Running an ecommerce business? You’re not just looking to attract customers – you want to turn those visitors into loyal buyers, right?

Of course, delivering top-notch service and high-quality products is key. But what if you could make it even easier for customers to hit that ‘buy’ button? That’s what happens when you provide a Buy Now, Pay Later (BNPL) option – a game-changer for your business.

With BNPL, your customers can get their hands on their favorite items straight away, while spreading out their payments over time.

It’s a win-win: your products become instantly more appealing and eliminate the cost barriers that might otherwise hold shoppers back.

To put it simply, more accessibility means more sales, and more sales means skyrocketing revenue.

So, if you haven’t integrated BNPL into your ecommerce site yet, what’s stopping you? We’ve done the hard work and rounded up the best BNPL providers, so you can effortlessly add this powerful tool to your online store.

Why Should You Offer Customers a BNPL Option?

BNPL gives customers an alternative payment method.

It is a more accessible form of credit than bank-issued credit cards, with BNPL providers often only running a soft credit check to check a customer’s eligibility.

BNPL providers are usually what’s called fintech (financial technology) firms rather than traditional banks.

When a customer chooses a BNPL option at check-out, they enter into a loan agreement with the provider. The provider pays you, the merchant or retailer, in full and takes on the customer’s debt. The customer receives their product right away then pays off the balance by making a fixed number of payments to the BNPL provider. Sometimes, they are required to make a down payment on the item.

So, how does this benefit you as an online seller?

Well, by letting customers spread their payments, you open up your products to a wider audience, and increase impulse buying.

Someone put off by a $50 item might be persuaded to pay $10 today and then spread the rest over the next three months.

Is there any proof of this? Well, research by The Motley Fool found that in 2023, 14% of U.S. shoppers used BNPL, a 2% increase on the previous year.

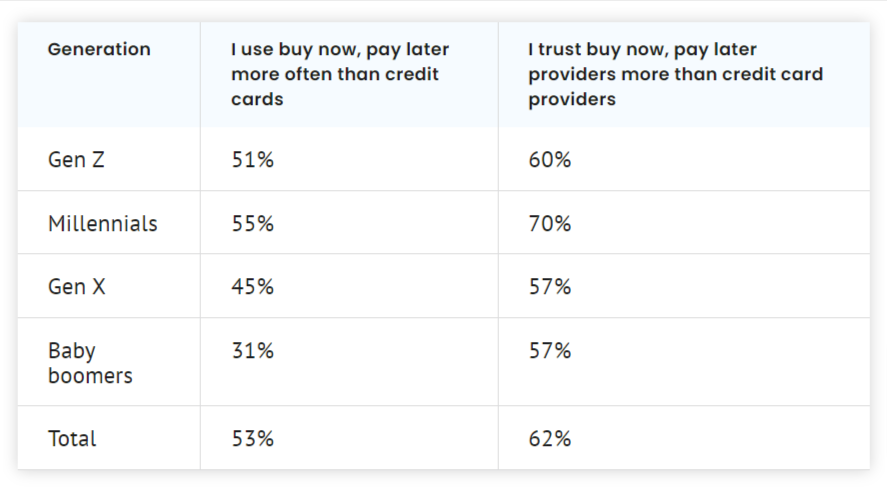

An even more eye-catching stat the survey uncovered is that 53% of Americans use BNPL more often than they use their credit card:

Survey participants’ reasons for using BNPL included:

- Desire to spread payments

- Convenience

- Making purchases more affordable

- Wanting a fixed number of payments

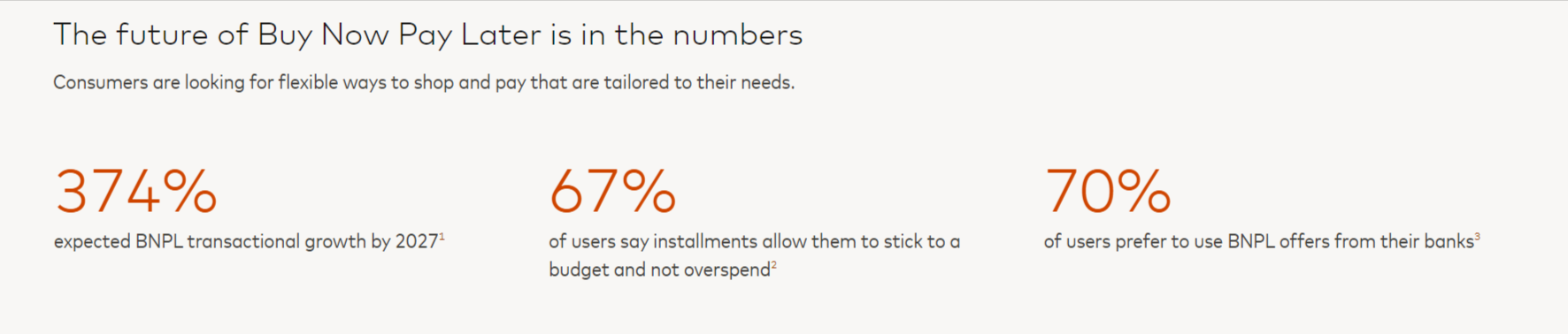

This is further supported by figures cited by Mastercard:

All of this tells us that BNPL is not only popular but is fast becoming a mainstream way of paying for purchases, and the trend is towards improving the customer experience by offering flexible options to pay.

Retailers who offer BNPL options may also enjoy increased customer retention, repeat purchasers, and higher order values.

So, let’s break down the leading BNPL providers for your ecommerce business, so you can take advantage of this significant shift in the online and physical retail space.

The Best BNPL Providers

Now you know the advantages for you and your customers of offering BNPL as a payment option, here is a look at some top providers to consider:

1. Klarna

Mention BNPL and people’s first thought is often Klarna.

Boasting stats like two million daily transactions and 147+ million global shoppers, it’s not hard to see why Klarna has become a big deal in the world of payments.

Klarna has partnered with lots of big-name retailers and platforms, so it offers shoppers peace of mind and a high level of recognition.

In turn, this is good for businesses that provide a BNPL option through Klarna.

It offers a good level of integration with ecommerce sites, while its reputation means a level of trust, which benefits you as a retailer.

Overall, a look at third-party reviews shows Klarna gets the thumbs-up from users. However, a few issues include complaints about customer support and problems with ID verification.

