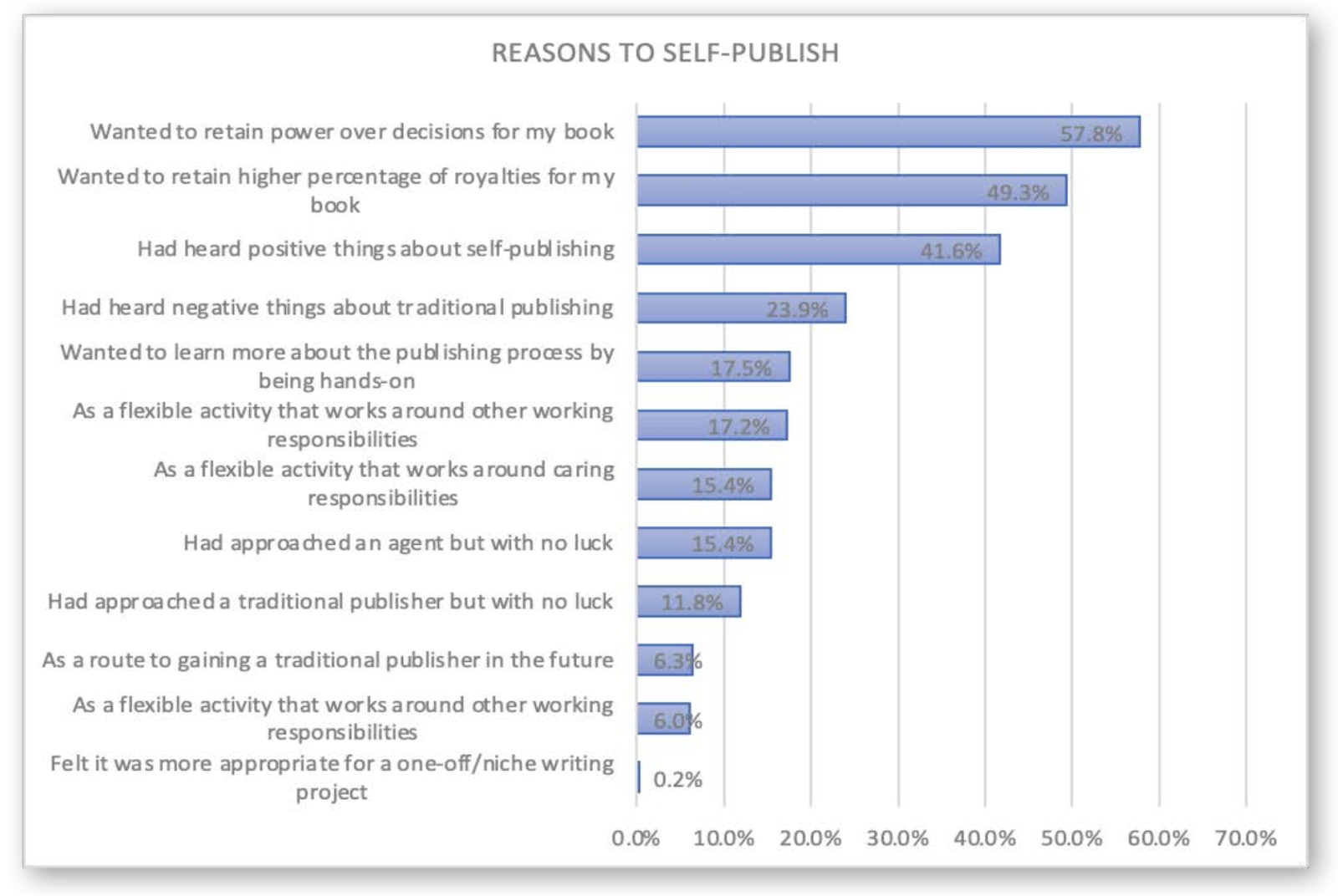

Self-publishing, which has gained traction due to platforms like Kindle Direct Publishing, has given independent authors control over their content, cover designs, revenue, distribution, and more.

A 2024 report found that 93% of authors13 had a positive perception regarding self-publishing.

- Over 50% of authors chose self-publishing as their preferred publishing model.

- 86% of self-published authors said they would recommend self-publishing to others.

- less than 50% of authors under 45 would prefer to have their next book traditionally published.

53% of authors used AI, while 47% did not14.

The top reasons why they didn’t use AI included a lack of familiarity with AI tools, not feeling the need to, and concerns about content creativity or originality.

Meanwhile, 86% of self-publishing authors would not use AI to write text in a book, demonstrating strong skepticism about AI’s usefulness in the actual writing or creative process.

However, when it came to using AI to create marketing assets, close to 50% were open to the idea.

In 2023, the global publishing market was expected to grow at 1% CAGR per year, while the self-publishing market was expected to grow at a faster rate of 17%.

Additionally:

- As of 2024, 42% of ebook sales via Amazon were self-published titles15.

- 30-34% of all ebooks sold were self-published in 2023.

