Ever heard of ‘bootstrapping’? The word is derived from the idiom “to pull oneself up by one’s bootstraps”.

It refers to achieving success without relying heavily on outside help — like when a business owner uses personal funds instead of seeking financing from banks or investors.

Bootstrapping can be a great option if you want to start a business but have limited credit or concerns over losing control to stakeholders. By funding a business independently, you can avoid debt and retain full control.

So, how can you bootstrap effectively to bring your startup vision to life? Let’s take a look at 20 great ideas that won’t risk breaking the bank.

A closer look at what bootstrapping involves

Many famous companies got over early hurdles by bootstrapping.

For example, Mailchimp was founded in 2001 without any outside funding. Today, Mailchimp owns 73% of the market for emailing marketing tools.

A bootstrapping executive might dip into personal savings, rely on business revenue, or even seek support from family and friends.

GoPro founder Nick Woodman took this kind of approach, using a family loan to fuel the company today renowned for its range of action cameras.

Other, more formal means of external funding, like securing venture capital (VC) or taking out business loans, don’t tend to come into the picture when bootstrapping.

However, the entrepreneur might turn to these more mainstream options as the business matures. This is when the company could encounter a few awkward roadblocks that threaten to slow down its growth rate. In situations like these, an extra injection of funding could be just what is needed to get the business to the next level.

In the beginning though, many entrepreneurs can’t readily source such funding for their new businesses. This is why bootstrapping is such an attractive alternative.

Looking for proof? Read our article on companies that have succeeded with bootstrapping.

Benefits of bootstrapping: why it works

Bootstrapping a business can bring the following benefits…

- Debt-free finances

Loading your business with debt by taking out a loan can leave you with little financial wriggle room in the foreseeable future. - Full control of the business

You can get capital by trading company equity but would have to give someone else an ownership stake in the business. - Flexibility

When you fully own your business, you can more easily pivot its direction and strategy in response to market changes. - Keep it lean, keep ‘em keen

Bootstrapping can force you to prioritize the customer experience, as word of mouth is a cost-effective form of marketing. - Spirit of innovation

When your budget is consistently tight, you may have to work hard to come up with highly creative, unorthodox workarounds.

As your company grows, bootstrapping can give you financial leeway to pounce on exciting opportunities down the road.

Drawbacks of bootstrapping: where it falls short

Why might bootstrapping not be a viable option for many new business owners? The lack of money within close reach from the onset could result in these issues…

- Stunted growth

From developing new products to hiring talent, various strategies can accelerate your company’s growth. However, these options may be out of reach when funds are limited. - Burnout

Bootstrapping often means taking on multiple roles you’d otherwise delegate, increasing your workload and stress. - Higher financial risk to the business owner

If you lack entrepreneurial experience, you could struggle to separate your business finances from your personal finances. This could put the latter in unexpected jeopardy.

With a careful, strategic approach, however, many bootstrapping drawbacks can be managed.

Imagine you start a small business at home. What if this kind of business typically operated from dedicated offices or retail spaces? This could impact your brand's professional image.

Fortunately, bootstrapping teaches resourcefulness, which can help you save for such investments sooner than expected.

Would bootstrapping be right for your business?

If you're launching a business with low overheads then bootstrapping could be right for you.

Basically, any business that offers remote services and runs without any need for a physical storefront or special equipment can succeed with bootstrapping. This could help to explain why many now-thriving SaaS companies have a history of bootstrapping.

Consider the example of GitHub, which a bunch of friends started on a weekend, pooling their financial resources for the project.