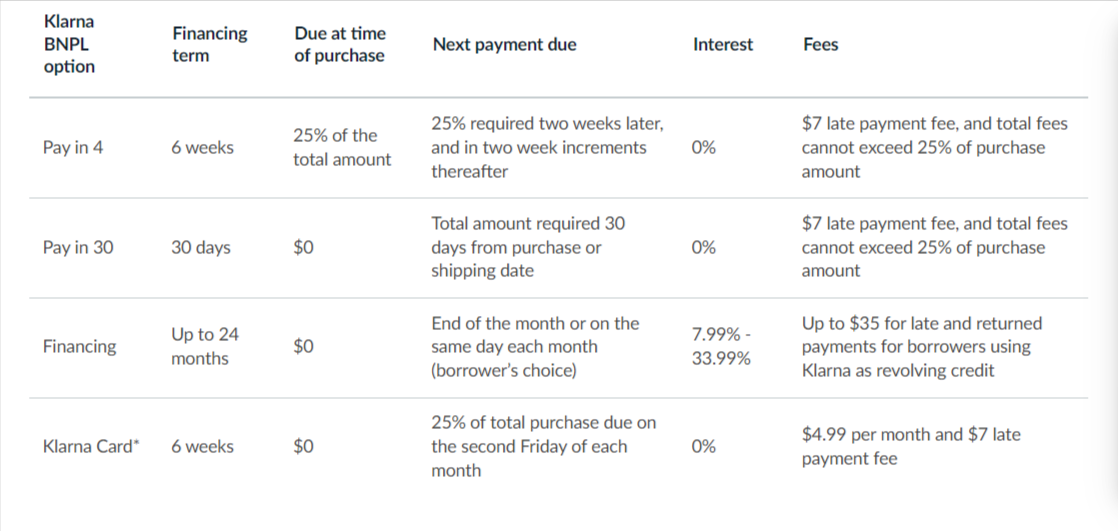

Payment options with Klarna

For U.S. shoppers, Klarna offers a “Pay Now” option, as well as three credit-based options:

1. Pay in 4: With this option, the full amount owed is spread over four interest-free installments, with payments taken every two weeks.

2. Pay in 30 days: This option allows shoppers to buy something but postpone payment for up to 30 days, when the full amount is taken, with no interest.

3. Pay over time: Customers have the option to spread purchases of $150+ over up to 24 months, making smaller monthly payments over a longer period.

Other options are available for consumers based overseas, such as a “Pay in 3” plan, which spreads payments into three installments made every 30 days.

Klarna has also recently introduced a credit card, in partnership with Visa.

Klarna costs and fees

For customers, Klarna’s fees are…

While BNPL options come with 0% interest and fees, it’s worth noting the relatively high late payment fees Klarna charges shoppers who sign up for one of its BNPL options. Those $7 late fees could stack up for customers. Likewise, the financing option has some steep interest rates.

For businesses, Klarna charges a $0.30 transaction fee and variable fees of between 3.29% and 5.99% of the total transaction.

If you’re starting an ecommerce business, it’s important to factor in these costs when deciding on pricing, so they don’t affect your bottom line.

Advantages and disadvantages of Klarna

| Advantages | Disadvantages |

|---|---|

| ✅ High name recognition & trust | ❌ Late fees can be steep |

| ✅ Flexible instalment plans | ❌ Reports of ID issues |

| ✅ 0% interest for shoppers | ❌ Reports of poor customer support |

| ✅ Soft credit checks | |

| ✅ Good ecommerce integration |

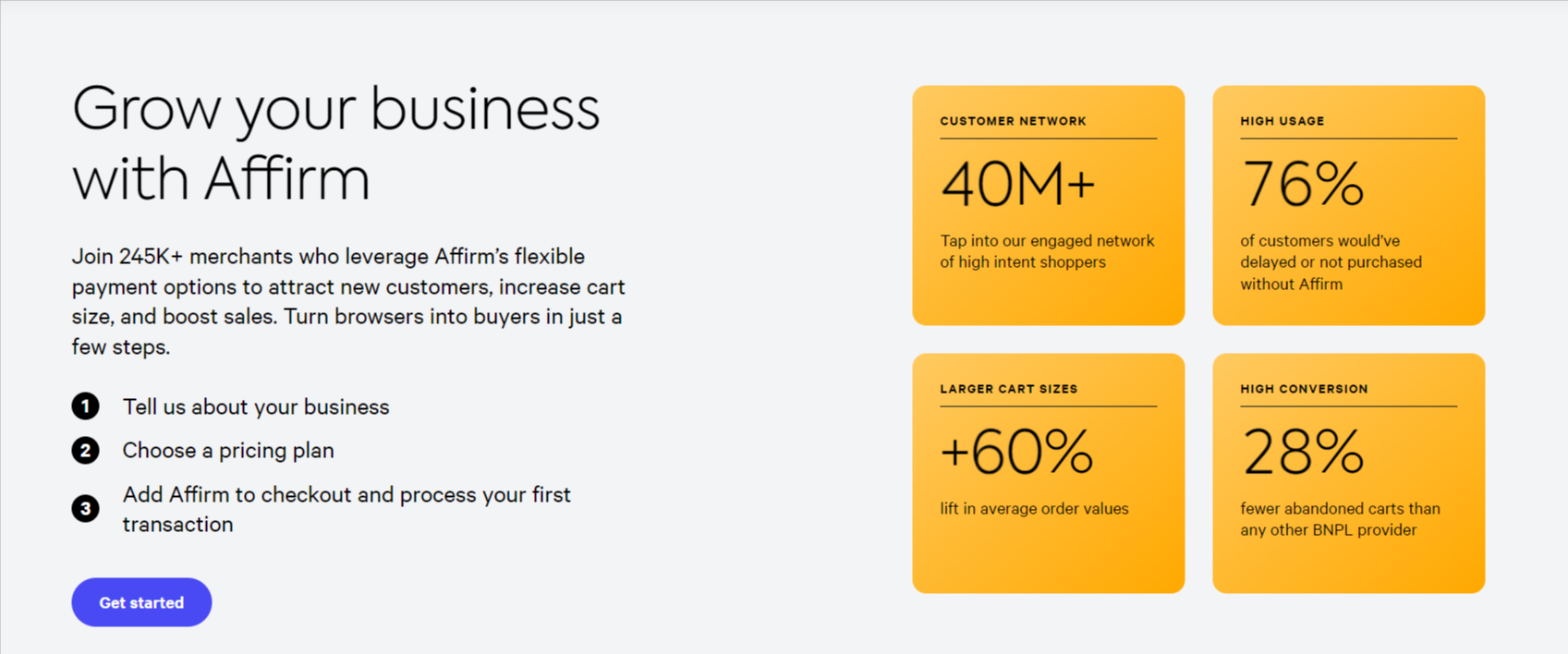

2. Affirm

Hot on Klarna’s heels, Affirm provides a similar BNPL offering.