- The number of self-published books grew by a whopping 264% in the five years leading up to 2023.

As of 2024, the typical costs associated with self-publishing included:

- Editing - $5 to $15 per hour or $10 per 1000 words

- Writing (If making use of a ghostwriter) - $0.10 to $1.50 per word or higher

- Formatting - $200 to $500

- Cover Design - $50 to $500

- Copyright - $35 to $55

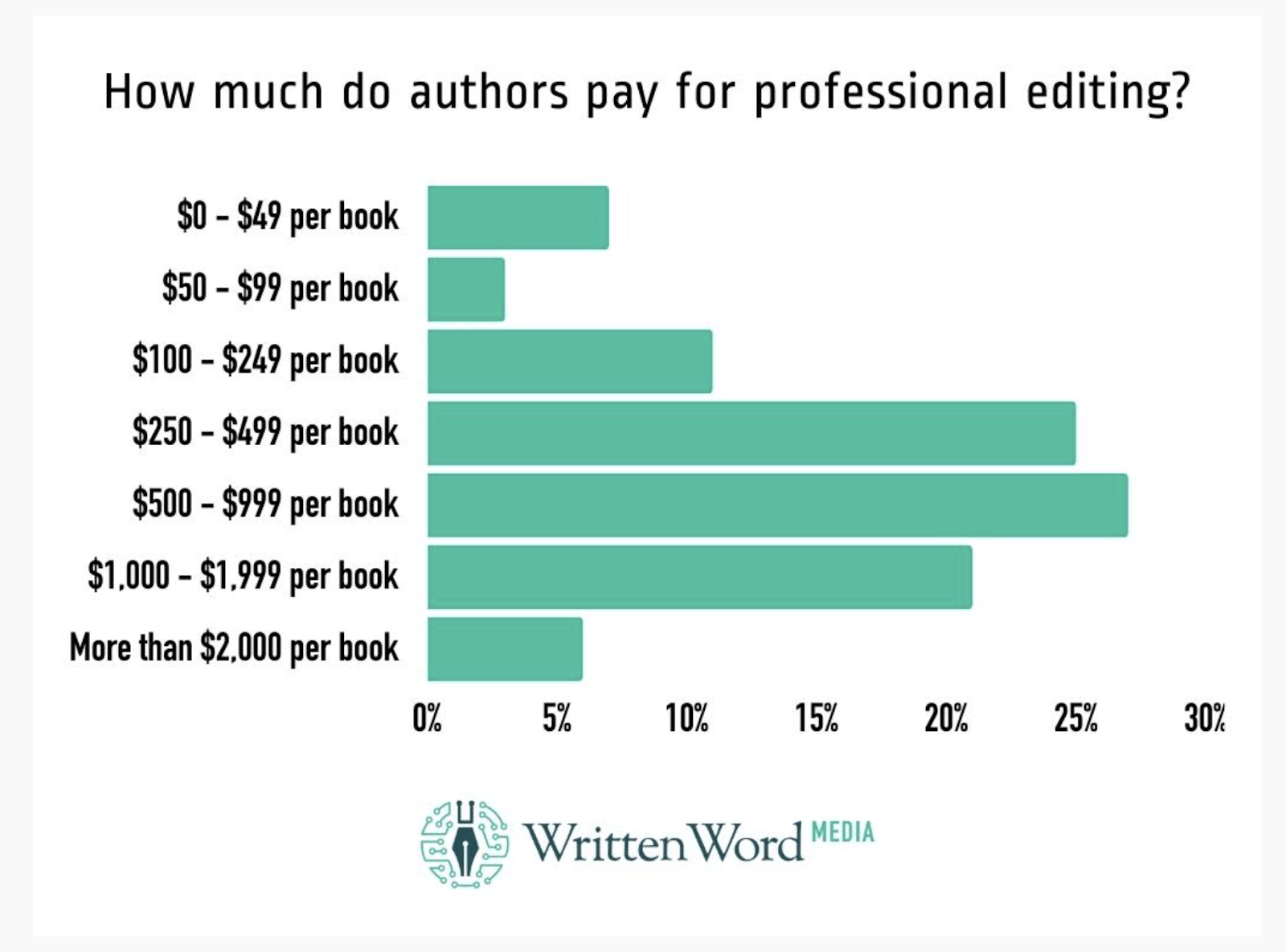

60% of authors paid for professional editors16. That’s up from 56% in 2020.

Around 25% chose to edit for themselves, while 10% asked a friend or family. A smaller percentage (less than 10%) asked a fellow author.

55% of authors who paid for professional editing services spent over $500 per book.

Meanwhile:

- 80% spent $250 or more per book, on editing services.

- 20% spent between $1,000 and $1,999

- 5% spent over $2,000 per book

50% of authors worked with a professional graphic designer for their book cover.

30% of authors designed their own covers, while up to 10% used a crowd-sourcing platform like Upwork or Fiver. Of those who worked with a professional designer, 86% spent $100 or more per cover.