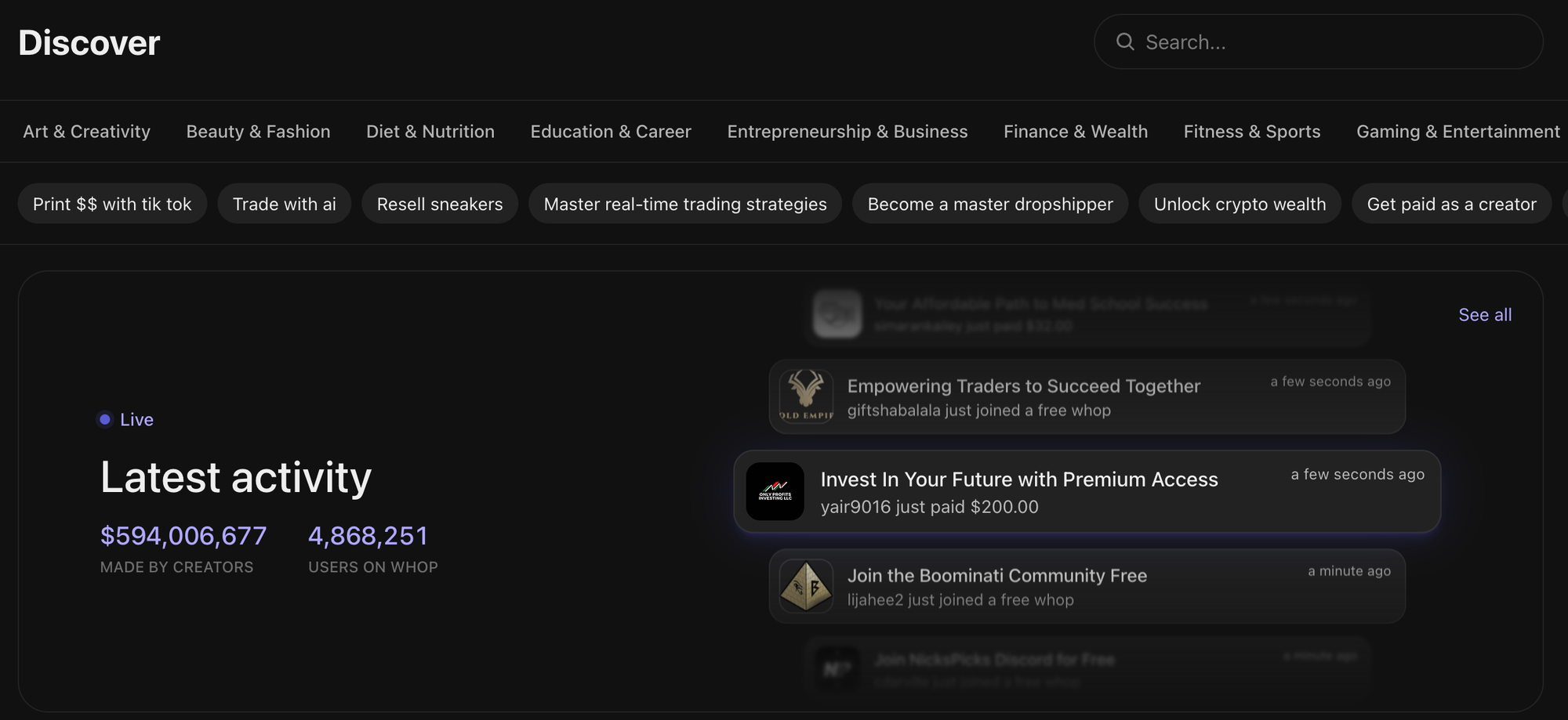

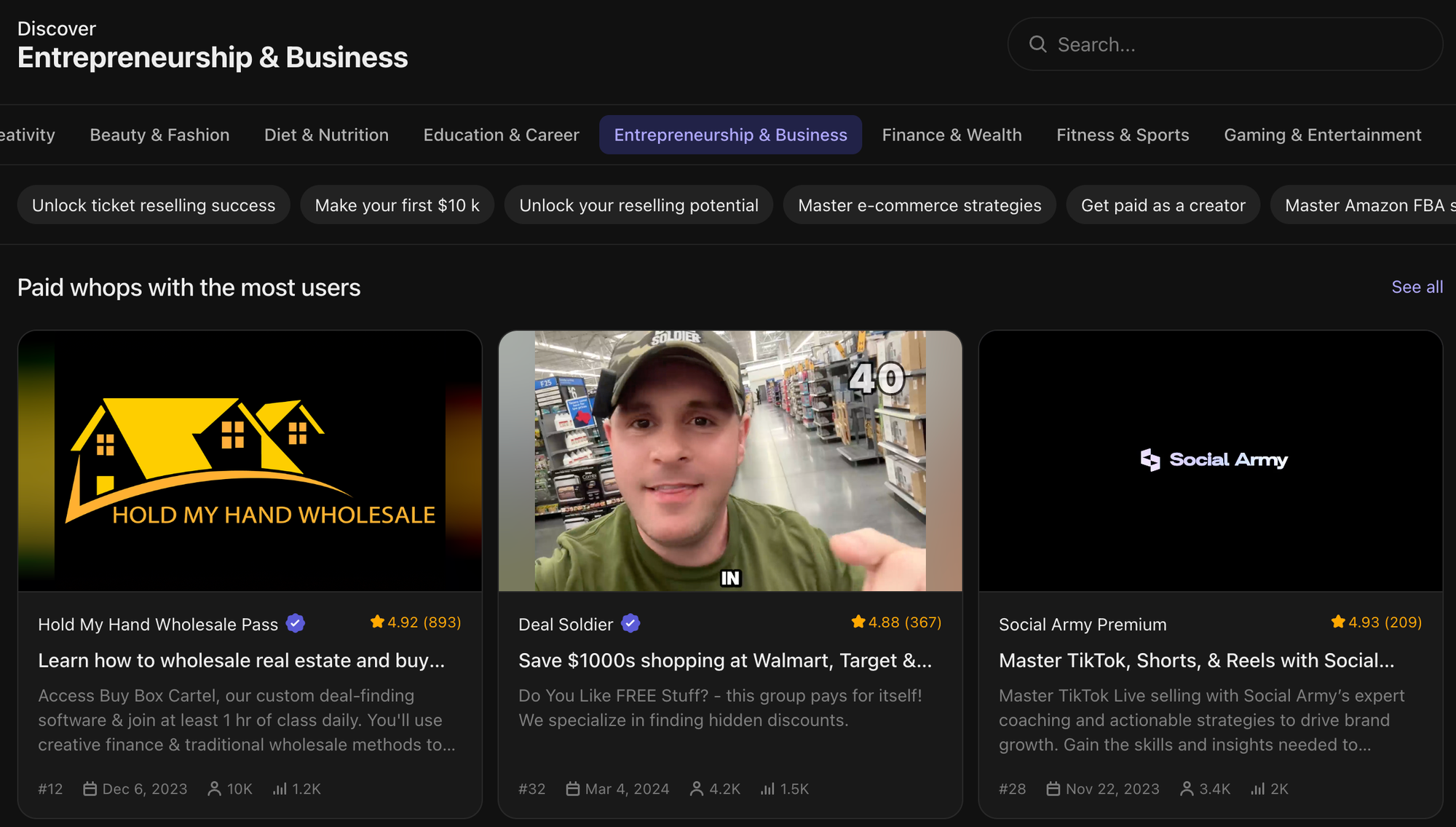

One modern bootstrapping tactic would be to launch a ‘whop’. With a whop, entrepreneurs can sell digital services like courses and communities, entirely online. Very little outlay (if any) is needed - you can create your whop without spending any money upfront.

As a result, you can avoid the (potentially extortionate) overhead costs that would occur when managing brick-and-mortar outlets.

On the other hand, if a large part of your business would entail selling physical goods, like books, smartphones, alarm clocks, and so forth, you may need to carve out some of your budget just for warehouse space where you would keep the stock.

Similarly, if you want to provide in-person services, such as cleaning, childcare, or gardening, you will need to spend extra money on traveling. So, in scenarios like these, the prospect of bootstrapping the business could be a tougher sell.

Still, if you break down your company’s individual expenses and scrutinize them, you're likely to spot some unnecessary financial flab worth tightening up.

For example, if you are wondering how to save money on ecommerce fulfilment, one option is dropshipping. This is where suppliers of your online store’s physical products would pack and ship them for your customers on your behalf.

20 ways to bootstrap your business

So, how do you bootstrap your business? Where do you invest money and where do you cut costs?

We have looked into 20 common ways that you can save money when building a business.

Let's dive in.

1. Lean into your existing skills and interests

“Choose a job you love, and you will never have to work a day in your life.”

You have probably often read that quote (or some variation of it), right?

It’s arguably a flawed mantra. Even if you succeed in landing a job you love, you will still need to treat it as a job. If you treat it primarily as a hobby or passion instead, you risk overlooking the practical essentials of getting ahead in the world of work.

It would be more accurate to say that choosing “a job you love” gives you a big “head start” or “helping hand”. Admittedly, this wouldn’t make for quite as much of a snappy, memorable quote — but there remains a large degree of truth in it.