To date, it has partnered with around half the number of retailers as Klarna. However, it is still a big name in the payments and BNPL space.

This may not be surprising given it was established by PayPal co-founder Max Levchin. Affirm has been around since 2012, so has rooted itself as a trusted payment partner.

Affirm sells itself on its transparency and the fact that, unlike Klarna, it does not charge late fees – a popular selling feature for customers.

However, action is taken if due payments aren’t made for 120 days.

Like Klarna, Affirm has issued a payment card. It is a debit card rather than a credit card, which can be used in physical stores as well as online. Users link the card to their bank account or an Affirm Money Account.

It also has a reported 90% approval rate for applicants who want to take out a loan.

Reviews of Affirm are generally positive from both consumers and businesses.

However, some reviews flag that there is currently just one interest-free option on the BNPL plan. There have also been isolated issues with things like customer support and ID verification.

Payment options with Affirm

Currently, U.S. customers can apply for one of two BNPL plans with Affirm. These are:

1. Pay in 4: Customers can choose to spread the cost of a purchase over four equal installments made every two weeks.

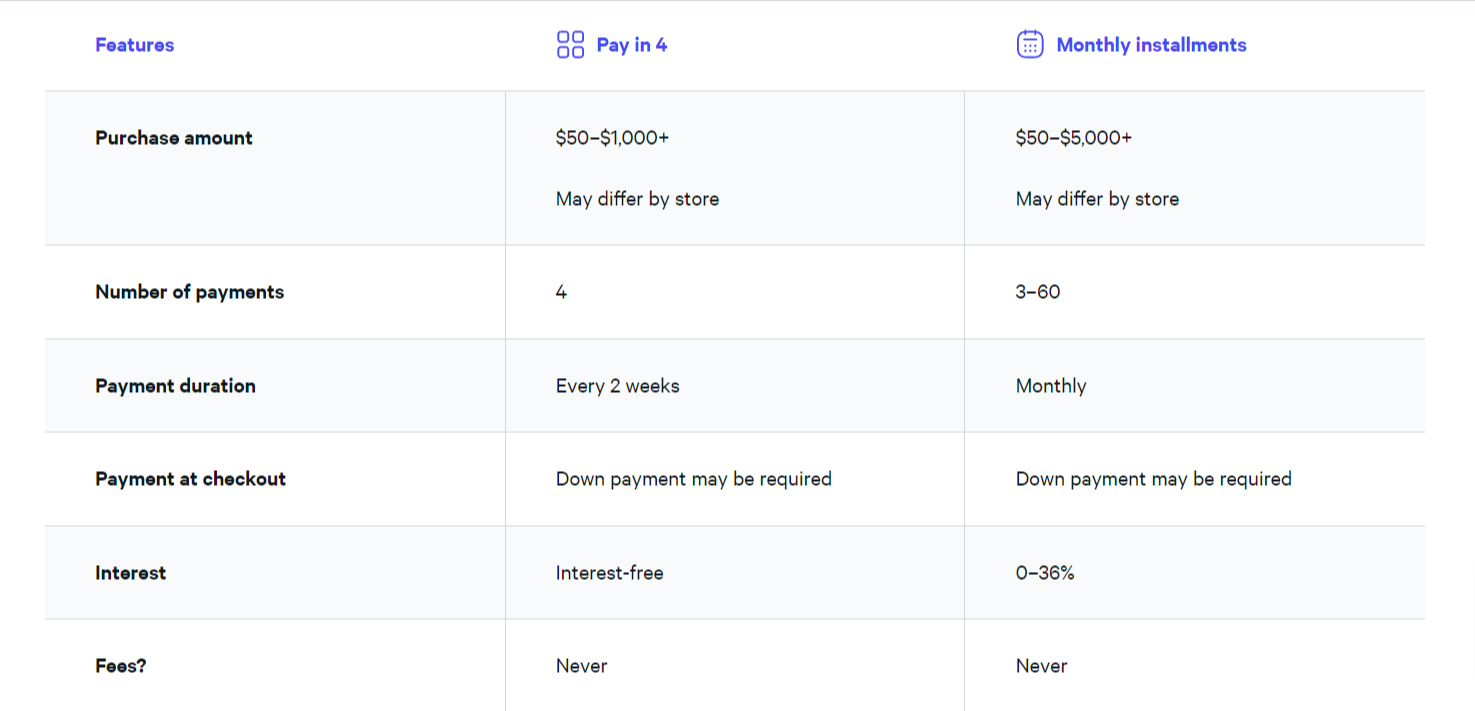

2. Monthly installments: Customers can spread the cost of their purchase over periods of between three and 60 months.

For both these options, a down payment may be required.

It’s also important to highlight that the minimum purchase to apply for an Affirm BNPL plan is $50, with a maximum of $30k (Affirm would finance up to $20k of this, with a $10k down payment).

As of July 2024, Affirm is in the process of rolling out two further payment options:

- Pay in 2: Customers can pay in two equal installments

- Pay in 30: Customers can defer payment for up to 30 days

These will offer increased flexibility, which – again – is a great selling point for e-tailers who want to give their customers every reason to make a purchase.

Affirm costs and fees

For customers, the “Pay in 4” BNPL plan is zero interest. For the monthly installment option, the interest ranges from 0% to 36%. The interest rate applied will factor in the customer’s credit rating.

For businesses, the fees charged vary but are around 6% plus a $0.30 transaction fee per purchase.

Advantages and disadvantages of Affirm

| Advantages | Disadvantages |

|---|---|

| ✅ Flexible payment options | ❌ Unavailable for purchases under $50 |

| ✅ No late fees for customers | ❌ Interest rates of up to 36% |

| ✅ Lots of retail partners | ❌ Fewer retailers than Klarna |

| ✅ Good integration with ecommerce platforms |

3. Afterpay

Another heavy hitter in the BNPL world is Afterpay.

In fact, it claims U.S. consumers search for Afterpay online 53% more than they do for Klarna, making it the country’s most searched-for BNPL platform.

For shoppers, it is very much an app-based offering, with customers encouraged to use their mobile devices to make payments and manage their Afterpay account.

Afterpay promotes itself to retailers as a way of attracting millennial and Gen Z customers. It offers a slick operation, though the BNPL plans are limited.

In line with its two big rivals, an Afterpay Card is available for use in stores. Customers can also upgrade to an Afterpay Card Plus for $9.99 a month.