30% of authors paid a professional web designer to create their author website.

The average cost for an author website was around $1,022.

Ebook Monetization Statistics

First-time authors with traditional publishing deals can make anywhere between $1,000 to $10,000 and 5-18% in royalties17 , once the upfront payment is covered by book sales.

Self-published or independent authors can make up to 80% in royalties depending on their distribution strategy.

Examples of successful indie authors include:

- LJ Ross, dubbed the Queen of Kindle, sold over 7 million ebook copies globally.

- Rupi Kaur, an Instagram poet, sold over 8 million copies of her collections.

- Rachel Abbott, the first self-published author to hit #1 on Amazon sold over 4 million ebook copies.

- Hugh Howey, a Sci-Fi author made $100,000 a month through Amazon sales alone.

As of 2024, ebook royalty rates across different publishing models were:

- Self-publishing - 35% to 70%

- Small Press - 25% to 50%

- Traditional Publishers (Big 5 authors) - 25%

Meanwhile, a study divided authors into groups earning more than $10K, $25K, $50K, and $100K and found that the number of indie authors making 5 to 6 figures per year from book sales was significantly higher than the number of Big 5 authors earning the same.

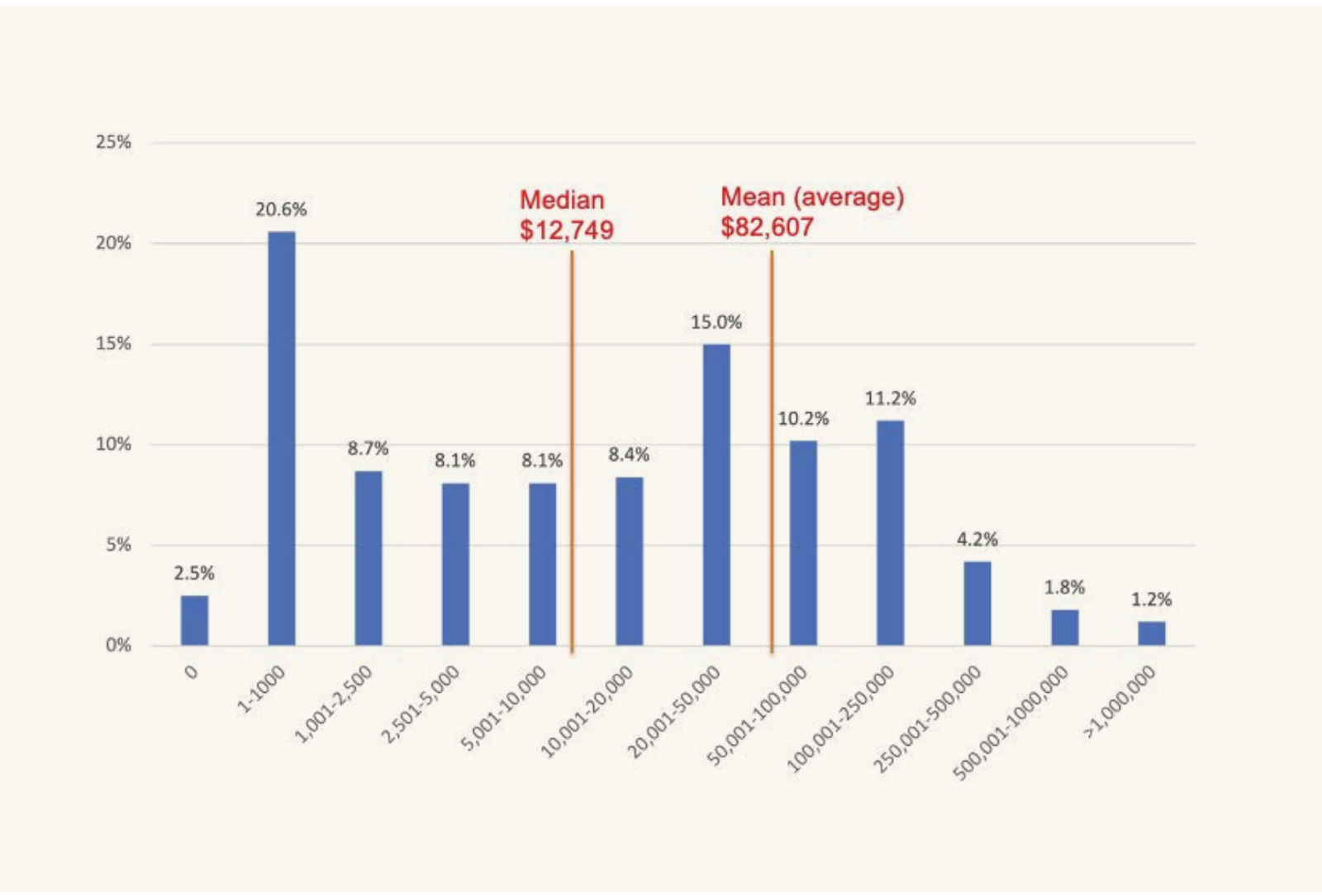

Self-published authors had a median wage of $12,759 in 2023, a 53% increase from 2022. Meanwhile, traditionally published authors reported a declining median wage of $5000-$8000.