When you launch a business rooted in what you are genuinely interested in, there’s a good chance that you…

- Know a lot about the subject (and so, at least to some extent, how to make a successful business out of it)

- Will enjoy filling any gaps in your knowledge of the subject

- Already have all or much of the equipment you will need for the job

Your field of work could be one where you must keep updating your subject knowledge to stay competitive. You can do this by not only taking up-to-date courses but also joining communities of the right specialism.

Thousands of people are making money doing what they love with Whop. From selling sports picks to sharing trading knowledge, running online fitness communities and creating mindfulness courses, creators are earning an income from nothing but their knowledge and a whop. To follow in their footsteps, read our guide to info products and how you can sell them.

2. Work from home (if and when you can)

Of course, many businesses require their workers to regularly commute to physical premises, such as a shop or office. However, if you worked from home during the COVID-19 pandemic, you might be able to do it again now.

The business you have in mind might be one where you would need to visit the homes or workplaces of your customers or clients. Maybe you intend to do painting, decorating, or plumbing, or be a ‘mobile hairstylist’ cutting people’s hair in their own homes?

Even in these instances, though, you could still do some work from home, like sorting out administrative tasks and taking customer orders. You wouldn’t need to spend money renting a separate physical workplace.

Working from home will also enable you to save money on commuting. If any of your customers want to see your face as they chat with you, why not take video calls? You can do that from your whop with using the Whop Video Calls app.

3. Carry out market research

So, you have figured out what kind of work your business will focus on. Now you can look closer at the market in search of specific opportunities worth pursuing. You want answers to these questions…

- What are customers most urgently crying out for in this market?

- Which of these needs aren’t currently being fulfilled (at least as well as they could be)?

- What types of products or services would best satisfy the target audience’s wants and requirements?

As for how to actually undertake this research, many platforms can help. One good option is SurveyMonkey, which caters to the finance, educational, healthcare, and retail industries, among others.

Naturally, it’s important to get the basics right. At the same time, you don’t want to devote too much attention to an oversaturated section of the market.

Attempting to beat the big boys at their own game could become a financially inefficient battle of attrition. By targeting a niche first, you can test the waters of your industry without putting too much money on the line.

You can make a survey for free and gain insights into the industry you're looking to enter.

4. Create and test an MVP (minimum viable product)

Your market research might be pointing toward a particular product idea, but what should work isn’t always the same as what does work.

Hence the rationale for releasing an MVP first. An MVP can be described as a relatively basic, stripped-down (and cheap-to-make) iteration of the ‘full’ product you were originally envisioning.

Your MVP must still be good enough to capture the essence of that full product and intrigue members of your target audience. That’s because the point of an MVP is to test people’s reactions to it to see if you are on to a good thing.

One famous example of an MVP is Instagram. The Instagram MVP simply allowed you to share photos and apply filters. This was the total offering of Instagram, which allowed founder Kevin Systrom to see if there was a market out there for his product.

Now, Instagram has evolved into not such a photo-sharing app but a home for news, businesses, social shopping, private messaging, and more.

Chances are that your MVP will get a mix of positive and negative reactions. Thanks to your market research, the MVP might have potential. At this stage, it’s easy to make errors, but they are unlikely to lose you a lot of money.

By tweaking your product in response to feedback, you can get closer to something that could form the bedrock of your business.

5. Put together a business plan

This is something you should do before launching the MVP. However, before starting work on the business plan, you should think long and hard about what general shape this MVP will take.

That’s because your MVP idea will inspire the business plan as a whole. What is usually meant by the term ‘business plan’, anyway? It refers to an overall plan for how an entrepreneur will work towards the goals they have set for their company.

Your business plan will be informed by a ‘SWOT analysis’. The acronym here stands for Strengths, Weaknesses, Opportunities, and Threats. Here are questions for you to consider when addressing these factors…

- Strengths: Where do your (or your workers’) skills lie? What resources do you have? In which aspects of the industry are you already thriving?

- Weaknesses: Which skills could you do with learning? Where are you struggling? How could you rectify identified shortcomings in your business?

- Opportunities: Which audiences are you likely to most easily please? Which emerging trends could your company capitalize on?

- Threats: Can you already see obstacles to your company’s chances of success? Which businesses could cause problems for your own?

Exactly what questions you answer in the business plan will depend on its template. HubSpot, Bplans and PandaDoc are among the organizations offering business plan templates you can download for free.