This is a digital card that offers the ability to pay at more retailers with the “Pay in 4” option. It can be used in places where Apple Pay, Google Pay and Samsung Pay are accepted.

Again, reviews of Afterpay are good, with retailers impressed at the ease of integration with ecommerce platforms and smooth payments.

Negative reviews tend to be mostly isolated complaints from customers who have had issues with their accounts, such as lowered spending limits.

Good to know: If you operate in Europe, customers will know this provider as Clearpay.

Payment options with Afterpay

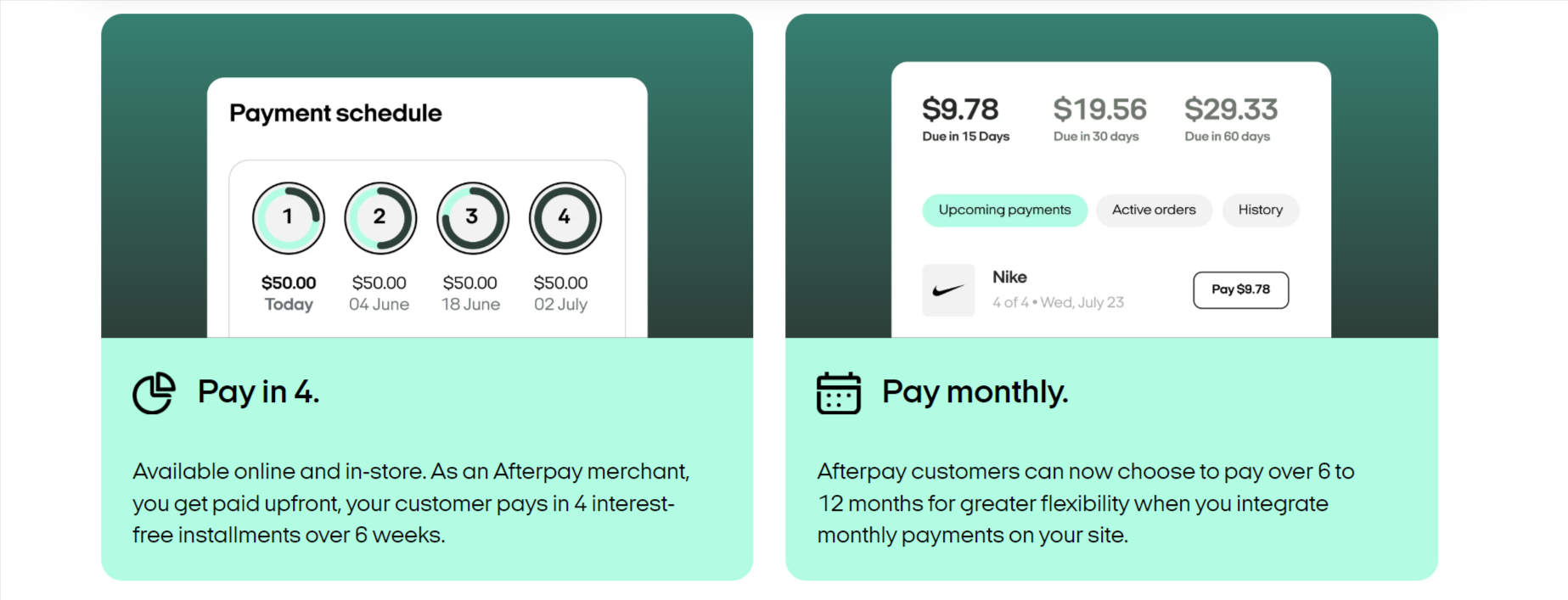

Afterpay offers two payment plans:

1. Pay in 4: Customers can spread their payments across four equal installments over six weeks.

2. Pay Monthly: For customers who want more time to pay, a six or 12-month payment plan is available.

A “no down payment” option is enabled for selected customers, such as those with a positive payment history.

Afterpay costs and fees

For customers, the “Pay in 4” BNPL option is interest free. For the Pay Monthly option, the interest (APR) ranges from 6.99% to 35.99%.

It’s worth noting Afterpay’s late fees:

Orders of $40 or less: Maximum late fees are 25% of the total. So, if a customer has a $20 order value with $5 a month payments, the late fee will be $5.

Orders of $40 or more: An initial fee of $10 is charged on a late payment, with a further charge of up to $7 if the late payment is not made within seven days of its due date. The maximum late fees are 25% of the order total or $68.

Customers who are struggling to pay can reschedule their next payment up to three times a year in the Afterpay app.

For retailers, Afterpay charges a $0.30 fee plus 4% to 6% per sale, which is about in line with Klarna and Affirm.

Advantages and disadvantages of Afterpay

| Advantages | Disadvantages |

|---|---|

| ✅ Ease of integration | ❌ High interest rates |

| ✅ User friendly | ❌ Steep late fees |

| ✅ 0% interest on Pay in 4 | ❌ Limited BNPL options |

| ✅ Positive retailer reviews |

4. FuturePay

Managed by WorldPay, this is a slightly different offering than BNPL.

FuturePay bills itself as a provider of “digital revolving credit” under the tagline, “Put it on MyTab”.

Customers can still buy an item today and spread the payments. However, unlike the providers we’ve already listed, FuturePay doesn’t offer a fixed installment plan, just monthly payments via its MyTab product.

This is a more flexible option but without the budget control offered by set installments.

In addition, the FuturePay Virtual Store Card offers a $1k to $5k line of credit to use in stores.

For retailers, FuturePay offers the chance to provide an alternative payment option that makes purchases more affordable.

It integrates with the likes of Shopify, Big Commerce and Magneto.

FuturePay enjoys positive reviews, with retailers noting the increased loyalty and higher levels of repeat customers.

Payment options with FuturePay

Just one – a line of credit. So, customers can make purchases and pay them off monthly like a credit card. FuturePay’s minimum payments are $20 a month.

FuturePay costs and fees

For customers, FuturePay charges a fixed $1.25 per $50 carried over. So, if a customer has an outstanding balance of $100 at the end of the month, a $2.50 charge will be added to their account. There is no fee on carried over balances of less than $50.

In addition, there is an annual $25 membership fee. Late fees and returned (or rejected) payments are charged at up to $38.

For retailers, a 3% merchant fee is charged on the total order value. There are no other fees for offering FuturePay as a payment option.

Advantages and disadvantages of FuturePay

| Advantages | Disadvantages |

|---|---|

| ✅ Good ecommerce integration | ❌ No fixed instalment BNPL plan |

| ✅ Free for merchants to add | ❌ Lower uptake than some rivals |

| ✅ Positive retailer reviews | ❌ High fees for shoppers |

| ✅ Simple fee structure |

5. PayPal

One of the most familiar names in the digital payments sector, PayPal has moved beyond just being an intermediary to jostle its way into the BNPL space.