Additionally, the mean wage for self-publishing authors was also higher at $82,600, a 34% increase from 2022.

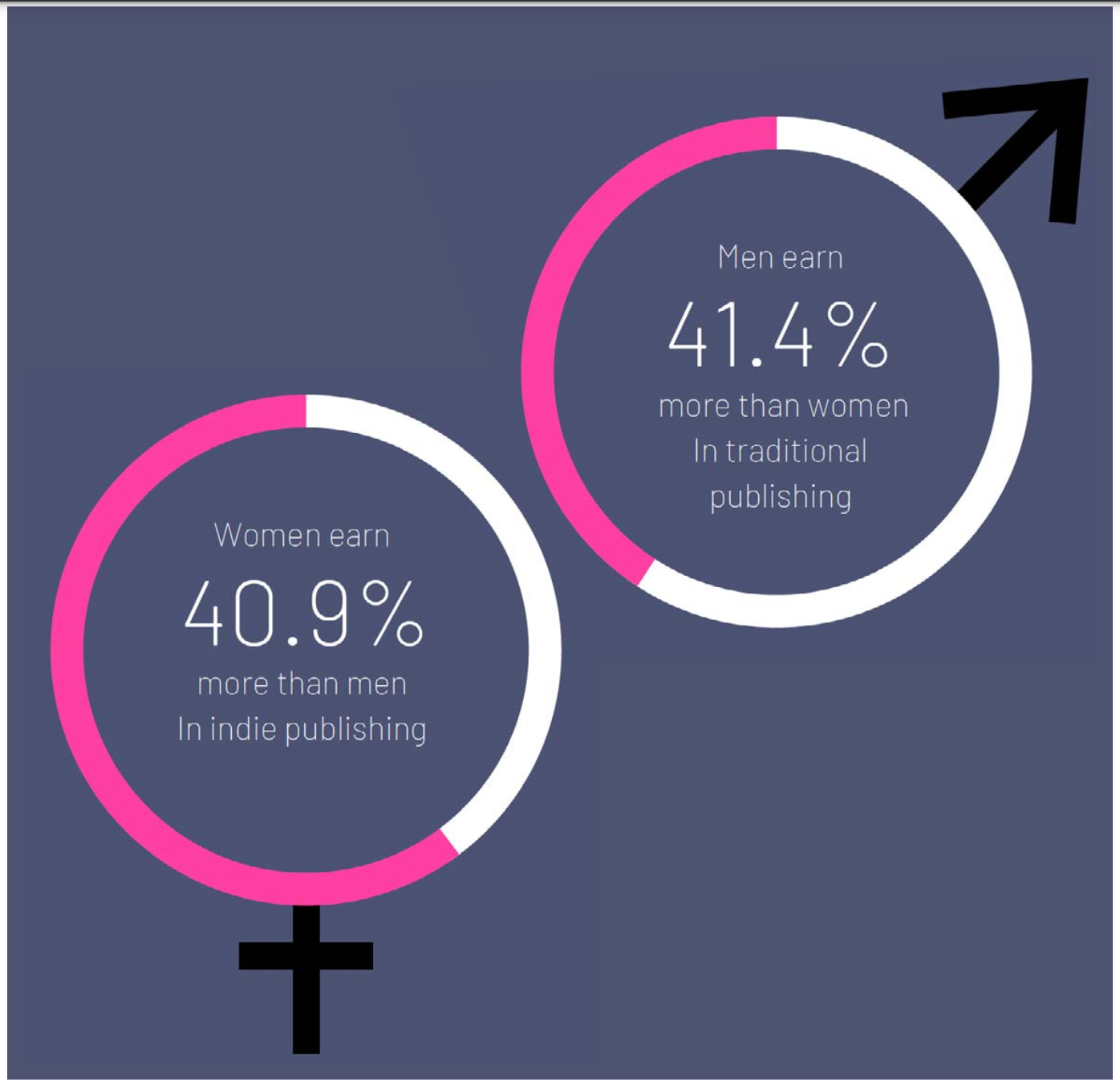

Women in indie publishing earned 40.9% more than men in 2023.

This is in contrast to traditional publishing where men earned 41% more than women. Self-publishing authors within the LGBTQI+ community also reported earning 19% more than they would in traditional publishing.

As of June 2024, KDP Select paid authors $56.1 million in royalties18, up from $47.9 million in June 2023.

The world’s largest self-publishing platform offered royalty rates of 35% for books priced under $2.99 or 70% for books priced between $2.99 and $9.99.

In the first half of 2023, the total paid out to authors just from Kindle’s ebook subscription service was $272 million19, a 10.7% year-on-year increase from what was paid out in 2021.