Filling in one of these templates will provide a roadmap for you to diligently follow in your mission to bootstrap your business. It’s harder to be wasteful with resources when you have a plan specifying in black and white what you must do.

Plus, according to studies, preparing a formal business plan can lead to greater corporate success. For guidance, read how to create an ecommerce business plan.

6. Start the business as a side hustle

Have a supposedly great idea for a startup?

Resist getting too excited too quickly. You simply can’t be certain whether your business will thrive or even, beyond more than a few years, survive.

For this reason, if you are already in a full-time job, it would be risky to leave it straight away. Even a small business with sound fundamentals can go through tumultuous periods that play havoc with its finances.

Yes, you might be capable of weathering these storms — but, while you do, you want the psychological comfort of financial security from another job. So, start your new business as a side hustle alongside your day job.

With this strategy, you can also reserve yourself the option to quickly relinquish your startup if it becomes more trouble than it’s worth. You will have garnered some valuable lessons about the business world without losing too much money in the process.

This leaves the question — when should you give up your day job? When the side hustle grows so large you reckon you would realistically be able to sustain a full-time wage from it well into the future.

- The best side hustles from home: How you can earn money without leaving your house

- Digital side hustles to make thousands of dollars a month

- How to know when it's time to turn your side hustle into a full-time job

7. Ask friends and family for help

Right now, you probably have a full-time job and financial savings to dip into. However, you might still lack enough money to cover your startup’s initial expenses.

Could friends and relatives therefore also throw some dollars into the funding pot?

Obviously, they are bound to have their own financial concerns to deal with. If they don’t have any money to spare for your business straight away, ask them to gift you cash on special occasions, e.g. your birthday.

In any case, people you are friendly with will naturally want you to succeed. So, they could still be inclined to help you if not financially. Here are some things they could do…

- Try out products and services before you start offering them publicly

- Test tools like booking systems that you intend your customers to use

- Promote your business by putting up adverts

One risk of using family members as a focus group is that their feedback could be overly biased in your favor. To ensure you get genuinely impartial advice, ask members of a relevant online community instead.

8. Consider using hardware you already have

As acknowledged earlier in this article, many jobs can be done from home. In fact, with many work-at-home business ideas, you need little more than a laptop, internet access, and the right software.

Hence, once you have decided what kind of business you will run, you could find that you already have all the required tech for it.

Admittedly, what exactly constitutes “the required tech” will depend on the nature of the work. For example, while a relatively basic laptop could suffice for writing, you might need some further accessories for podcasting, such as:

- Microphone

- Headphones

- Digital recorder

- Camera

Fortunately, if your business idea is borne out of a personal interest or pastime, you might not need to buy too much more (if anything).

As long as your device uses a mainstream operating system like Windows or iOS, you are unlikely to struggle to find apps suiting your needs.

Also make a point of regularly checking your operating system’s software update facility. That way, you can make sure the OS is kept up to date — including with security patches. Otherwise, your device could be easy prey for cybercriminals.

9. Get damaged hardware repaired (if possible)

To paraphrase a certain Jurassic Park character, “Just because you can, doesn’t mean you should”. This mantra would certainly apply well to the concept of using outdated technology.

If you originally bought your current laptop many years ago, it could now feel too sluggish for you to use regularly for work purposes.

Imagine how frustrating it would be to see this device keep freezing up when you are striving to meet a tough deadline. Neither would it be ideal for the laptop to have a faulty battery. What if a long-lasting power outage strikes in your area?

Of course, arranging repairs for this hardware might cost you some money. However, these fixes could more than pay for themselves if they enable you to enjoy your work more and always get it done on time.

In the first instance, try to get the device repaired by its original manufacturer. Apple can rectify damage to iPhones, iPads, and Macs.

10. Need to buy new devices? Play the long game

Some devices can be so old (and in such a bad state) that replacing them altogether would be the most cost-effective option. The older a device is, the more prone it can be to random glitches and breakdowns.

If you do need to buy new hardware, select ‘future-proof’ models. This means devices you can realistically anticipate remaining easy and reliable to use for many years to come.