Its Pay Later options are a way for customers to spread purchases made through the PayPal platform.

The offering works in a similar way to the BNPL providers, except the options are limited to selected goods (determined by PayPal and the merchant). There are also limits on the value of purchases eligible for installment plans.

As with other BNPL providers, merchants get paid upfront. PayPal also offers a credit line for eligible customers, with a credit check carried out.

PayPal reviews are mixed, with some irked customers complaining about individual purchases rather than the credit facilities.

Those who talk about the financing options mention things like the low credit limit and poor customer service.

Payment options with PayPal

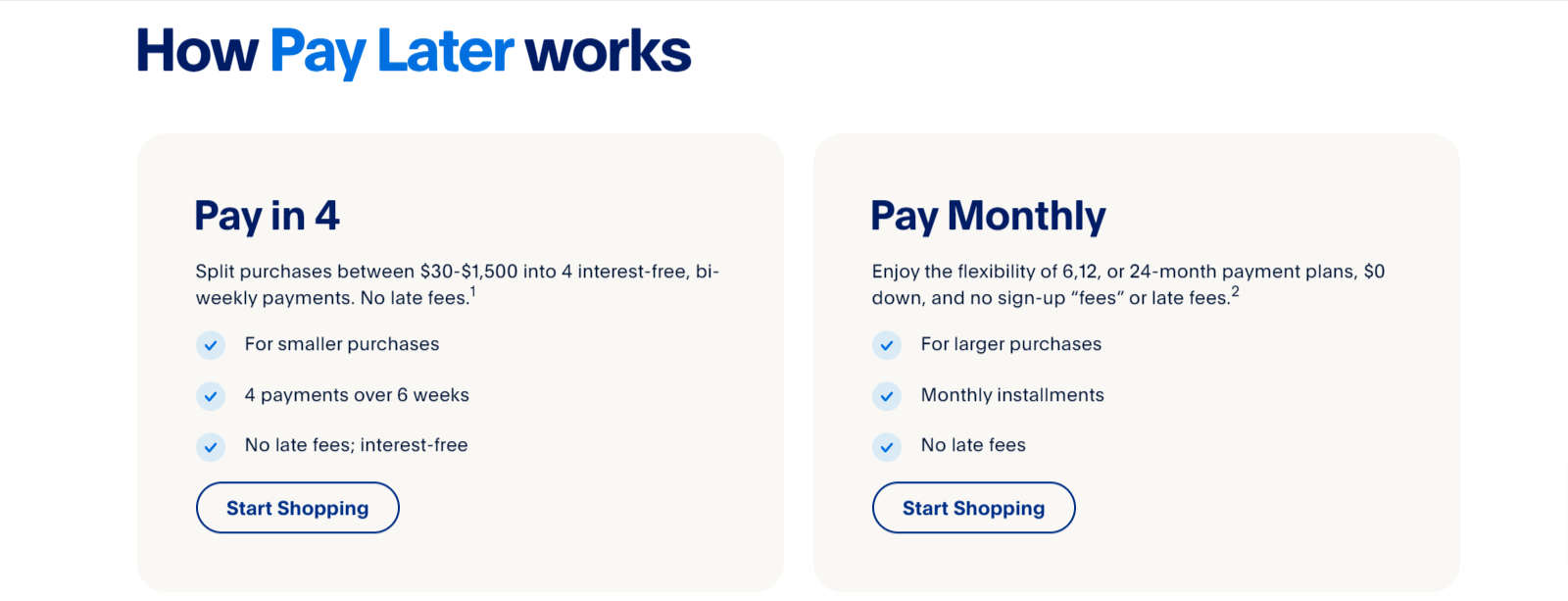

PayPal offers U.S. customers three credit-based payment options:

Pay in 4: This relatively new offering allows shoppers to pay for selected goods valued between $30 and $1.5k in three equal installments.

Pay Monthly: This option offers the chance to spread the cost of selected purchases of $199 to $10k over six, 12, or 24 months.

The “Pay in 4” and “Pay Monthly” options are enabled for eligible transactions at the point of purchase on the PayPal platform. In other countries, a “Pay in 3” option is available.

PayPal Credit: Another way for eligible customers to finance purchases of $99 or more is PayPal’s credit line.

PayPal costs and fees

For customers, the “Pay in 4” option is zero interest. The “Pay Monthly” interest rate is between 9.99% and 35.99%. No late fees apply to installment plans

PayPal Credit has zero interest if the balance is paid in full in six months, and charges no annual fee. Unpaid balances incur an interest rate of 29.24%, with a late fee of up to $41.

For retailers, PayPal charges a fixed fee per transaction of $0.05 to $0.49 plus a percentage from 1.90% to 3.49%.

Note that the merchant fees apply to offering PayPal as a general payment option. This means they are payable even if you choose not to offer the option to customers of paying by installment.

Advantages and disadvantages of PayPal

| Advantages | Disadvantages |

|---|---|

| ✅ Name recognition | ❌ Not available on all purchases |

| ✅ Wide availability | ❌ High fees and interest rates |

| ✅ Flexible payment options | ❌ Transaction limits |

6. Sezzle

Founded in 2016, Sezzle works with 39k active merchants and 13 million consumers.

Sezzle’s partners include Shopify, WooCommerce and Big Commerce. It claims shoppers spend on average 22% more per order when Sezzle is offered as a payment option.

Launched with its “Pay in 4” offer, Sezzle has since expanded to include other payment options.

In addition to its BNPL plans, Sezzle offers a Virtual Card and Sezzle Premium, which rewards shoppers with discounts and other benefits.

Reviews of Sezzle are largely good, with negative issues mostly to do with the higher merchant fees and inadequate customer support.