Through the KDP Select revenue model, independent authors can:

- Earn their share of the KDP Select Global fund when customers read their books through Kindle Unlimited.

- Earn 70% royalty for sales to customers in Japan, India, Brazil and Mexico.

- Increase their discoverability and reach in 12 key markets.

- Gain access to promotional tools such as time-bound discounts while earning royalties.

Self-published authors accounted for over 50% of Kindle’s Top 400 books for 2023.

On average, Amazon has paid an average of $520 million in royalties to self-published authors each year. However, while the reach of Kindle Unlimited’s subscription program has increased significantly, author remuneration is not keeping up.

For example, in 2023, Kindle Unlimited grew by 18%, yet Amazon’s page-read royalty payments only grew by 12%, resulting in the indie author pay rate for page-reads dropping by 5.5%.

The earning potential on other top self-publishing platforms as of 2024, was as follows:

- iBooks: The world’s second-largest ebook retailer offered a flat 70% rate to independent authors.

- Barnes & Noble Press: Accounted for 3% of global ebook sales and offered a royalty rate of 70%.

- IngramSpark: Created by the world’s leading distributor of print books, the platform charged commission rates of between 30%-53% less book production costs.

- Google Play Books: The world’s largest app store offered 70% for every ebook sale in over 60 countries and 52%.

- Smashwords: The popular platform for indie publishers stated that authors’ earning potential was up to 80% for purchases on Smashwords’ store and 60% of sales from outside retailers.

- Kobo: One of the oldest self-publishing platforms for ebooks offered between 45% -75% royalties for books below $2.99 and above $2.99, respectively.

- Lulu: The platform had a 90% revenue share for ebook sales and charged a one-time fee of $4.99 for global distribution.

- Draft2Digital: The platform charged a flat 10% fee for its services.

According to a Convertkit report, book authors were among the top 10 most common creator type20, accounting for 9% of creators in 2023.

In 2023, 51% of creators incorporated ebooks into their strategies, making them the second most common form of content created by creators.

Digital products like ebooks and courses were considered among the top 2 income streams for creators in 2023.

Additionally,

- 24% of creators considered digital products such as ebooks and courses the easiest way to monetize in 2023.

- 18% of creators earned their first dollar through selling digital products.

The same report found that 20% of authors made over $100,000 per year in 2023.

13% made between $10,000 and $100,000. Meanwhile, 66% made under $10,000 per year.

In addition:

- 88% of authors expected to make more in 2024 than previous years.

- 23% planned to make more through selling digital products like ebooks and courses.

63% of six-figure creators stated that digital downloads such as ebooks had made them the most revenue in 2023.

Again, digital products were selected as the top revenue stream for six-figure creators. A key reason being that products such as ebooks which are created once, generate passive income.

Successful independent authors published a median of 8 books.

They also spent an average of 15 hours per week writing. Additionally, 83% wrote in multiple genres.

Writer income was also found to be linked to the number of books an author published.

- For authors earning between $0 and $249 per month, the median number of published titles was 5.

- For authors earning between $5,000 and $7,500 per month, the median number of published books was 30.

- For authors earning more than $15,000, the median number of books published was over 40.

Ebook Promotion Statistics

In 2024, nearly 80% of authors said marketing was the most challenging part of the process.

With more ebooks in circulation than ever, getting in front of audiences remains a key challenge for authors.

As of 2024, authors spent an average of $617 on marketing per month and dedicated over 31 hours to promoting their ebooks.

This equates to about 7 hours and $150 per week spent on promotion.