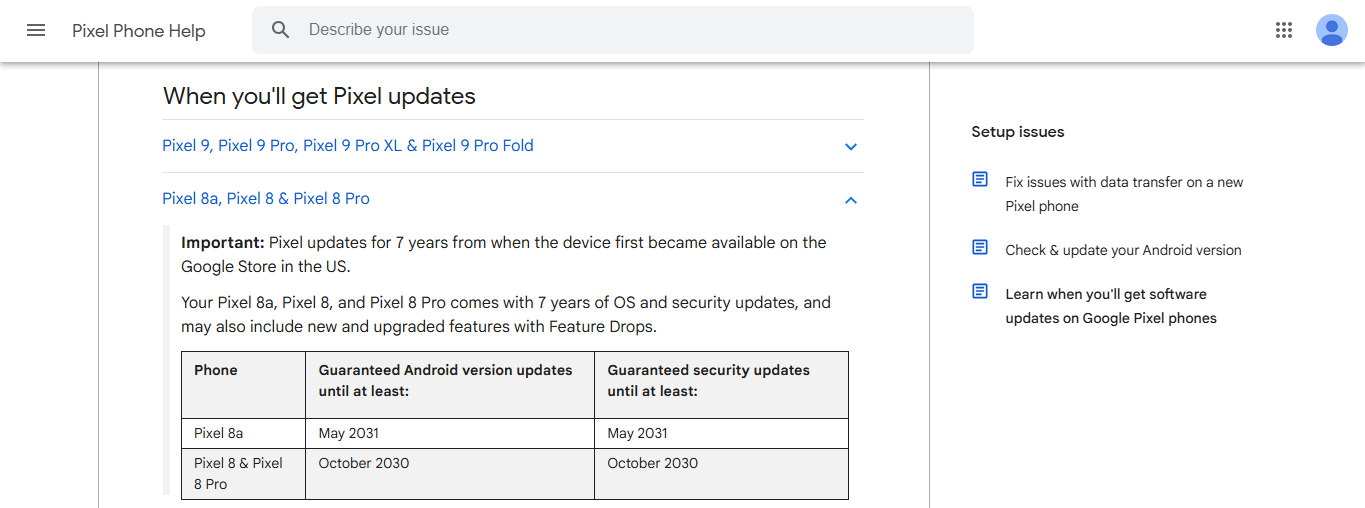

For example, if you are considering buying a Google Pixel smartphone, check the Google website to see details of the device’s software support cycle.

By looking at the screenshot below, you can see that the Pixel 8a is guaranteed to receive software updates until at least May 2031.

That’s especially impressive when you also take into account that the Pixel 8a is a ‘budget’ smartphone with a standard starting price of $499. That’s much cheaper than other Pixel handsets, including the Pixel 9, priced from $799.

It’s now clear, then, that ‘future-proof’ tech doesn’t have to be expensive even when bought new. Nonetheless, you might be willing to buy it preowned and consequently save even more money.

Either way, the more ‘future-proof’ any piece of hardware is, the longer you will be able to wait before needing to replace it. It’s just one example of improved ROI (return on investment).

11. Look for versatile hardware and supplies

Ok, this is our third point on hardware - but for good reason. If you're bootstrapping a SaaS or solopreneur business than hardware is likely your main expense.

If you don’t have all the hardware you need for this new chapter of your work life, how many purchases will you have to make? Probably fewer than you were expecting…

Many items can ‘do double duty’. To better understand this point, see the publicity materials for the recently released ‘iPad mini A17 Pro’, as Apple brands it.

This iPad is compatible with the Apple Pencil Pro accessory, which you could therefore use for making notes and digitally signing documents on the tablet.

With its 8.3-inch display, the iPad mini A17 Pro is about the same size as a notebook, making it easy to carry around with you. The device is also just the right size for reading ebooks which could inspire your future work projects.

Repurposing belongings can also be good for the environment. Have you bought some physical goods from an ecommerce store recently? Then why not use padding from the boxes to protect such products you sell online yourself?

12. Reach for a personal loan

One big plus point of bootstrapping is that it can provide you with greater clarity over your corporate finances as a whole. As a result, you can more easily avoid sliding into the red even during economically testing times like a recession.

Sometimes, though, borrowing money at first can help you make more money later. Hence the appeal of personal loans, which you would be able to secure against one of your assets — e.g. your home — rather than your company.