Payment options with Sezzle

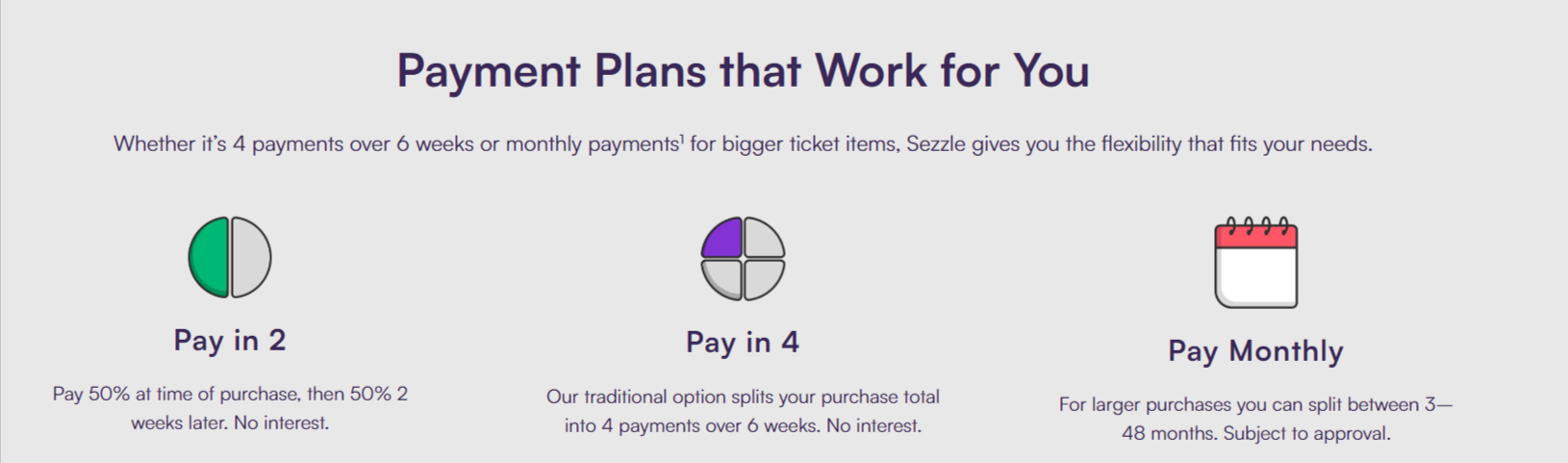

Sezzle offers three BNPL options:

1. Pay in 2: With this plan, consumers pay 50% of the order value at the time of purchase and the remaining 50% two weeks later.

2. Pay in 4: This option is similar to its rivals, with payments split into four installments over six weeks. A down payment of 25% of the purchase price is required.

3. Pay Monthly: This option spreads payments over three to 48 months. It is available to eligible applicants.

Sezzle costs and fees

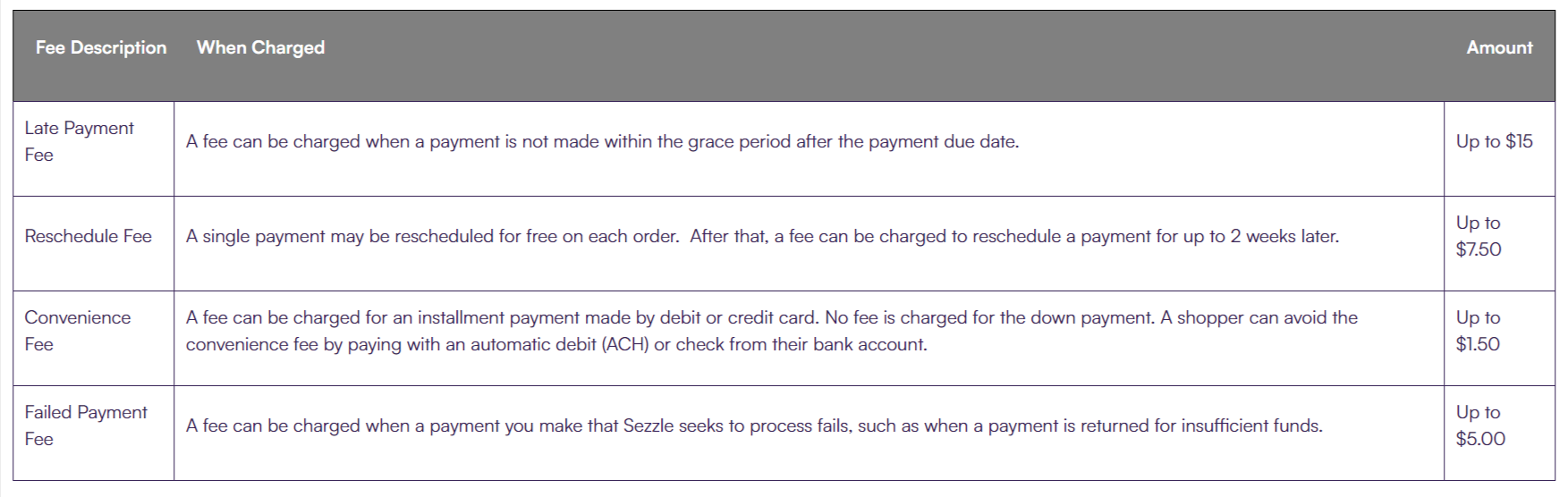

For customers, there is no interest charged on the “Pay in 2” and “Pay in 4” options. The monthly payment plan has interest of 5.99% to 34.99%. This is based on factors including credit history, as well as loan amount and term.

A late payment fee of up to $15 applies. However, Sezzle offers the option for users to reschedule a payment for free one time.

A summary of Sezzle’s user fees can be found here:

For retailers, Sezzle is a bit fuzzy about its fees, but merchants report a $0.30 processing fee plus 6% of the order value. There are no set-up costs.

However, a $15 monthly fee is applied to merchants who clock up less than $300 of order processing volume over a 30-day period.