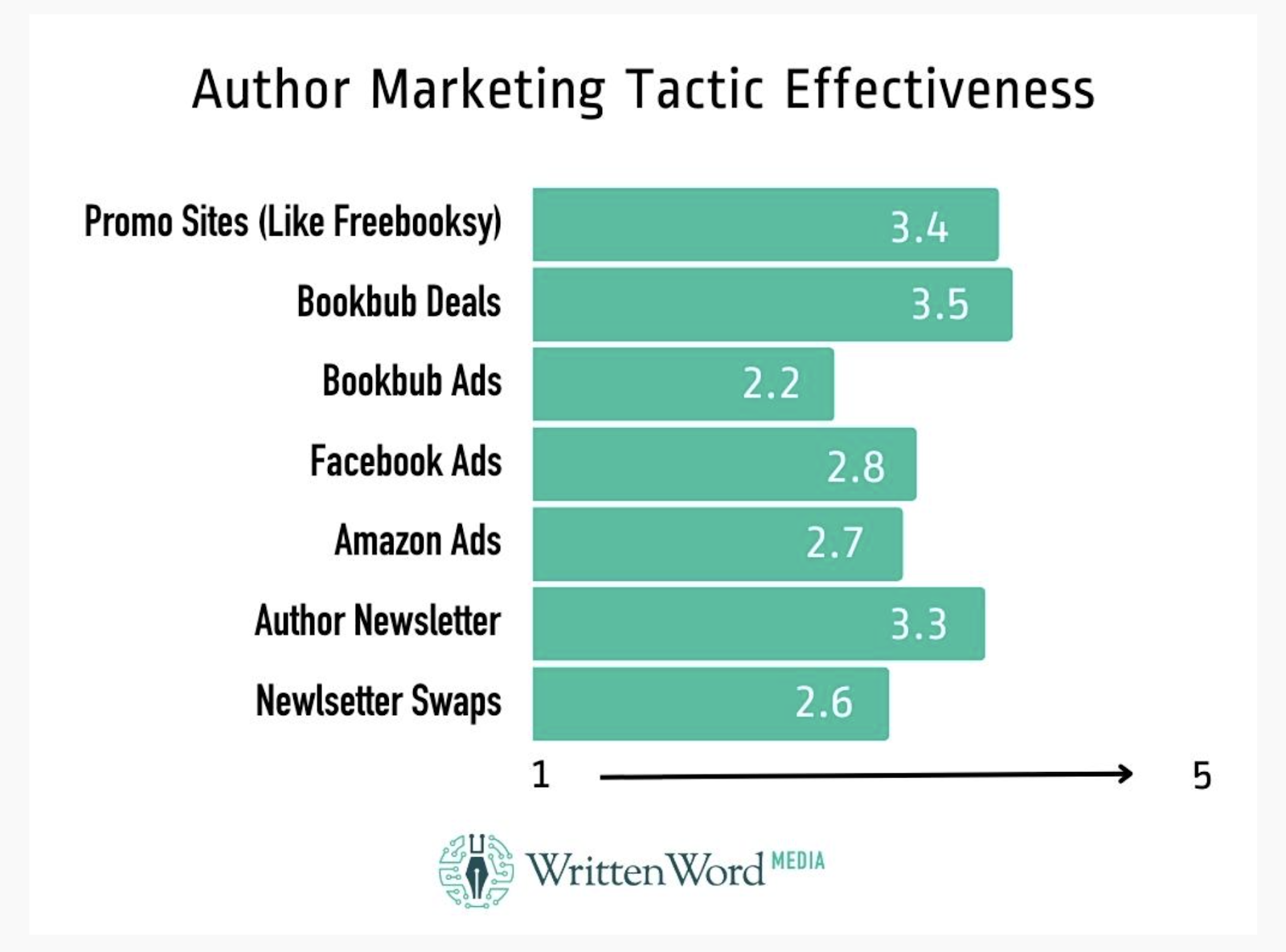

In terms of the most effective tactics, Bookbub deals took the lead with an average rating of 3.5 out of 5. In second place were Promo sites with an average rating of 3.4. This was followed by author newsletters with an average rating of 3.3.

Other effective tactics included:

- Facebook ads - 2.8

- Amazon ads - 2.7

- Newsletter swaps - 2.6

- Bookbub ads - 2.2

Paid social ads can boost visibility and drive ebook sales. According to a Data Reportal report there were over 5.07 billion social media users21 around the world as of 2024, equating to 63% of the total global population.

The average social media user uses an average of 6.7 different social platforms each month and spends around 2 hours and 20 minutes or 14% of their day on social media.

According to the same report, Youtube had the largest social media advertising audience, reaching 2.5 billion users per month.

This was followed by:

- Facebook with a reach of 2.24 billion

- Instagram with a reach of 1.69 billion

- TikTok with a reach of 1.58 billion

Depending on the platform and audience demographics, paid social ads can cost anywhere between $200 to $1,500 per month (or more).

For authors on a tight budget, this may be out of reach. Luckily, the top 3 social media platforms are home to prolific online book communities where authors can build organic growth, drive engagement, and even go viral. These communities include:

- BookTube (Youtube)

- Bookstagram (Instagram)

- BookTok (TikTok)

In 2022 alone, BookTok authors experienced a 60% increase in sales22.

This is following a 40% increase in sales in 2021 over 2020. Gen Z and millennial consumers, who have emerged as significant book consumers, continue to drive the BookTok trend.

A 2023 report found that 85% of authors had their own website. Of the 15% who didn’t, 46% planned to have a website within a year.

Author websites play a crucial role in building readership and valuable reader mailing lists.

Only 27% of authors with their own websites sold directly to readers on their site. Of those who didn’t, 39% planned to offer direct sales by the next year.

For authors selling direct, a majority (45%) used BookFunnel, an author service specializing in ebook and audio distribution. Other platforms included:

- Shopify - 25%

- Payhip - 20%

- Woocommerce - 20%

When it came to pricing their books, 79% of authors priced their most expensive ebook at $4.99 or more.

Meanwhile, 26% of authors priced their most expensive ebook at $4.99 or less.

In terms of their least expensive ebook, 50% of authors set their price at $0.99 or free.

Pricing a title, particularly the first in a series at $0.99 or free remains a common tactic to hook readers and boost subsequent book sales.