By taking this route, you wouldn’t have to surrender equity and, with it, a large part of your say over how the company is run. So, you — and you alone — would continue to have full control over your company’s:

- Overall mission (and mission statement)

- Strategy

- Marketing

- Research efforts

- Development of products and/or services

Your financial circumstances permitting, you could take out a mortgage on your home. In this scenario, you must be confident that you would have the financial muscle to repay the mortgage when required.

Hopefully, by then, your company will be making enough money to help you meet this expense. If it isn’t, your personal finances might have to bear the brunt.

13. Get a business credit card

What is a business credit card? You probably already have a credit card you use to fund personal purchases. Maybe you buy groceries, vacations, and clothing on credit you later pay off?

In theory, this card could cover business expenses, too. In practice, however, it can work out better for you to obtain a credit card specially designed for this purpose.

What differentiates business credit cards from personal credit cards? Well, business credit cards...

- Tend to have higher credit limits

- Can help you more easily spot ways to reduce your tax liability

- Enable you to build a positive business credit score

These are not small advantages. Corporate expenses can be much heftier than day-to-day household costs, as businesses often need to buy supplies in bulk. So, those more generous credit limits can certainly come in handy.

Always study the terms and conditions attached to a business credit card before you decide which one to go with. One reputable issuer of small business credit cards is the Bank of America, which advertises various options on its website.

Regularly paying back credit on the card can improve your business credit score. This, in turn, can help you to get cheaper deals on insurance and loans.

Your card issuer might also be happy to provide you with rewards further reducing your commercial expenditure.

Just look at Chase’s Ink Business Cash Credit Card…

This card entitles you to 5% cash back on money you spend on internet, cable, and phone services. (For specifics, check the relevant Ts and Cs.)

14. Crowdfund new initiatives

When you are developing a new product, there could inevitably be a spike in your corporate spending. Unfortunately, if you have long been bootstrapping a business, it might not be designed to accommodate even slightly increased expenditure.

How can you meet the added short-term cost?

One idea is crowdfunding. This process involves publicizing an in-development project, like a future product or service, and inviting many people to contribute a little to its funding.

What would be in it for them? That’s a very good question. When you use an online crowdfunding platform, you could offer would-be donors a choice of rewards in exchange for their money. These incentives could include…

- An online shout-out, e.g. on your company’s website or whop

- A discount on the purchase price of the finished product or service

- A small share of any profits the project makes

- Being one of the first people to receive the finished product or service

Kickstarter is one of the best-known crowdfunding websites, but only permits ‘fixed funding’ campaigns. This means that if you fall short of your funding goal on the platform, you won’t receive even a cent of the money pledged.

On the other hand, with rival crowdfunding platform Indiegogo, you can opt for a ‘flexible funding’ campaign. That way, you will be entitled to all the money raised, regardless of whether you reach the funding goal.

Keep in mind that Indiegogo charges fees for flexible campaigns. You might also be tempted to sell your crowdfunded product through Indiegogo. However, for your specific needs, Whop could prove a better option than IndieShop.

15. Find inexpensive ways of marketing

Another plus point of crowdfunding is how it can accrue positive publicity for your business. Once you have set up a crowdfunding page, you can mention it elsewhere, such as on your website and social media pages.

Many people might click through to the crowdfunding page simply out of curiosity. When a visitor ultimately decides against pledging money, it could still be after reading a lot of on-page details about the project.

So, this project could long linger in their mind afterwards. They might even buy the product or service when it eventually comes out. After all, they might have held off donating beforehand simply due to financial worries they faced at the time.

There are other inexpensive marketing methods worth exploring, too. Social media is free to use but can feel too busy — you could have to go the extra mile to really stand out on it. Fortunately, social media management apps can aid you in that endeavor.

There are many such apps to choose from, including Crowdfire. This multifunctional tool can schedule and publish content on Facebook, Instagram, X, and LinkedIn.

On your brand’s behalf, the free version of Crowdfire can publish up to ten posts per social media platform per month. That could be more than enough for a new company's marketing needs.

16. Reinvest revenue back into the business

It’s easy to get excited when you first start making sales with your new business and revenue begins to come in. You might even be tempted to immediately spend this money on a special treat to congratulate yourself on your entrepreneurial breakthrough.

Now, it might be better to resist this temptation and instead pour that money back into the company itself. Doing so could further spur your company’s growth and so get you making money at a quicker rate.