Advantages and disadvantages of Sezzle

| Advantages | Disadvantages |

|---|---|

| ✅ Flexible payment options | ❌ High fees |

| ✅ 0% BNPL offer for consumers | ❌ Reports of poor customer support |

| ✅ Easy to use |

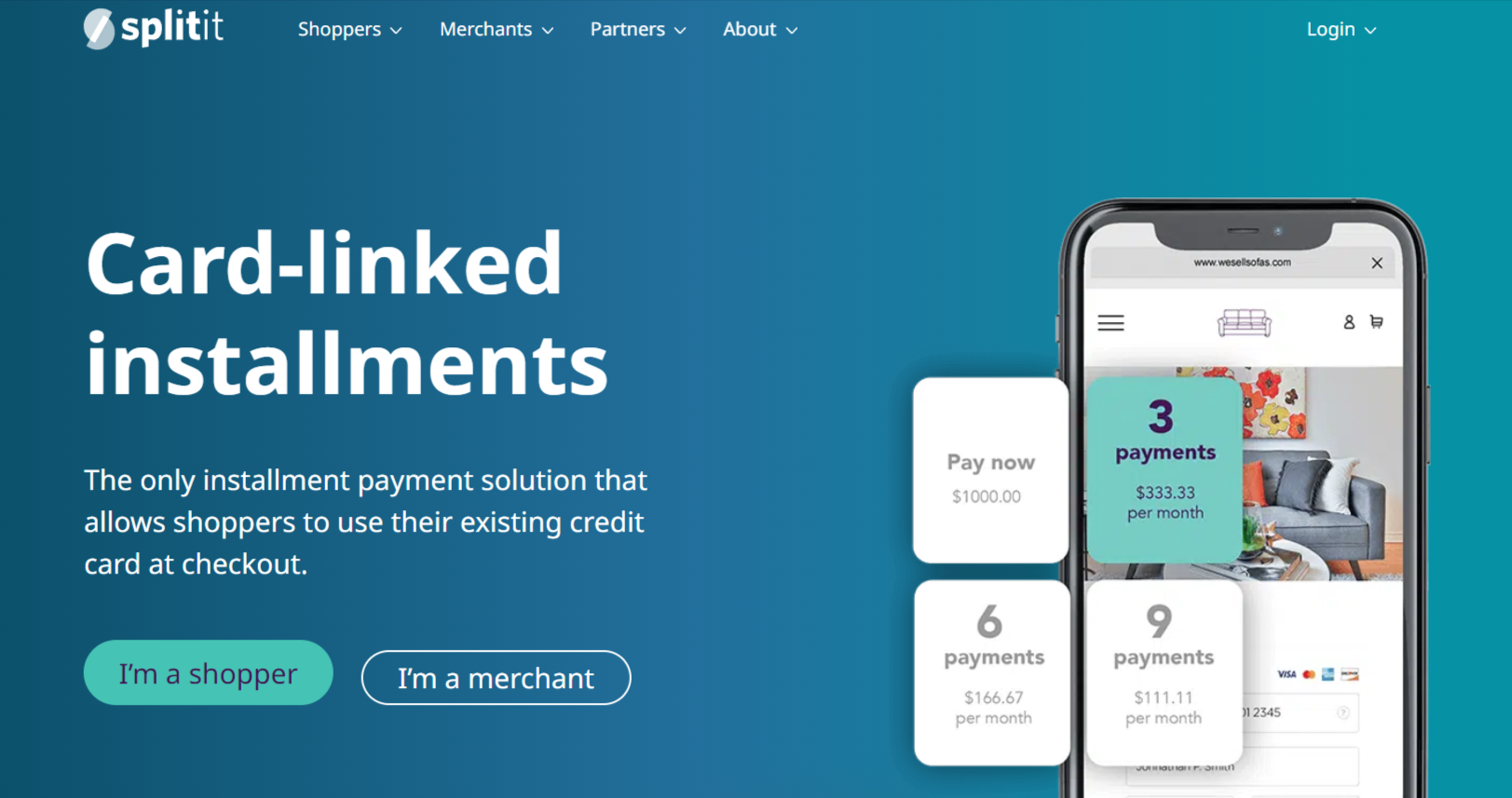

7. Splitit

We round out our list with a slightly different offering from Splitit.

Bear with us on this one…

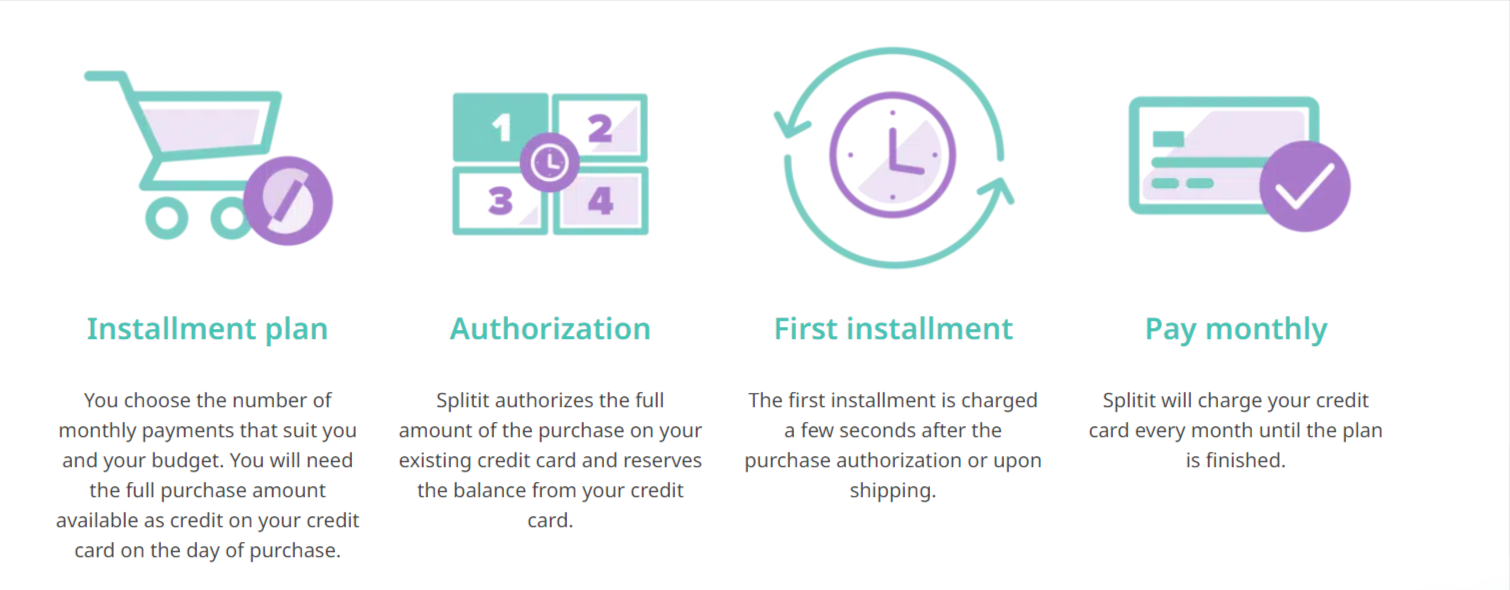

Instead of offering a separate line of credit or loan, Splitit works in tandem with a shopper’s existing credit card.

It does this by “pre-authorizing” the card for the full amount of the purchase, then takes automatic installments until the balance is paid off.

This authorization takes the form of a hold. So, if the customer has – for example – $2k available credit on their card and buys something for $1k, they will be charged the initial installment. However, Splitit will place a hold on their card for the full $1k.

Phew…

Why wouldn’t someone just use their credit card and pay it off, you ask?

Well, the difference is that the payments are spread, with just the first payment taken at the point of purchase.

So, Splitit helps cardholders to avoid interest charges and to budget for larger items.