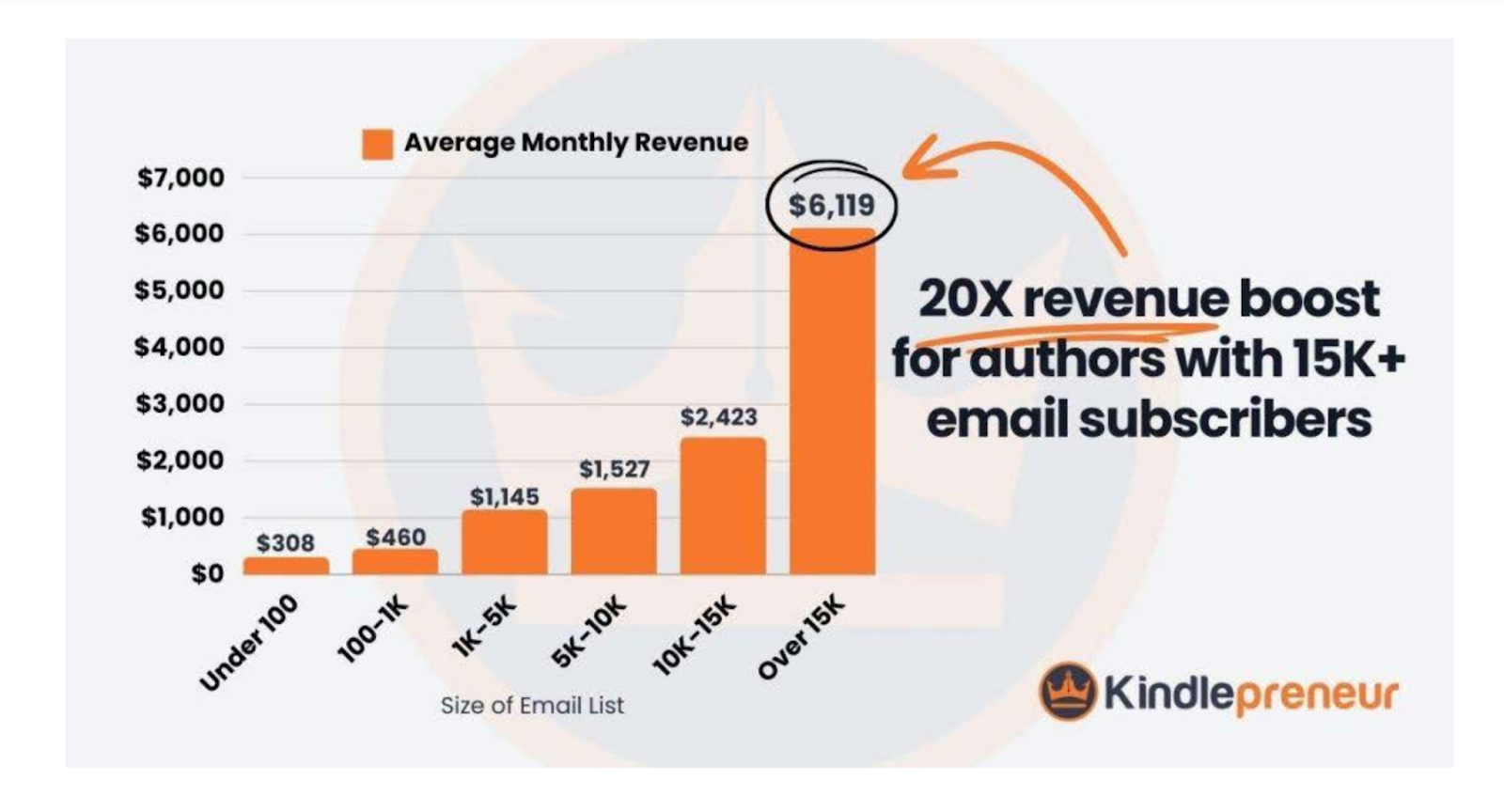

With an ROI of up to $36-$45 per $1 spent, email marketing can be a powerful promotional tool for authors.

As of 2024, an email list of:

- Under 100 can generate up to $300 per month in revenue.

- 100-1,000 can generate up to $460 per month in revenue.

- 1,000-5,000 can generate up to $1,145 per month in revenue.

- 5,000-10,000 can generate up to $1,527 per month in revenue.

- 10,000-15,000 can generate up to $2,433 per month in revenue.

- Over 15,000 can generate up to $6,119 per month in revenue.

Ebook Piracy Statistics

14.4% of ebook consumers engaged in book piracy in 2023.

Interestingly, book pirates were book buyers, book subscribers, and book borrowers. In fact, compared to the general survey population:

- 39% bought more ebooks.

- 31% borrowed more ebooks.

The report concluded that the main reason behind piracy was a lack of accessibility.