It would also help you to keep debt at bay but don’t get too optimistic if you suddenly start earning more than you had expected. Businesses can have both ‘good’ and ‘bad’ months, so you want to create a buffer against financial shocks.

It’s therefore not hard to see why you could struggle to budget for the long term. To counter this effect, why not wait a few months to see how your sales revenue figures shape up over that period?

Those figures might remain relatively static or noticeably fluctuate from month to month (or season to season). Either way, you can get a better idea of how much money you will be able to afford to regularly put back into the business.

17. Get products into customers’ hands ASAP

Obviously, when it comes to selling physical products online, ‘ASAP’ can still mean at least a few hours.

It's always in your best interests for your customers to get their hands on their products as quickly as possible. Here are several reasons why…

- Customer service

Customers who complain that their purchases from you take too long to arrive could decide to buy from your competitors next time. - Reputation

If you ship items more quickly than customers had expected, there could be a positive knock-on effect in reviews of your business. - Word of mouth

Whether their experiences with your company are good or bad, customers could soon let friends, family, and internet users know.

Also, the more quickly you fulfil customers’ orders, the higher the number of them you can fulfil in a given period. So, you can also maximize your financial returns — no small boon when you are going down the bootstrapping route.

18. Recruit remote workers

As your business grows in reputation and attracts more and more customers, you could start needing a few extra hands. However, if you are working from home, why not hire remote workers, too?

When you need to fill a vacancy, don’t be afraid to advertise it as a remote position. Advertising it to a national pool of jobseekers could make it easier for you to hire workers with the right talent, skills, and other credentials.

You could even invite overseas candidates to apply if you think the time zone differences wouldn’t be an issue in the job itself. Plus hiring overseas workers can save massive amounts of money in the form of reduced salaries.

Assembling an entirely remote workforce would save you from having to hire an office for your burgeoning team. The bigger the in-person team you have, the larger — and thus possibly more expensive — the office you would need.

If you have set up a whop, add the Whop Job Board app to it. With this app, you can post job openings directly on your whop, allowing members of it to apply in a smooth, seamless manner.

19. Network with other entrepreneurs

Don’t underestimate the sheer number of places where you can do this. Look up your business meetup groups on Facebook and other social media sites, where networking events may often take place.

On a similar note, watch out for corporate conferences set to be held in your town or city.

Admittedly, spending money traveling to in-person events may not be convenient when you are trying to bootstrap. One appealing alternative is to participate in online chats, like within ecommerce communities active on Whop.

Associating with fellow entrepreneurs — online or offline — is a great strategy for several reasons. For a start, they can provide you with little-known tips and tricks and keep you updated about developments in your industry.

Also, you might get to know some professionals who would be happy to rush to your rescue in occasional, one-off crises.

For example, it might not be cost-effective for you to employ an attorney full-time if you only sometimes need legal advice. It could work out better if you simply strike up a friendship with an attorney you later turn to only when you need them.

20. Carry out market research (yes, again… and again)

Market research isn’t something you should conduct just once. You need to treat it as more of an ongoing thing — especially as consumers’ tastes (and practical needs) can change over time.

One platform that could show you where the wind is blowing is User Interviews. Many B2B companies use this platform to arrange interviews (of course) and focus groups.

With User Interviews, you can even organize multi-day studies. This is where participants interact multiple times with a new product or service as it is being developed. So, you can keep tweaking it in response to feedback.

When you glean insights into what your target customers want to buy and when you can plan accordingly. Want to sell inflatable swimming pools? They are likely to be much more in demand in the summer than during the colder months.

With this information at hand, you can hike (or lower) your orders for particular products as peak (or quieter) sales periods arrive. This means you can spend more efficiently by buying only the precise levels of stock you really need.

Supercharge your bootstrapping journey with Whop

Ready to take control of your business finances? Boost your chances of success by exploring Whop. Here, you can learn all there is about how to start, run, and grow a profitable company from the ground up.

From digital products, courses, and essential tools, the Business category offers everything you need to grow - bootstrapping style.

Already one step ahead and have digital products to sell? Whop can help you there, too. Launch your own online store and start monetizing straight away.

Whether you're selling software, community access, online coaching, mentoring, webinars, ebooks, courses, or anything else digital, you can do it with Whop.

The best part is that it's easy, free, and fast to join.

Get bootstrapping with Whop today!