Splitit has partnered with the likes of Shopify, WooCommerce and Magento. It also boasts the highest conversion rate in the BNPL industry, at an average of over 85%.

Because of how it works, no credit checks are carried out (as users have already been approved for their credit card).

Retailers report positive experiences with Splitit, with an average customer order value of over $1k.

Payment options with Splitit

With Splitit, customers use their existing credit card, with installments paid over up to 36 months. It offers three types of payments:

- purchase-based installment payments

- subscription-based installment plans

- interest-free loan options

These are essentially just different ways of splitting the cost of a purchase over multiple payments.

Splitit works with Visa, Mastercard, American Express, Discover and UnionPay, depending on the merchant.

Retailers using Splitit can choose the “Pay after delivery” option, allowing trusted customers to receive their item prior to any payment being made.

Splitit costs and fees

For customers, Splitit charges no interest on payments made on time. There are also no late fees. Missed and rejected payments are charged according to the credit card provider’s terms.

Customers must have the full balance of the purchase available on their credit card when using Splitit as a payment option.

For retailers, Splitit charges a variable flat fee, plus 1.5% to 6.5% per transaction. The total costs will depend on whether the merchant wants the entire payment upfront or is happy with installment payments.

Advantages and disadvantages of Splitit

| Advantages | Disadvantages |

|---|---|

| ✅ No Splitit fees or interest | ❌ Needs a valid credit card |

| ✅ No separate credit line issued | ❌ Credit must cover the total purchase |

| ✅ Easy to use | |

| ✅ Good integration |

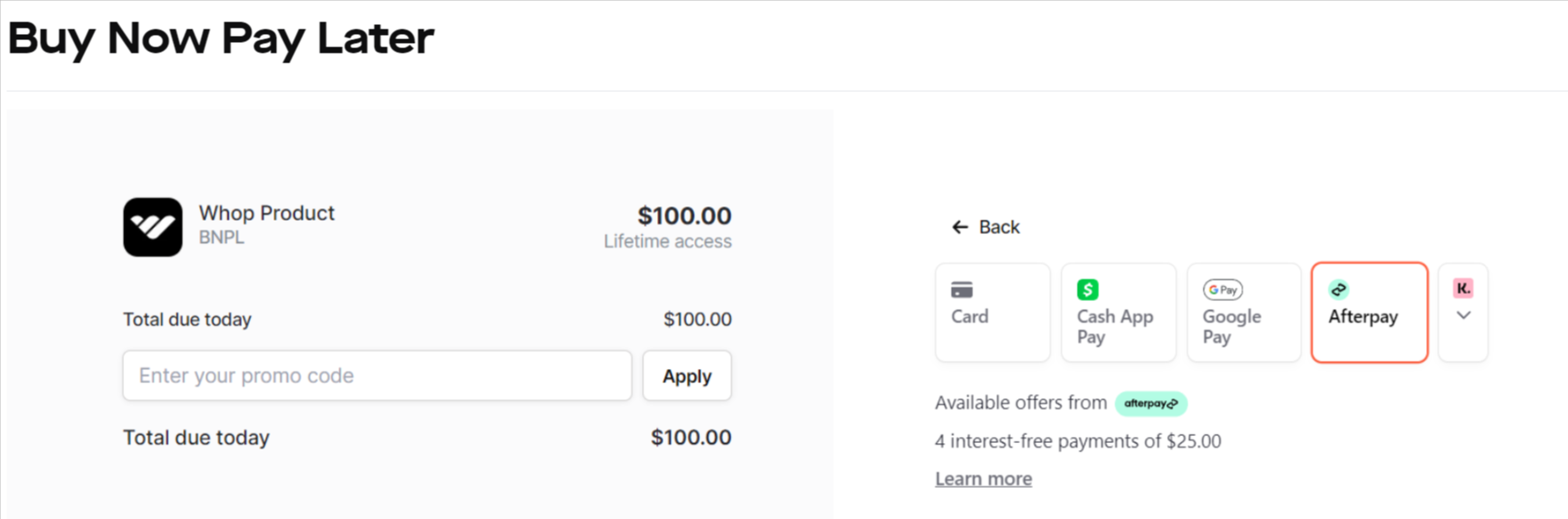

Sell Anything (and Offer Flexible Payments) with Whop

Whop is your number one destination for building your ecommerce business.

Not only can you sell anything online but you can offer all kinds of ways for customers to pay, including BNPL…

This means higher customer engagement, more sales and increased profits.

What’s not to like?

Even better, we only charge you 3% on sales. No monthly fee! With the ability to sell all kinds of digital products and services and create your own online hub - with no platform membership fees - you can create your business for free today. And with BNPL, you can offer an easy way for your customers to purchase high-ticket products like masterminds, online courses, and live coaching sessions. More sales for you, and less money upfront for your customers - it's a win-win.

Create an account and get started today with Whop – your one-stop-shop for building and growing your perfect online business.

BNPL FAQs

What should I look for in a BNPL company?

As a retailer, the things you should look for include offer rate (or acceptance rate). This is the proportion of customer requests that the BNPL provider accepts.

Providers are generally tight-lipped about their offer rates but according to the Consumer Financial Protection Bureau, 69% of applicants aged 18 to 24 were approved for BNPL loans in 2022.

You want a provider that has a pretty high rate so your customers are mostly accepted – too many rejections doesn’t look great for your business.

Other factors to consider when picking a provider include:

- ease of integration with your ecommerce platform

- variety of customer payment methods offered by the provider

- cost of the BNPL solution for the retailer

- risk strategies used by the provider (including credit and fraud control)

- positive customer reviews

What if a BNPL customer misses a payment?

Remember that when a customer takes out a BNPL loan, it is with the provider.

You get paid in full upfront and the payments are between the customer and the BNPL provider.

As you can see from our list, how late, rejected and missed payments are handled depends on the provider.

The consequences may be late charges or the inability to use the provider again. Repeat non-payment may lead to the debt being charged off (or written off) and transferred to a collection agency.

What if a BNPL customer wants to make a return?

Customers can still make returns if they have chosen to spread payments through a BNPL provider.

You will get back the item and send the full refund to the BNPL provider, which is responsible for applying the correct refund to the customer’s account.

Do BNPL firms have to comply with any rules?

Until recently, BNPL has operated outside of the rules applied to other financial services firms. However, this is changing, with providers increasingly facing U.S. regulation.

This is good for you as a retailer. You want to make sure the companies you deal with operate ethically. A customer’s negative experience with a company you work with will reflect badly on you (especially if they are active on social media…)