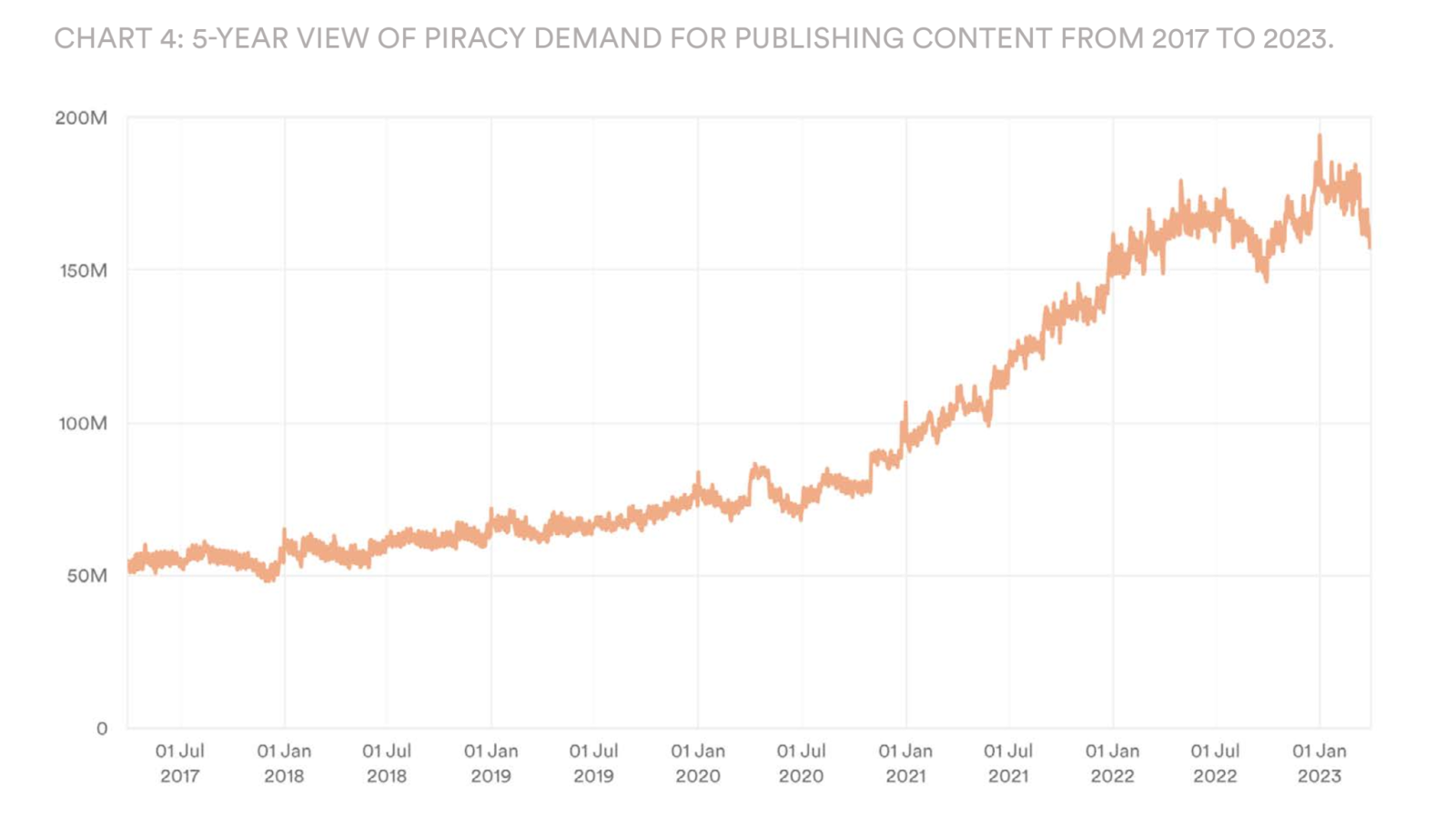

A 2023 MUSO report found that between 2017 and 2023, there was a 189% increase in demand for publishing piracy of ebooks23.

- 2x as many people in 2023 visited publishing piracy websites each month.

- There were over 60.8 billion visits to publishing piracy websites, a 27% increase from 2022.

- At 12.8%, the demand for publishing piracy was highest in the US, followed by Vietnam (6.8%)

According to the same report, publishing overtook film as the second most in-demand media sector for digital piracy in 2020.

Additionally, the AAP estimated that the US publishing industry lost over $2.9 billion to piracy in 2020.

Create and Sell Ebooks With Whop

The ebook industry is growing at a rapid rate, from 700 million ebook readers in 2017 to a whopping 1 billion (estimated) readers in 2024. More and more consumers are seeing the value that ebooks bring as a lower-cost and more easily accessible form of their favorite books.

If you have an idea or skillset, why not turn it into an ebook? Whether you're writing a short, inspirational ebook about your journey as an entrepreneur, or a full-length romance novel, there is a place for everyone in the ebook market.

Writing an ebook is easier than you think, and once it's out there, you can start earning passive income. Plus, if you sell with Whop, you get to keep 97% of your sales - which is a huge difference when compared to the likes of Amazon KDP, which takes anywhere from 30 to 65% of your sales income.

Create an account on Whop for free and start selling your ebooks today.